Will stock markets rise in 2019? This question made it to the top of the list after another volatile week with ‘trade wars’ being the hot topic in the news. We look at U.S. stock markets, the German stock market and emerging stock markets in this article. Visibly, there are some challenges in all regions. Most stock markets are at or near decision points. Depending on how they behave around current levels it will become clear if stock markets will rise in 2019.

The social Q&A platform Quora has many questions about when and how stock markets ‘should’ rise.

They are all irrelevant. The only question is (1) what do the charts of leading stock market indexes suggest as a trend and (2) what do leading indicators tell about the trend of those leading stock market indexes.

Will U.S. Stock Markets Rise In 2019?

The U.S. stock market index, Russell 2000 (RUT), our leading indicator, looks to be trading ‘in the middle of nowhere’. Bulls have the benefit of the doubt.

Above 1300 is in bullish territory. A small retracement from current levels to 1500 points is acceptable, for sure if it leads to another run higher.

U.S. stocks are at a tactical decision point as long as they trade in the 1500 to 1600 range.

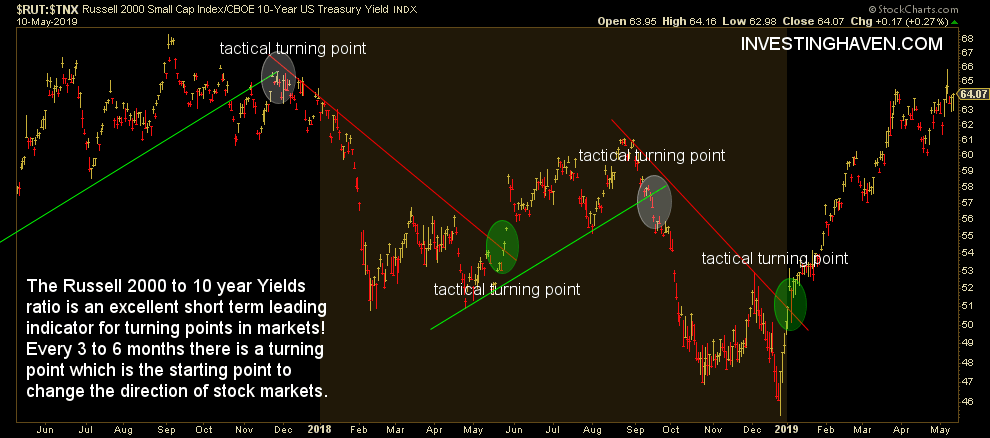

Our leading indicator for U.S. stock markets is 10-year Treasury yields. They are a risk indicator: higher yields signal more appetite to invest in risk assets like stocks.

Consequently the Russell 2000 to 10-year yields ratio is an important leading indicator for U.S. stock markets.

After a tactical turning point in January of 2019 this indicator still favors stocks. Until the ratio drops below the currently rising trend it spells a preference for stocks. It suggests U.S. stocks will rise in 2019.

