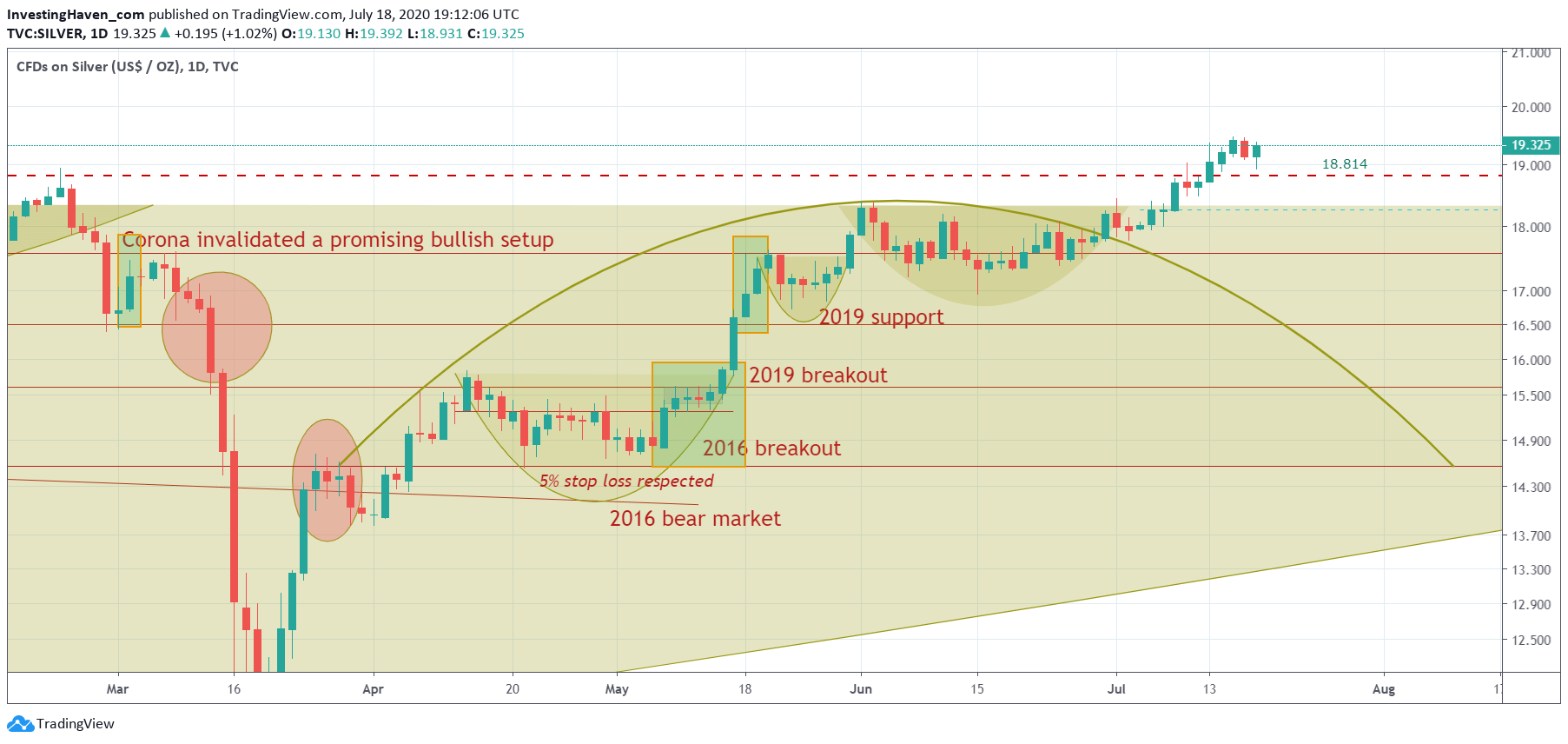

In recent weeks we wrote extensively about the gold and silver market. It did become clear that our gold price forecast as well as silver forecast for 2020 were very accurate. Moreover, we provided coverage on how much more upside potential we see in both gold and silver. While last week was very strong, we need one more week of trading above 18.814 USD/oz in the spot price of silver to confirm an uber bullish trend.

It was just 3 weeks ago when we alerted readers on a silver price ‘break up’ in our article: Silver Flirting With A ‘Break Up’, Better Pay Attention

The daily silver price chart shows another attempt of silver to ‘break up’ which means that it wants to move above its potential bearish reversal.

Silver has to overcome huge resistance at 18.50 USD. The first time it tested it a month ago was too hard to overcome this resistance because it was double resistance. However, with the ‘break up’ which is occurring at current levels we can expect a lower level of resistance once silver gets back to 18.50 USD. Yes a final breakout above 18.50 USD is in the cards!

Then just one week ago we wrote this: Silver Market Is Turning Ragingly Bullish

The silver price chart is very, very simple: a multi year breakout test is now happening. A tiny push higher is required to confirm this silver price breakout. What is our expectation? BULLISH on SILVER!

The fundamental driver for this: interest rates were stabilizing, and not able to move higher. That’s the perfect environment for gold and silver to thrive!

Even MarketWatch featured our bullish silver stance. This is the article in which our silver forecast appeared: Silver, copper prices mark an impressive recovery from March lows (published 06.26.2020), and this is the quote that covers our forecast, both on silver as well as copper:

Gold has benefited from that, as has silver, which is both a precious and industrial metal. “Silver’s solid price action is driven by its precious metal side much more than its base metal characteristic,” and the low interest rate environment is great for precious metals, says Taki Tsaklanos, founder of InvestingHaven.com. A second wave of virus infection probably would put “even more fuel under silver’s price rally” because of the prospects of a long-lived low interest rate environment, and inflationary measures of policy makers to stimulate economies, says Tsaklanos, who expects silver to test $21 before year-end.

The silver price chart (daily timeframe) has now 3 full candles above 18.814 which we consider the proverbial ‘line in the sand’.

If silver can continue to trade above this level of 18.814 USD/oz, ideally without touching it (even not one second) for the next few days it is a confirmed multi year breakout. In that scenario we can reasonably expect much higher silver prices to be underway.

Next will be crucial for the silver market.