In a game-changing development for the uranium market, spot uranium prices are confirming their breakout above the critical $60 per pound level. This marks a pivotal shift in our uranium market outlook, changing from a ‘bullish bias’ to a definitive ‘bullish’ stance. The spot uranium breakout is not only validating our previously held views but also aligning with our earlier forecasts from August 2023. Moreover, two weeks ago, we observed that the uranium market is ready to stage a breakout which now seems confirmed. We are bullish on uranium stocks.

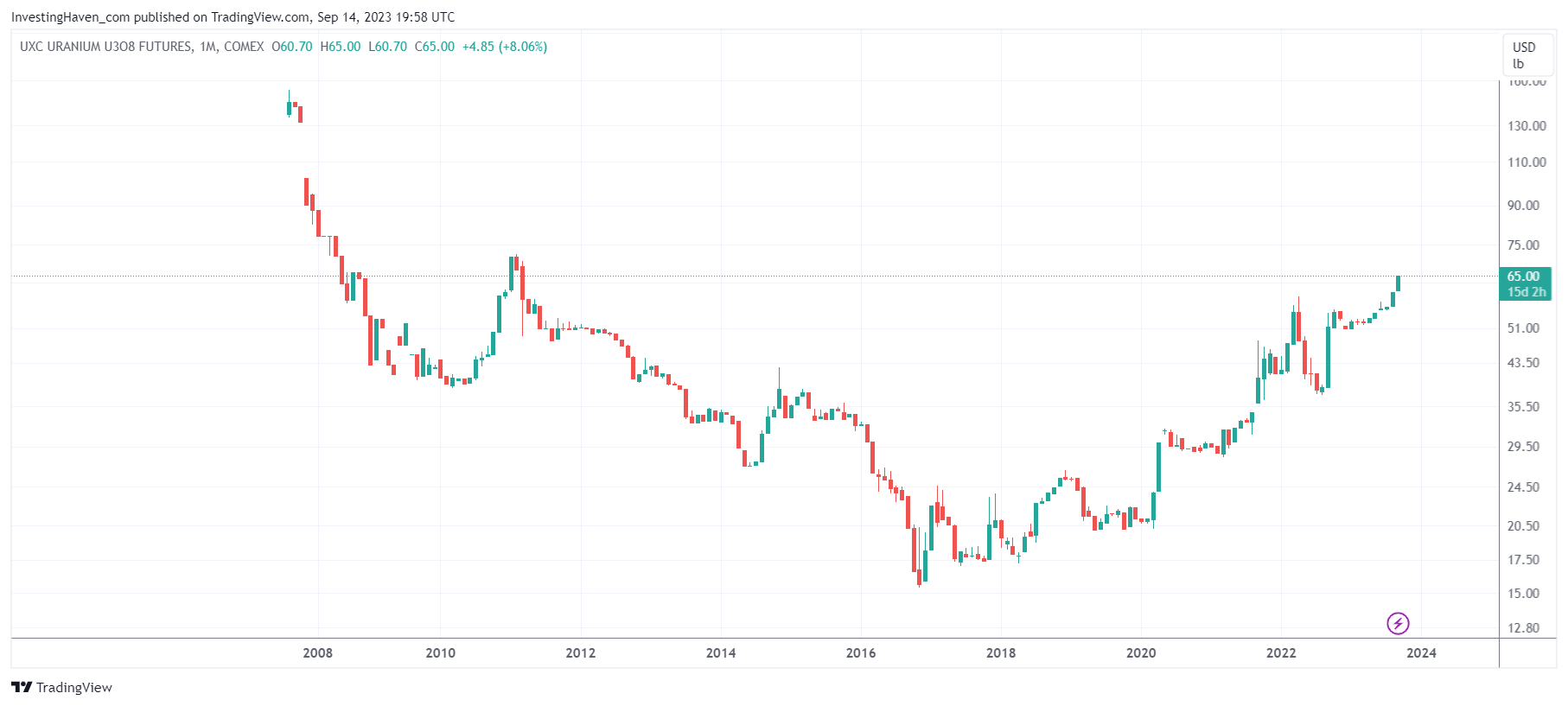

In our comprehensive uranium market analysis, we initially reviewed the spot uranium chart, analyzing it across various timeframes, from the long-term monthly perspective since 2008 to the daily chart over the last five years.

The longest-term uranium price chart has revealed a bullish reversal pattern characterized by three key levels: $55, $90, and $103 per pound. Notably, spot uranium exhibited an 18-month consolidation phase in the $50 to $60 range, emphasizing the importance of patience in a quiet market. As we stated earlier in 2023, “our uranium market outlook will turn bullish once uranium spot clears $60.” This prediction holds true as spot uranium now slowly but surely prepares to move above the $60 threshold.

This spot uranium breakout carries significant implications for the uranium market as a whole. It is likely to ignite bullish momentum across the uranium sector. While we haven’t delved into a detailed URA ETF chart analysis in this article, it’s important to understand that a rising spot uranium price is often mirrored by uranium-related ETFs, such as URA. As spot uranium continues to gain ground, it is expected to drive renewed interest and investments in uranium-related assets, potentially leading to substantial gains in uranium ETFs.

In conclusion, the spot uranium breakout above $60 per pound is a momentous confirmation of our bullish uranium market outlook for 2023 and 2024. The breakout carries significant implications for the uranium sector, with the potential to spark a broader bullish trend. Investors in uranium-related assets, including ETFs like URA, should keep a close eye on spot uranium’s trajectory as it is likely to influence the performance of these assets. The uranium market appears poised for a potentially explosive uptrend, offering opportunities for those positioned to capitalize on this bullish turning point.

Our top uranium picks are available in this report Alternative Energy: Top Stocks Selection >>