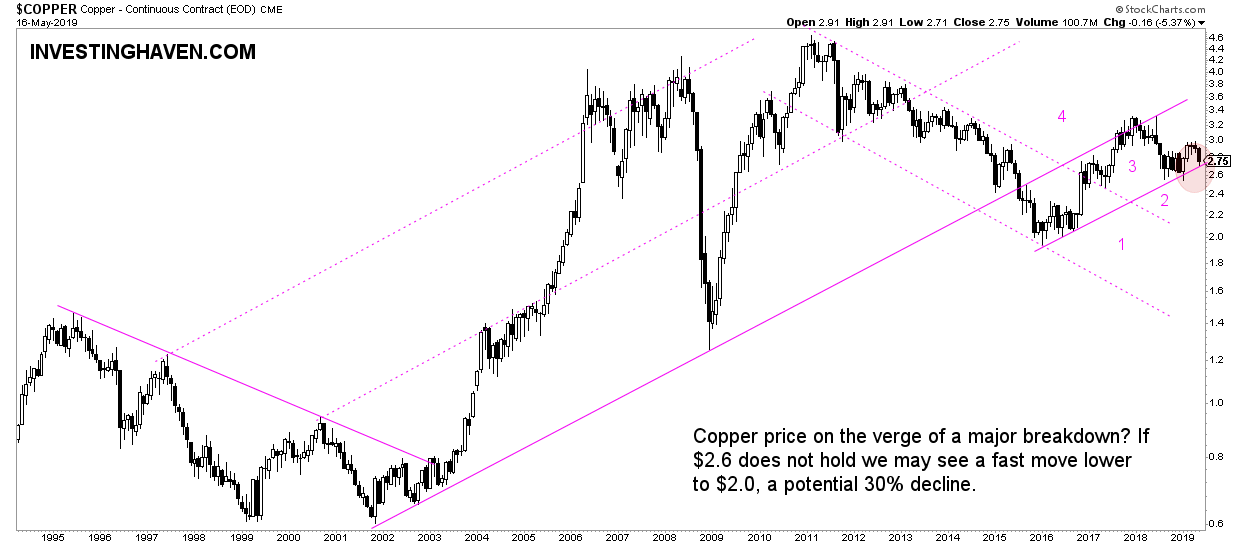

The price of copper (COPPER) is testing support. As per our copper forecast 2019 we said the copper market does not look bad, but it certainly does not qualify as a market that will make it into the TOP 3 Investing Opportunities Of 2019. A fall below current price levels, with 3 consecutive weekly closes and 3 consecutive monthly closes below $2.7 will confirm a breakdown, qualifying for a juicy short opportunity.

We said in our latest update that copper is back in its neutral area (indicated with the number 3 on below chart).

It never confirmed its breakdown to area (2). For now, the $2.7 to $3.6 area is the one in which copper is forecasted to remain in for the remainder of 2019.

For now the rising channel indicated with #3 on below chart is the one in which copper is moving. This is a 3-year old channel, so the probability of a continuation of this is high.

However, this is an important support level, and investors better start thinking what happens IF support fails. Even though the probability may be low, say less than 20%, it cannot be excluded.

Being ready with a plan B as part of scenario analysis is one of the golden investing tips.

The point we are trying to bring across is that copper is not and will not be in a raging bull market in 2019. Yes, we go against famous investors like Frank Holmes as we believe his bullish copper call is disconnected from reality. Let’s re-phrase this: his call is disconnected from the chart. He may be super bullish for copper in 2019 as explained here but we believe it is exaggerated.

As per our investing principles START WITH THE CHART we start our analysis and end our analysis with the chart. Fundamentals and sentiment should be read as a function of the chart, not vice versa.

Below is the long term copper chart, it makes the point(s) we outlined above. What’s next? Either a fall to the $2.0 area, a decline of 30%, or a rise to the $3.6 area, a rise of 30% is what will follow in the next months and year.