2024 is here. We published our market forecasts for 2024 many months ago, we are on the lookout for signs that our forecasts will materialize.

Our top 3 market forecasts for 2024 which we published in the public space:

- Will Markets Print New All-Time Highs In 2024? 7 Must-See Charts.

- A Stock Market Crash In 2024? Here Is A Surprising Answer.

- Silver Price Forecast For 2024

While financial media is fast with their fear mongering headlines, like this one Stock and bond markets will see a ‘year for non-consensus’ in 2024, technical strategist says, among many other similar headlines, we have a very different view. In our latest Momentum Investing note, to premium members, we shared quite some insights about our strategic plan for 2024, dominant trends, and one sector with potential multi-bagger potential.

We pick out 3 thoughts, they can be considered as 3 forecasts for 2024.

As a general, high level market forecast, we expect these market dynamics to be dominant:

2024 promises to become an intense year in financial markets. This market forecast is based on intensifying mini-cycles. Our timeline readings reveal a diversity and intensity that we have not seen in recent years. This is not good nor bad, it means that we have to be sharp, take profits at least once this year (presumably right before summer) and stay very much focused on the dominant market dynamic which is sector rotation.

Moreover, we identified 3 specific exit criteria which we consider ‘take profit’ signals. We expect these ‘take profit’ signals to be fulfilled throughout the year. Below is one of the three, the other two (probably more important) will be covered throughout the year in our Momentum Investing alerts:

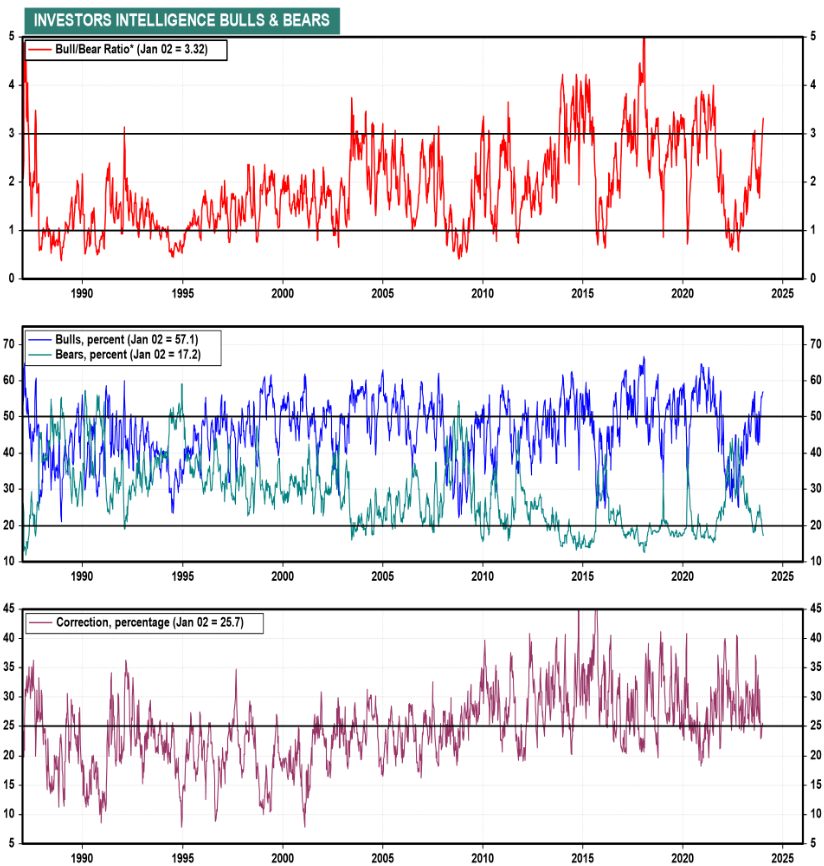

Second, investor sentiment reaching very bullish levels which is bearish from a contrarian perspective. The chart below will be leading, the bull/bear ratio moving to 4 or even higher will coincide with a ‘take profit’ signal.

In closing, we closely track 10 sectors that can (will) create bullish momentum throughout the year. Below is one sector that has an explosive setup. As said in our note to premium members:

One sector ETF shows an orderly consolidation, and support creation process. Lovely, as long as support holds.

This is the sector ETF, the double bottom (W-reversal, a bullish pattern) has tremendous upside potential.

We left out the symbol and reference to the sector in order to respect premium (paid) members. The research note is available for instant access after signing up: 2024 Insights: Mini Cycles Intensify, Premium Discounts Revealed.