It’s official. The leading indicator for markets has reached a major price point. As per our method 1 percent of price points on a chart carry 99% of the importance, and we reached one such points this week.

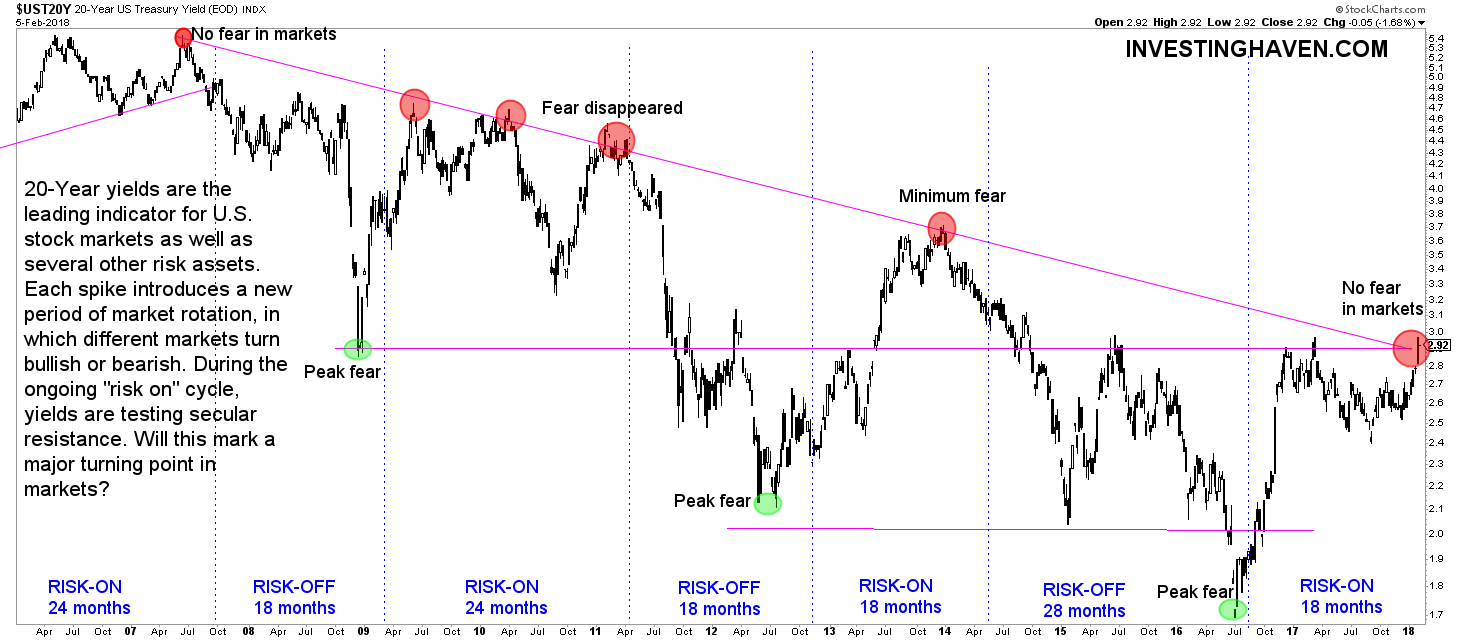

We are talking about yields. In particular, U.S. 20 year yields are the leading indicator for U.S. stock markets. We identified 3% in 20 year Yields as a major point. The chart below shows that this level got achieved this week.

At InvestingHaven, we signaled that it would happen already a year ago. In Disruption Ahead In Stock And Bond Markets? we wrote:

That could suggest that Yields have set a secular bottom, and that they will go higher from here. As soon as they go slightly higher from current levels, they will also break out (technically), which would be incredibly important news. Financial media will have no clue, and they will not notice this, but InvestingHaven readers are lucky to get notified once there is really important news.

What exactly will happen once Yields start a new long term uptrend is not clear. Because of the inverse long term correlation with stocks (stocks are in a secular bull market since 1981) it could suggest that stocks would weaken on the longer term. That does not necessarily mean a stock market crash, it rather means no strength in U.S. stocks.

Smart investors watch very closely 3% in 20-year Yields, a secular breakout level.

More recently we followed up in The Most Important Chart In 2018 For U.S. Markets with:

If, and that’s a big IF, 10-year yields break outside of its falling channel it will be very disruptive for U.S. markets. First and foremost, U.S. stock markets would look entirely different. A new paradigm will hit U.S. stocks. We prefer not to predict the exact evolution as that’s largely unknown. We will assess how intermarket trends play out at that moment in time. If anything, interest sensitive sectors would do very well.

Read also Another Indicator Suggests A New Mega Trend: Rising Interest Rates:

Again, do not underestimate the importance of this major shift from a 4-decade bear market into a bull market in interest rates. We are not there yet, but all indicators confirm it is about to happen anytime soon.

Because of this once-in-a-lifetime event we have initiated a special research track within InvestingHaven’s team to investigate what the implications can be of rising rates. We will report back to our readers once we have clarified this hugely important question.

Our point is that this a critical juncture. Are we in a 2008-alike scenario? Is this bullish or bearish?

That is the question we are solving with InvestingHaven’s research team. We aim to be back with a clear vision in a week from now.

Do not underestimate the importance of what’s happening right now, but please do not panick neither. This is a moment to take a step back, look at the setup of leading markets like yields, bonds, stocks, currencies, gold, economic and fundamentals, and conclude on the direction of markets.