Long-term Bitcoin holders are reducing supply while exchange deposits rise. This is increasing the risk of a sharper pullback.

Bitcoin’s most patient investors are starting to move coins again. On-chain data shows long-term holder supply has slipped in recent days, while exchange inflows have picked up at the same time.

When coins that have been idle for months begin to circulate, it often signals that silent holders are now selling. This in combination with rising deposits to exchanges presents a market with more immediate supply and less cushion underneath price.

Bitcoin Price Prediction

Visualize future value based on annual growth.

RECOMMENDED: Robinhood CEO Doubles Down on Crypto: “Very Bullish” For The Long Term

Long-Term Holders Are No Longer Accumulating

The most important shift is happening quietly on-chain.

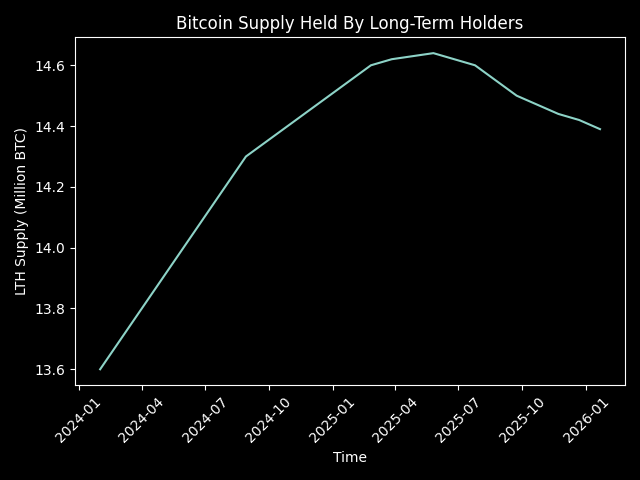

Data from Glassnode shows long-term holders, defined as wallets holding BTC for over 155 days, now control about 14,409,346 BTC as of Feb 16. This number has slipped from previous highs. This is not a huge drop but it breaks a steady accumulation trend that had supported price for months.

When long-term holder supply stops rising, it tells us that fewer coins are being locked away while more are being spent or moved. This reduces the market’s natural supply squeeze.

Recent analysis cited by Decrypt also points to weakening accumulation. In short windows over the past few weeks, net long-term holder supply turned flat or slightly negative. This means coins that once sat idle are now re-entering circulation.

While this does not mean every long-term holder is selling, it does mean the strongest hands are no longer absorbing supply the way they were. In tight markets, even small shifts like this can change price behavior quickly.

