Identifying sectors that are poised for a significant breakout can provide valuable opportunities for investors. In recent months, industrial stocks have been showing promising signs of a potential secular breakout. The Industrial Select Sector SPDR Fund (XLI ETF) chart highlights this exciting development, with a higher high setting the stage for a potential upward trajectory. A confirmed breakout would be consistent with our 2023 forecasts, particularly no market crash in 2023 forecast and long term Dow Jones chart readings. Also, industrials are doing what our leading indicators were signaling many months ago as explained in great detail in ‘the most important chart of 2023.’

After a lengthy consolidation period, industrial stocks are primed to move higher this summer, presenting a favorable investment opportunity for those who are paying attention. InvestingHaven readers were prepared for this: Will The Summer Of 2023 Be Hot For Stock Market Investors and This Leading Indicator Has A Summer Message For Stock Market Investors.

Industrials stocks chart readings

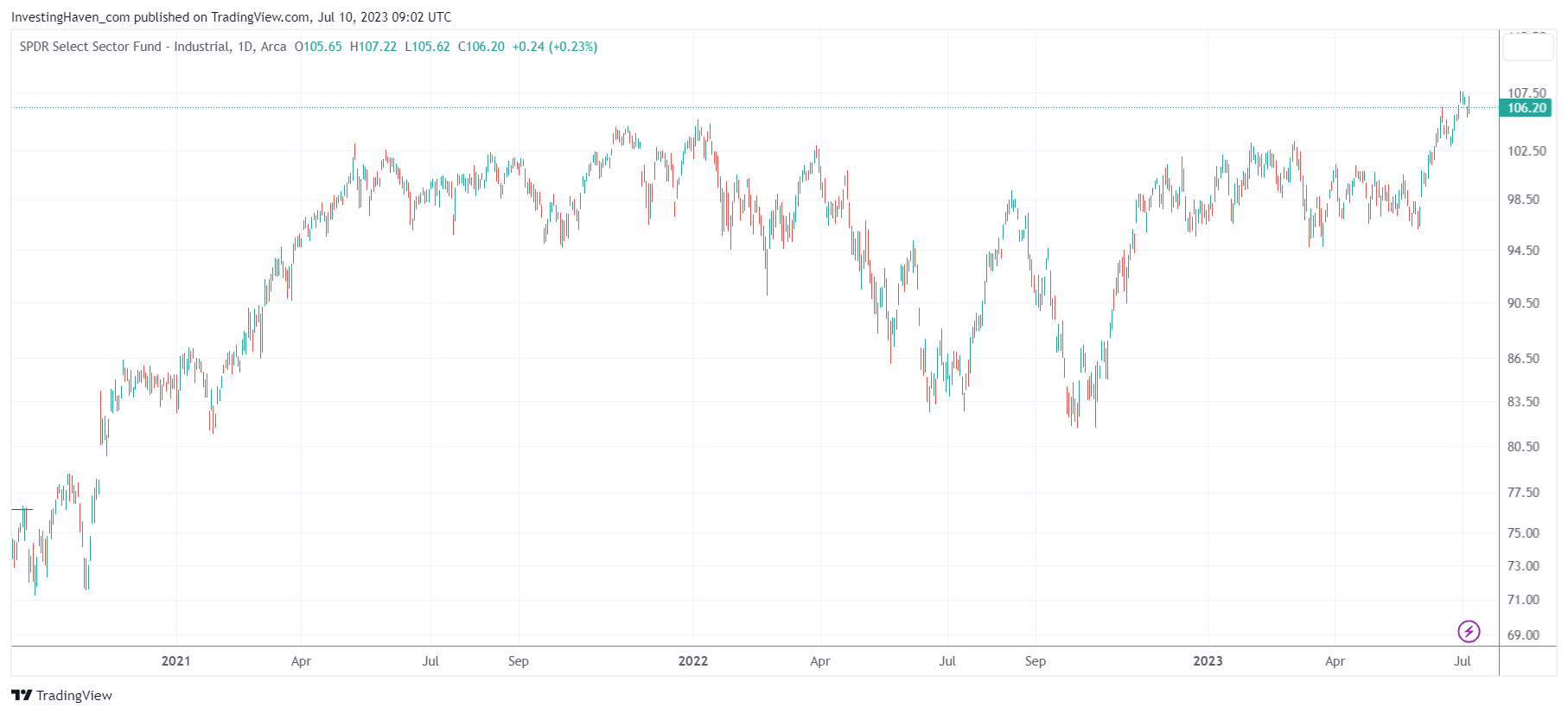

The chart of the XLI ETF reveals a significant development in industrial stocks. Over the past 24 months, this sector has undergone a prolonged consolidation phase, characterized by a sideways movement within a defined range. However, recent price action has ignited optimism among investors as industrial stocks attempt to break out of this consolidation pattern.

The chart clearly shows that after the forecasted volatility window of the last 10 days of June, the XLI ETF experienced a notable shift in momentum. The price made a decisive move to the upside, surpassing previous resistance levels and setting a higher high. This breakout is a crucial signal indicating a potential secular shift in industrial stocks.

The significance of this breakout cannot be overstated. It signifies a departure from the prolonged sideways movement and suggests that industrial stocks are finally ready to embark on a new bullish phase. This breakout comes as a result of the accumulation of positive market forces, including improving economic conditions, growing industrial demand, and a supportive business environment.

The breakout also confirms the validity of our previous forecast and analysis. By identifying the volatility window and monitoring the price action during this period, we were able to anticipate the potential breakout in industrial stocks. This demonstrates the importance of technical analysis and staying abreast of market trends to make informed investment decisions.

Implications and Opportunities

The breakout in industrial stocks presents exciting opportunities for investors. As the sector moves higher, it is likely to attract increased attention from market participants, leading to potential gains for those who position themselves strategically. Industrial stocks encompass a broad range of companies involved in manufacturing, infrastructure, transportation, and other key sectors of the economy. By investing in this sector, investors can gain exposure to various companies that are well-positioned to benefit from improving economic conditions.

The breakout in industrial stocks also signals a potential shift in market leadership. While certain sectors have dominated the market in recent years, such as technology and consumer discretionary, the resurgence of industrial stocks suggests a rotation of investor interest. This rotation can provide diversification benefits for portfolios, as it introduces exposure to different sectors and potential outperformers.

Investors should consider conducting thorough research and analysis to identify specific industrial stocks that exhibit strong fundamentals and growth prospects. By selecting companies with robust financials, innovative products or services, and solid market positions, investors can enhance their chances of capitalizing on the anticipated upward trajectory in the industrial sector.

Conclusion

After a lengthy consolidation period, industrial stocks are finally showing signs of a secular breakout. The XLI ETF chart confirms the recent higher high, indicating a potential shift in momentum and an upward trajectory for this sector. As the summer unfolds, investors should closely monitor the performance of industrial stocks and consider capitalizing on this promising investment opportunity. By positioning themselves strategically, investors can potentially benefit from the anticipated upward movement in the industrial sector.