Nouriel Roubini renewed his long-standing Bitcoin criticism, warning of structural risks and speculative excess, while blockchain data shows a market reacting, not collapsing.

Bitcoin is trading around 67795.84 and volatility picked up shortly after economist Nouriel Roubini repeated his warning that crypto remains structurally fragile and vulnerable to sharp declines.

Roubini has issued similar warnings for years, yet traders still react because his calls often arrive when risk conditions already look stretched.

At the same time, blockchain data showed a rise in large wallet activity and transfers toward exchanges. This created anxiety, but price reactions alone rarely explain what large holders are actually doing.

A more reliable signal comes from tracking where coins move, how traders position leverage, and whether supply truly increases on exchanges.

Bitcoin Price Prediction

Visualize future value based on annual growth.

RELATED: Prediction Markets Turn Bearish On Bitcoin – Is A Flash Crash Coming?

What Did Roubini Say About Bitcoin?

Roubini’s latest comments stayed consistent with views he has expressed for years, but the timing amplified market attention.

He described Bitcoin as a highly speculative asset exposed to liquidity shocks and argued that price growth depends largely on investor sentiment rather than economic fundamentals.

He warned that leverage across crypto markets increases downside risk because rapid sentiment shifts can trigger forced liquidations.

The economist also pointed to broader financial conditions. Higher interest rates and tighter global liquidity reduce appetite for risk assets, and Roubini believes crypto remains especially sensitive to those shifts.

In his view, Bitcoin rallies occur during periods of abundant liquidity and weaken when financial conditions tighten.

He further argued that large holders and concentrated ownership create instability. When liquidity thins, even moderate selling from major wallets can cause outsized price reactions.

Therefore, without stronger fundamental valuation anchors, Bitcoin remains vulnerable to sudden corrections.

ALSO READ: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

What Whale Activity Really Shows Right Now

Large Bitcoin holders moved significant amounts of BTC across wallets and exchanges in recent sessions. Some reports estimate tens of thousands of coins shifting between major addresses. While this sounds alarming, movement alone does not mean selling.

Whales frequently reposition funds for custody changes, derivatives collateral, or private transactions.

