We mentioned a while ago that a new secular bull market in agricultural commodities was born. In our Momentum Investing we featured wheat as a strong buy two weeks ago, after featuring it two months ago. Wheat is up, strongly, since then. What’s more, it may just be the start.

Two years ago we wrote this in the public domain The Bear Market Of 2019: Agricultural Commodities

In our article mentioned in the intro of this post we clearly said that the opposite was happening in 2021:

Today, we see the confirmation of a new uptrend which is a conclusion we derive from the monthly chart. April of 2021 is clearly set to close higher.

We also made the point that once again financial media is clueless about reading markets. We wrote this in our previous article:

But wait a second the news is different. This is for instance what we find in the recent news flow Here is why agri commodities are expected to fall further. Here is the answer: charts don’t lie. Moreover, news is a lagging indicator. News, in our terminology ‘storytelling‘ very often, is contrarian to the real trend, watch out reading news if you are looking for really relevant investing insights.

Agri commodities are up, strongly. Similarly, our favorite, wheat, is also up strongly.

Amusingly, our Momentum Investing members have an edge. They received the Wheat tip two months ago for the first time, and two weeks ago for the second time. Most of our Momentum Investing members have understood that financial media hurts investing results.

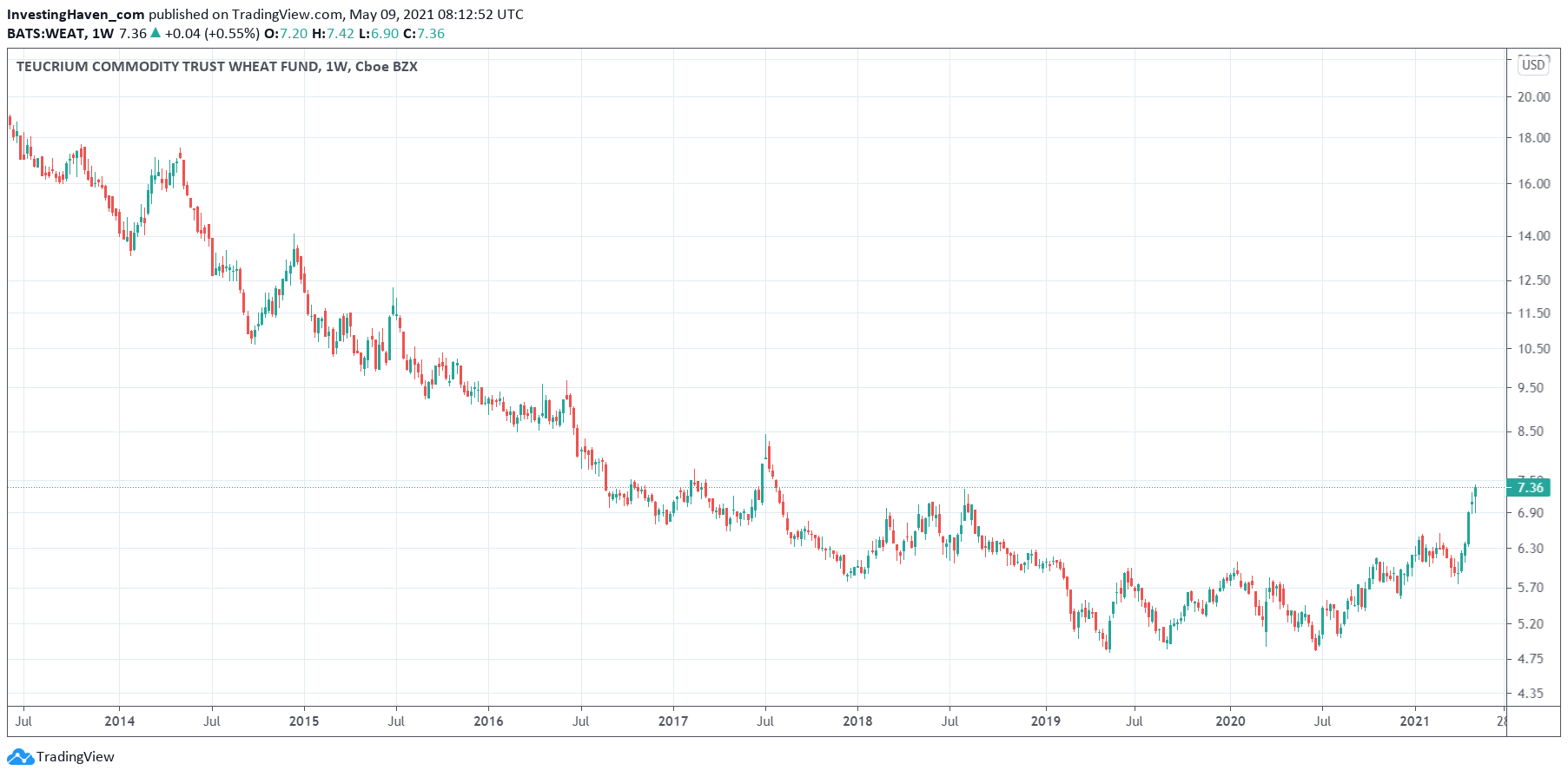

The weekly chart of WEAT ETF, tracking the price of wheat, has an amazingly powerful long term reversal setup. Upside targets? First 8.50 USD, next 10.50 USD, ultimately 14 and 16 USD.

Financial media knows how to sell eyeballs, we know how to read charts. Big difference in the bottom line of investors’ portfolios.