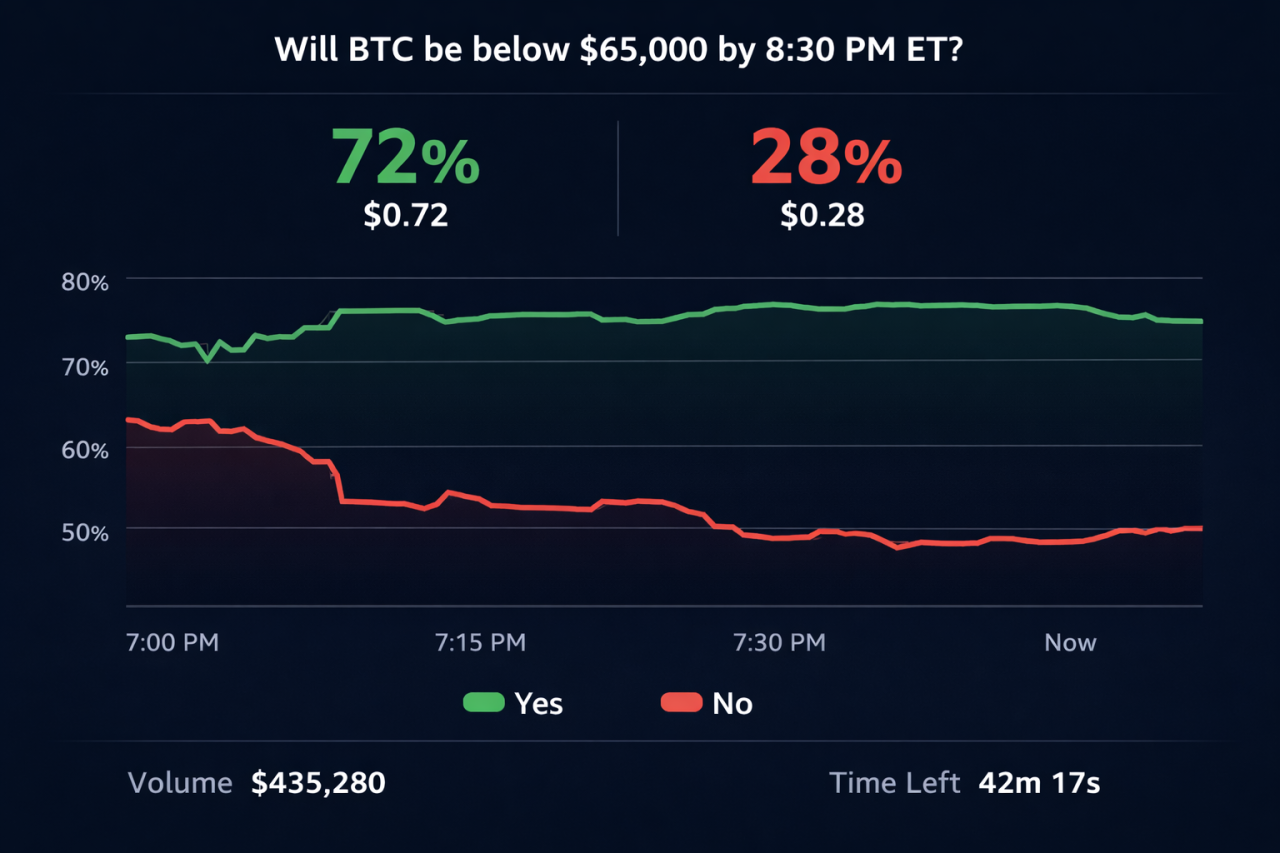

Short-term betting odds now lean heavily toward a Bitcoin drop, and trading activity on prediction platforms is elevated.

Short-term prediction markets are pricing strong downside odds in multiple windows, with some contracts showing more than 70% probability of Bitcoin falling below key levels such as $65,000.

At the same time, activity on these platforms has increased sharply. When traders are willing to put real money behind short-term bearish bets, it signals rising tension in the system.

This does not mean a crash is guaranteed but indicates the market is sensitive.

Bitcoin Price Prediction

Visualize future value based on annual growth.

RECOMMENDED: Why Bitcoin Keeps Failing At $70,000

Bitcoin Prediction Market Odds Are Turning Bearish

Several short-dated Bitcoin markets, including intraday and weekly windows, show traders pricing a higher probability of price falling below $65,000. In some contracts, downside odds moved above 70%. Such a high percentage reflect real capital backing a short-term bearish view.

Activity across prediction markets has also risen in recent weeks. More participants are placing bets, and contracts are filling quickly. Higher participation gives these probabilities more credibility because more money influences the pricing.

Still, prediction markets are not crystal balls. They reflect crowd expectations over short windows. They respond quickly to sentiment shifts, and that speed is exactly what makes them useful.

Why Prediction Markets Can Signal Fast Moves

Prediction markets compress sentiment into one number that updates in real time.

When a large share of traders price in a short-term drop, it often means fear or caution is spreading. That shift does not move Bitcoin by itself but can influence derivatives traders, liquidity providers, and high-frequency desks.