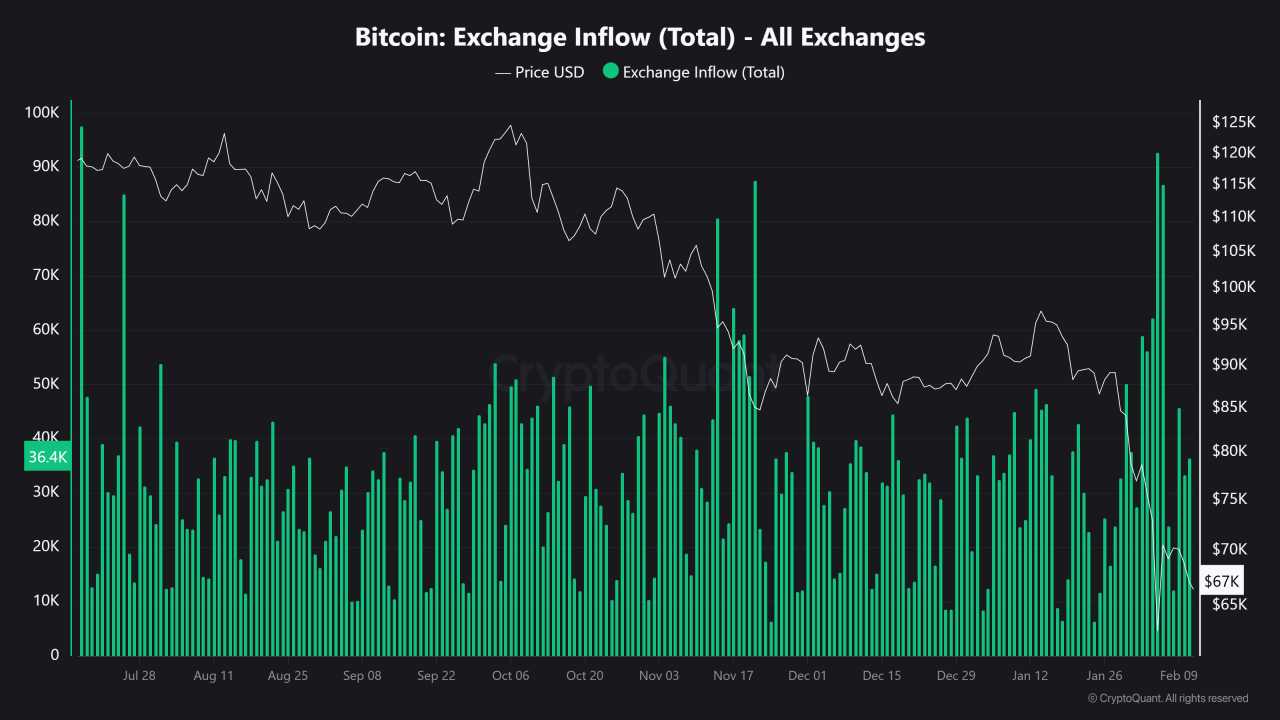

An even stronger signal comes from exchange netflows. When more Bitcoin enters exchanges than leaves, available selling supply increases. Recent data shows inflows rising briefly, which explains short-term price pressure.

However, total exchange balances have not surged aggressively over longer timeframes. This suggests selling exists, but not at levels normally seen before prolonged bear phases.

A key detail many traders miss is duration. One large inflow can move markets for hours. Sustained inflows over several days create real structural weakness. Right now, the data sits between those two conditions.

YOU MIGHT LIKE: Shocking Data: Long-Term Bitcoin Holders Are Suddenly Selling

The Technical Levels That Decide Panic Or Stability

Markets react to liquidity zones, not opinions. On-chain cost basis data shows where large groups of investors bought their Bitcoin.

When price approaches those levels, reactions become stronger because traders defend positions or exit losses.

Recent funding rates turned positive while open interest expanded, meaning traders increased long exposure during uncertainty. This often creates fragile conditions.

A single aggressive sell order can trigger cascading liquidations, accelerating declines far beyond the initial selling pressure.

At the same time, realized volatility has not exploded to extremes typically seen during full capitulation events. That suggests stress exists, but the market has not entered panic territory yet.

Three Possible Market Directions From Here

- Deeper correction: This happens if exchange inflows continue rising for several days while leveraged longs remain crowded. In that case, liquidation pressure could push prices quickly toward lower support zones.

- Fast capitulation followed by recovery: A sharp drop forces weak hands out, after which large buyers withdraw coins from exchanges. Falling exchange balances often signal accumulation returning and liquidity tightening again.

- Slower distribution: Whales sell gradually into rallies while volatility stretches over weeks. Price moves sideways with sudden spikes both up and down, frustrating traders expecting a clear trend.

Each scenario has observable signals. Rising exchange balances and expanding leverage favor downside risk. Falling balances combined with steady accumulation suggest stabilization.

ALSO READ: Why Bitcoin Keeps Failing At $70,000

Conclusion

Roubini’s critique centers on long-term sustainability instead of immediate price targets. His concern is that crypto markets repeat boom-and-correction cycles because sentiment shifts faster than underlying adoption.

History shows partial truth in that claim. Bitcoin has experienced multiple drawdowns exceeding 50% during previous cycles.

If exchange balances begin rising consistently and leverage expands again, Roubini’s warning gains stronger confirmation. If coins continue leaving exchanges and volatility stabilizes, the market may absorb the fear without deeper damage.

Should You Invest In Bitcoin Now?

Before you invest in BTC, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest premium crypto alert here: Bottoming Patterns Everywhere?(Feb 15th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.