ADA trades around $0.80 with mixed momentum. Monitor DEX volume, staking flows, and Bitcoin for clear directional clues.

Cardano is trading at roughly $0.80 after a choppy week, testing resistance between $0.80 and $0.90. Traders will look to derivatives and on chain flows for a clear path to $1.00 or back under $0.90.

To understand whether ADA will break the $1 resistance or flop, let’s look at our Cardano weekly prediction.

RELATED: Best Crypto to Buy Today: Cardano’s Path to Mainstream Adoption

Key Levels And Derivatives Setup

The immediate range centers on $0.80 to $0.90 as the first resistance. A clean daily close above that band would raise the odds of extensions to $1.00 and $1.10, with $1.20 as a stretch target if volume expands.

Support sits around $0.80 to $0.82, with $0.75 and $0.70 as deeper floors if selling accelerates. If you are trading, you should watch DEX turnover and perps open interest for confirmation of conviction on a breakout or breakdown.

RECOMMENDED: 5 Reasons To Buy Cardano

On Chain And Ecosystem Health

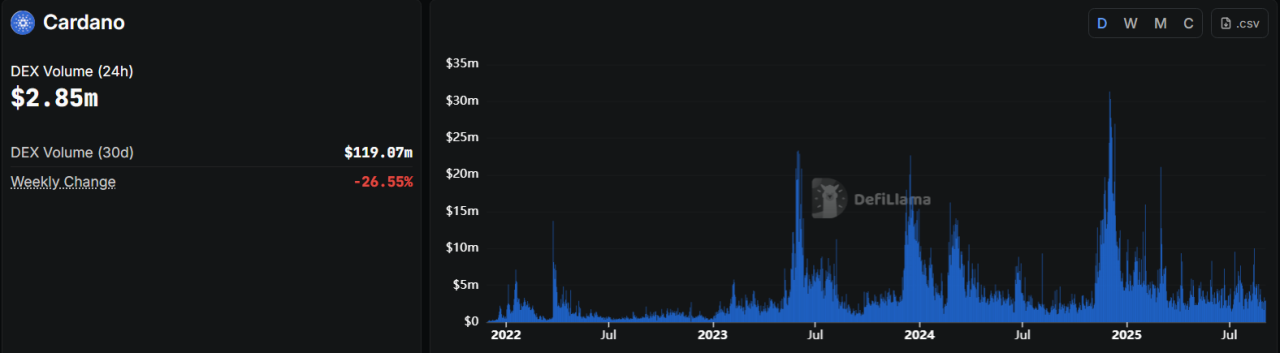

Cardano DEX volume runs at roughly $2.8M over 24h, modest compared with larger L1s, so any sustainable rally needs higher trading throughput.

Staking participation remains elevated at about 67%, which reduces circulating float while muting instant supply shifts.

Daily active addresses and smart contract calls show steady engagement but have not matched late 2024 peaks, so bulls need rising on chain transactions to validate a move above $1.00.

ALSO READ: Which Cryptocurrency Is More Likely to Be a Millionaire Maker? XRP vs. Cardano

Catalysts And Macro Watch

Macro risk will shape appetite, with Bitcoin trading around $111K and setting broader risk tone. News about potential ETF traction or protocol upgrades can flip sentiment fast, so monitor headlines, staking inflows, and developer updates.

Oracle integrations and tooling progress remain key ecosystem items that could cap or enable upside.

Conclusion

Based on our Cardano price analysis, a bull case requires a daily close above $0.90 on expanding DEX volume and rising open interest. Bear case takes hold if $0.80 breaks, which would expose $0.75 to $0.70. Keep BTC and flows in view for confirmation.

If you need a more long term outlook, you can also check our Cardano price prediction in 2025 and beyond.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)