A recent analysis from VanEck explained how concentrated positioning and leverage imbalances can accelerate downside moves. When traders are already leaning one way, small price shifts can trigger forced selling.

The thing is, prediction markets often react faster than spot price. They can signal stress building under the surface before candles show it clearly.

If downside odds stay elevated while leverage remains high, the risk of a sharp unwind increases.

RECOMMENDED: Bitcoin Miners Built a $77K Price Floor – Are We on the Cusp of a Miner-Fueled Bitcoin Rebound?

The Conditions That Could Trigger A Flash Crash

A flash crash needs fuel and bearish prediction odds alone might not be enough.

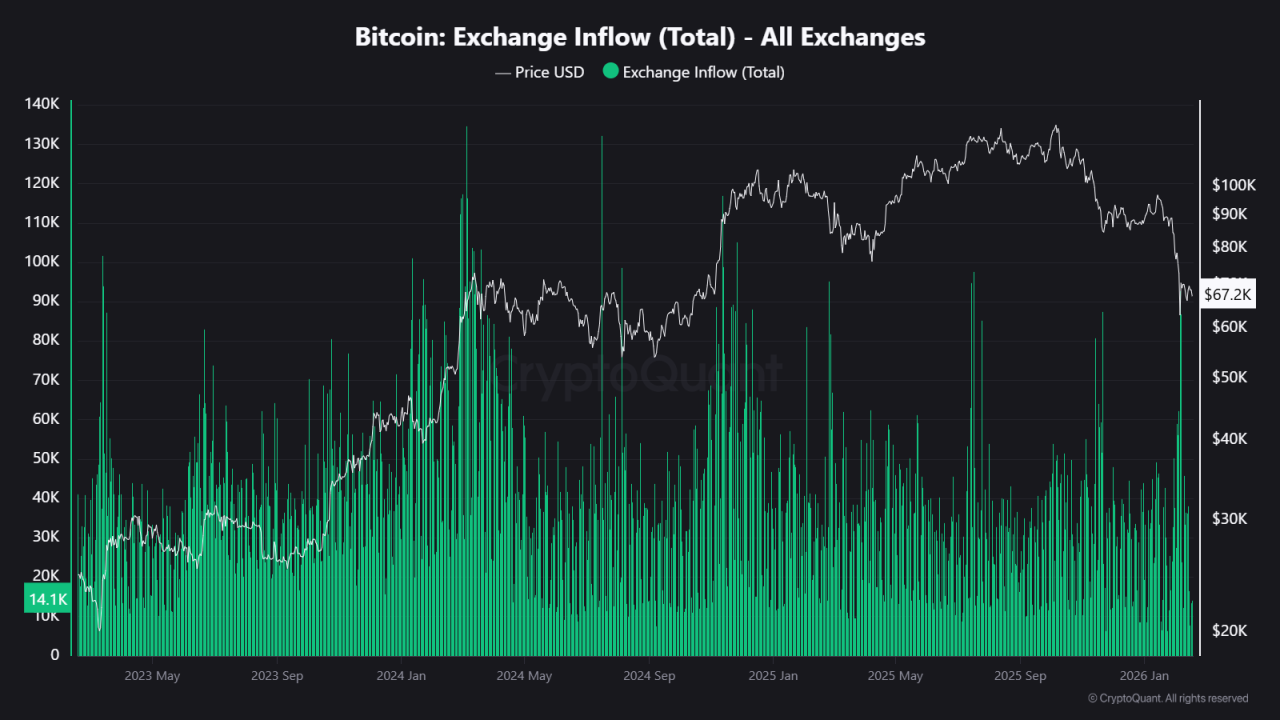

First, exchange inflows must rise. When more Bitcoin moves onto exchanges, sellers gain immediate access to liquidity. This increases the probability of quick execution. Data from CryptoQuant has shown that spikes in exchange deposits often precede short-term weakness.

Second, derivatives positioning must be stretched. If funding rates turn negative and open interest begins to fall, it signals traders are unwinding leverage. That process can snowball when price drops quickly.

Third, large holders moving coins to exchanges can intensify pressure. Concentrated deposits increase available supply at sensitive levels.

When these three factors work with bearish prediction odds above 65%, volatility can expand rapidly leading to price gaps.

What Traders Should Monitor Now

Start with short-term prediction odds on platforms like Polymarket. If contracts consistently price downside above 65%, that reflects strong short-term conviction.

Next, check exchange net inflows. Rising 24-hour deposits increase sell-side risk.

Finally, track funding rates and open interest. Falling funding combined with shrinking open interest often signals deleveraging.

When all three move in the same direction, reduce leverage. Smaller position sizes lower the risk of forced exits. Long-term holders should avoid reacting emotionally to short-term swings, but short-term traders need tighter risk control when probabilities shift this strongly.

ALSO READ: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

Conclusion

Prediction markets now lean bearish on Bitcoin, and participation levels are elevated. As a result, there is an increased chance of a rapid move if exchange flows and leverage confirm the signal.

A flash crash is not certain. But when probabilities, liquidity, and positioning come together, price can move faster than most expect.

Should You Invest In Bitcoin Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: A Harmonic Setup in BTC Indicates a Bottoming Area Is Forming(Feb 8th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.