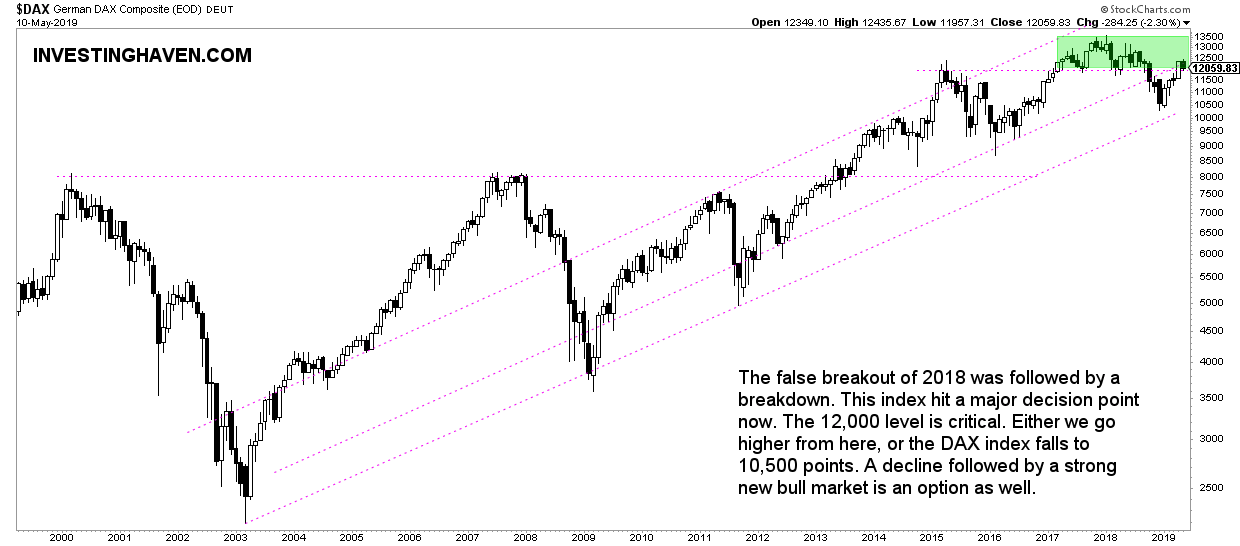

Will the German Stock Market Rise In 2019?

German stocks, representing European stock markets (to some extent), are at a similarly important decision point.

Between 10500 and 12000 points the DAX index is still bullish, but in corrective mode in the context of a larger uptrend.

Ideally, bulls want to see a rise above 12500 points. Below 11800 will probably lead to more selling.

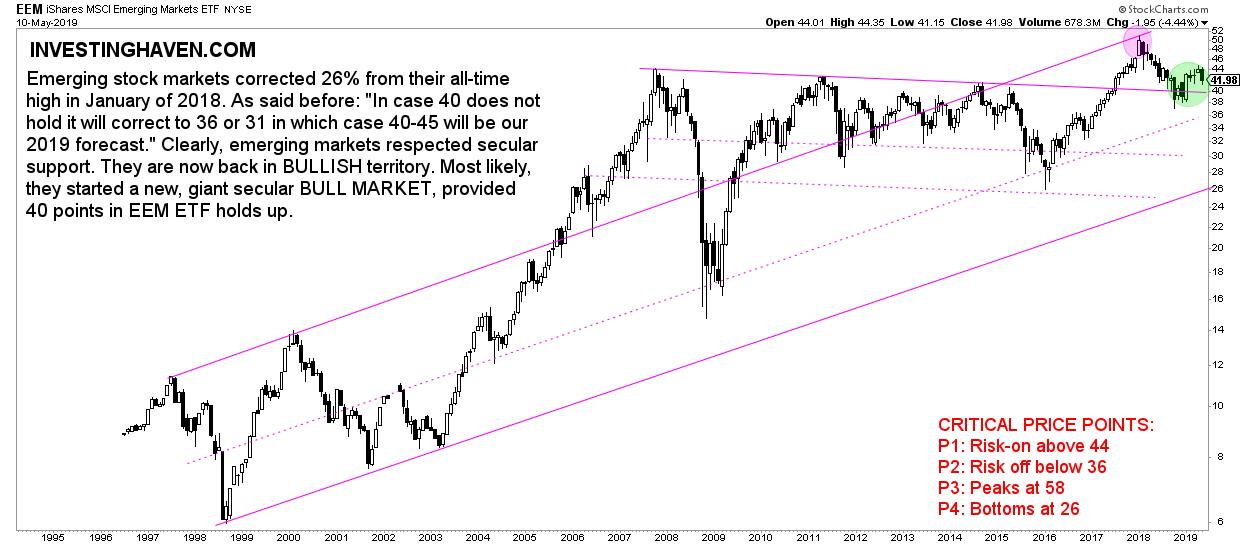

Will Emerging Stock Markets Rise In 2019?

Emerging markets are at the most important decision point.

After a major secular breakout some 15 months ago we saw a retracement. This should qualify as a breakout test, see green circle annotated.

The impact of emerging stock markets falling below 40 points will be meaningful. It will not create a bear market, but it will significantly delay another breakout into a secular bull market.

We watch 40 points in EEM ETF (EEM), especially monthly closes, very closely! Above 40 points we are in a new secular bull market! Below 40 points we see a decline to 36, and then to 30 points.