ALSO READ: Goldman Sachs Reveals $2.3B Crypto Exposure

Exchange Inflows And Whale Activity Are Rising

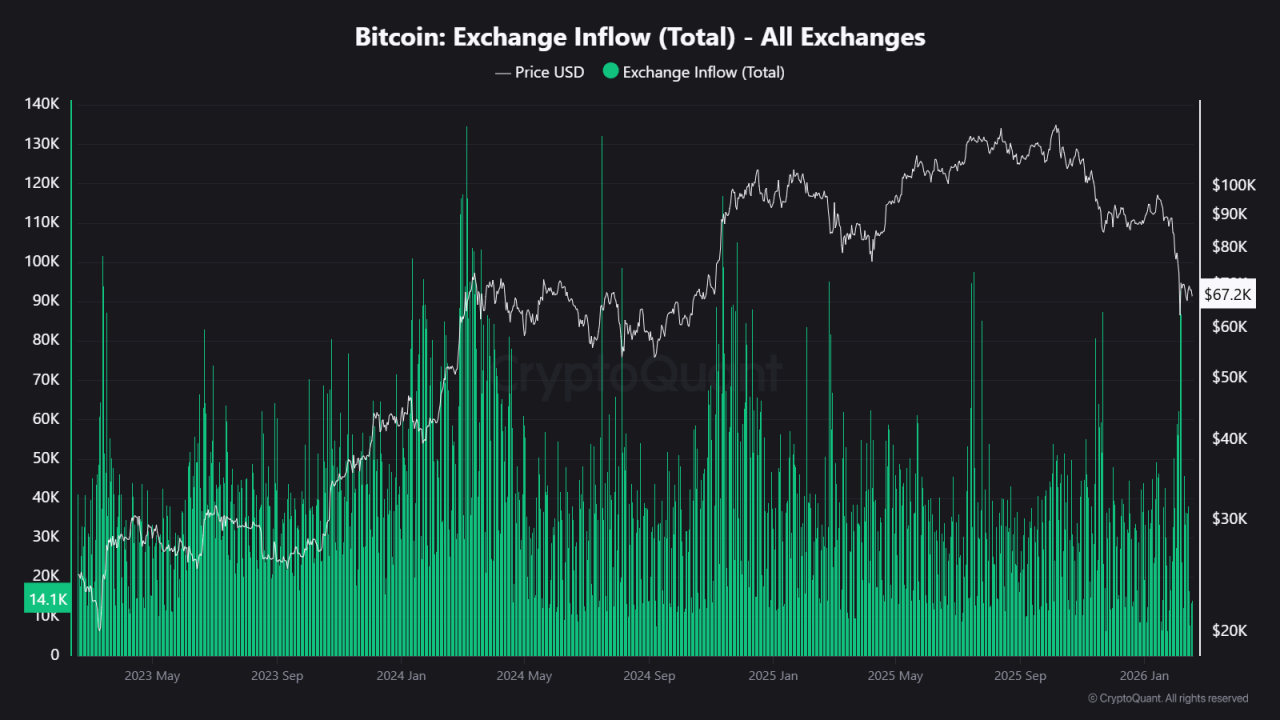

According to CryptoQuant, Bitcoin exchange inflows have risen on a 7-day average. When coins move onto exchanges, they become immediately available for sale. Rising inflows do not guarantee a drop, but they increase the probability of short-term selling pressure.

The situation becomes more sensitive when whales move size.

Last week, reports showed a 5,000 BTC transfer to exchanges. At current prices, that represents hundreds of millions of dollars in potential supply. A single large holder can influence short-term order books, especially during periods of thinner liquidity.

When you combine these three factors; reduced long-term accumulation, higher exchange inflows, and visible whale deposits, you get a market where supply is easier to execute. And while this does not predict collapse, it increases chances for price fragility.

Key Bitcoin Price Levels To Watch

Bitcoin’s immediate support sits around $65,000. This level has acted as a short-term pivot in recent sessions. If buyers defend it, price can stabilize and rebuild momentum.

If that level breaks with rising inflows and negative long-term holder change, the next major structural zone sits closer to $54,000. Market commentary from KuCoin has identified that region as a deeper support cluster based on demand zones and cost basis models.

To understand risk clearly, track three indicators together:

- Long-term holder supply change. If it continues falling, distribution is active.

- Exchange net inflows. If deposits spike, immediate sell pressure rises.

- Derivatives positioning. Falling open interest with negative funding rates usually signals deleveraging.

When all three align, volatility often follows.

RECOMMENDED: Michael Saylor Just Pledged To Buy Bitcoin Forever Despite A $12.4 Billion Loss

What Happens Next?

There are two realistic possibilities from here.

The first one is acceleration. Long-term holders continue reducing exposure, exchange inflows remain elevated, and price breaks below $65,000. This will increase the chance of a quick move toward $60,000 and possibly the $54,000 structural zone. Liquidations can also amplify the move if leverage is high.

Scenario two is exhaustion. Selling pressure fades, exchange balances stabilize, and long-term holder supply flattens. If that happens, Bitcoin can rebuild higher from current levels because available supply tightens again.

The difference between these outcomes will show up in on-chain flow data so keep your eyes on that.

YOU MIGHT LIKE: Bitcoin’s Fall From Grace: 5 Secret Signals To Turn Panic Into Profit

Conclusion

Long-term holders have stopped absorbing supply at the same pace, and exchange deposits are rising. As a result, there is an increase in short-term downside risk. However, this does not guarantee a breakdown.

The clearest early warning signals remain long-term holder supply change and exchange inflows. If those stabilize, Bitcoin can regain strength. If they worsen, volatility likely follows.

Should You Invest In Bitcoin Now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest alert here: Bottoming Patterns Everywhere?(Feb 15th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.