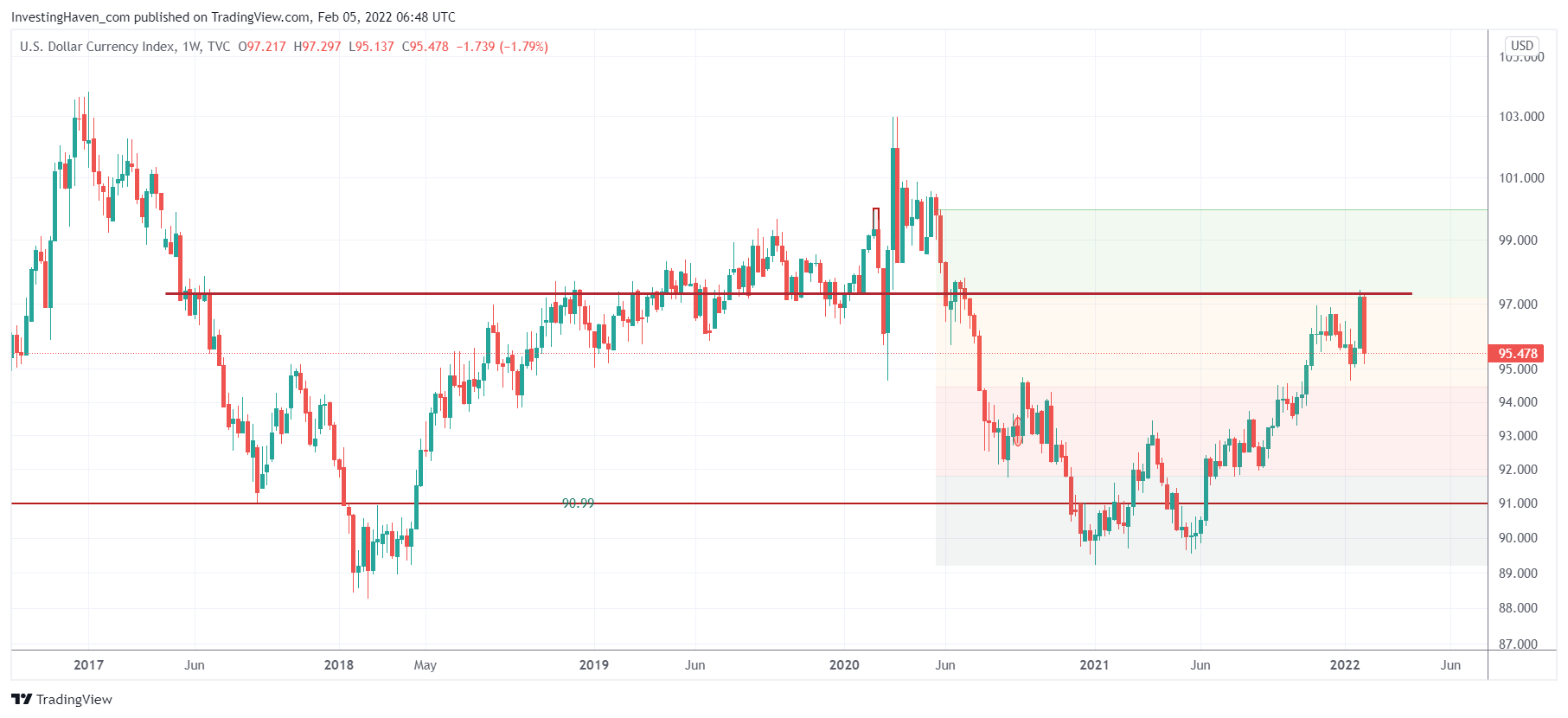

The USD impact on markets and metals has been outspoken. The USD has been holding back precious metals in 2021. This might be coming to an end now. The weekly USD chart shows a dramatic (!) rejection of the USD to move higher. This might complete the 2021 bullish reversal of the USD. It might also confirm that our bullish gold forecast and silver prediction are now underway!

While the precious metals market have multiple price drivers (all of them are explained in great detail in our annual forecasts) we did observe that the USD has been providing most pushback in 2021.

In historic terms, it is really unusual to see the USD push precious metals so much back in a year in which it rises less than 9 pct. Last summer, for instance, the USD did rise 3 to 4 pct and it was able to entirely break the bullish silver setup (all other leading indicators of silver were bullish).

We conclude that the USD impact is significant, and that metals and markets could largely benefit from a falling USD (whenever the USD would change course).

February of 2022 might be the turning point.

The USD is printing a dramatic rejection which is primarily visible on the weekly chart (shown below).

We can’t emphasize enough the significance of the rejection which was created by the last 2 weekly candles. The last red candle is also larger than the previous green candle.

Many investors tend to think of gold and silver as markets that won’t perform well in 2022. That’s a human reaction, as explained in 7 Secrets of Successful Investing. The last 18 months were trendless for precious metals, it creates a narrative. And narratives create bias.

That’s why we stay focused on charts structures and leading indicators: the help avoid narratives.

The one thing we do know from history is that leading indicators tend to influence other markets with some delay. In other words, don’t expect stocks to be wildly bullish as of next week. Don’t expect gold to start a bullish trend as of next week. There is a lagging factor which is easy to explain: large flows of capital out of one market into another market need time. Investing decisions by large participants take time to execute.

We expect a few more weeks of volatility in stock markets before a new bullish trends starts.

We expect at least 4 to 8 weeks until precious metals will break out (that’s because their other leading indicator ‘bond yields’ is too bullish right now, it needs to complete its bull run before precious metals can shine).

In our Trade Alerts weekend update (accessible after signing up) we showed one more ‘under the hood’ chart which makes silver wildly bullish. It’s a must-read update. We will also share a special edition on silver in the not too distant future, with ideas on how to play what we expect to be the big bull run of 2022 in silver. In our Momentum Investing weekend update (accessible after signing up) we made the point about being ultra selective when it comes to silver miners. We will pick out our top 3 and include in our stock shortlist.