Ethereum sits at a critical price floor as shrinking liquid supply meets fragile trader positioning. The next price target depends on whether buyers defend $1,900 or momentum flips sharply lower.

Ethereum has entered a tight and uncomfortable range where small moves carry large consequences.

After repeated failures above $2,000, price has settled just above $1,900, a zone that has absorbed selling several times in recent weeks.

Volatility has compressed while trading volume fluctuates, a combination that often appears before decisive moves.

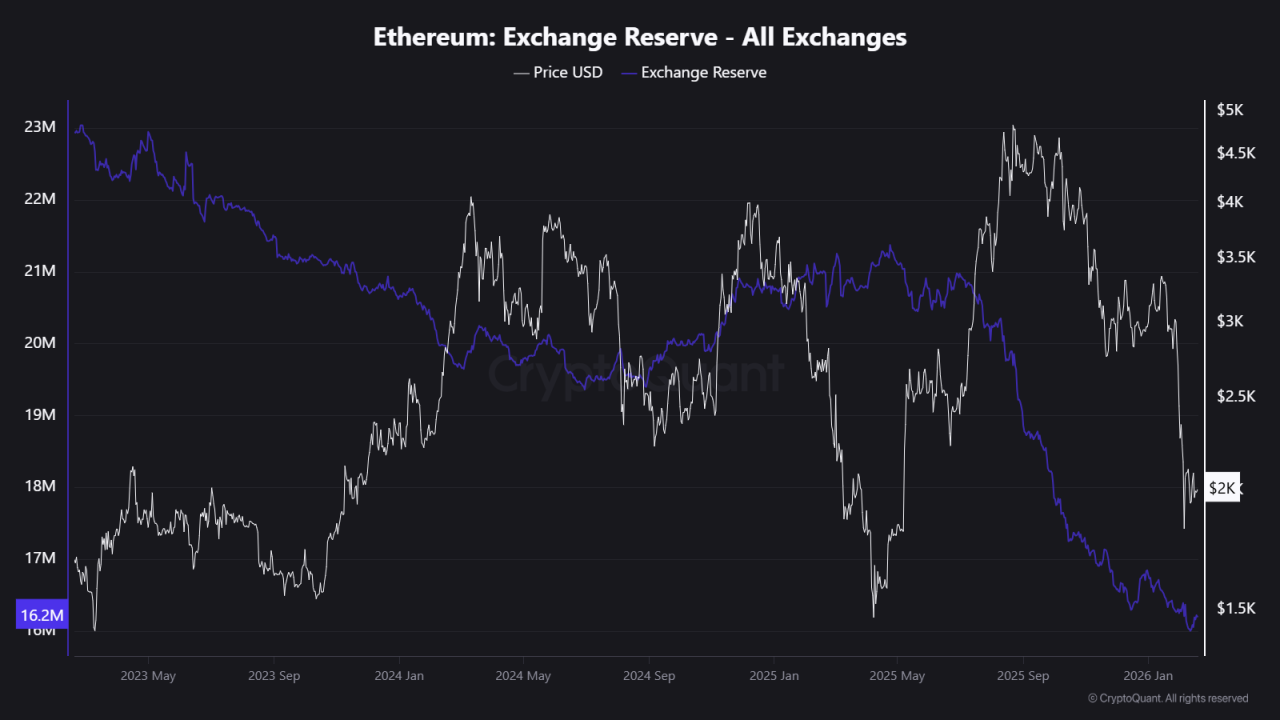

At the same time, on-chain data shows more ETH leaving exchanges and more coins locked in staking, creating conditions where price can move faster once direction becomes clear.

RECOMMENDED: Week Ahead: Can Ethereum Blast Past $2,000?

Why $1,900 Is A Critical Support Level

The $1,900 zone has become Ethereum’s most important short-term level because multiple technical signals converge there. Recent daily candles repeatedly bounced from this area, showing buyers stepping in each time price dipped.

Momentum indicators such as RSI also stabilized around oversold territory, reinforcing the idea that traders view this range as value.

However, support weakens each time it is tested. Lower highs on shorter timeframes show sellers gradually gaining control. If ETH closes a full trading day below $1,900 with strong volume, the chart reveals very little historical buying activity until the $1,600 to $1,650 range.

This gap increases the risk of a fast drop rather than a slow decline.

Staking And Exchange Flows Are Changing Supply

Ethereum’s supply dynamics look very different compared with past cycles. About 30% of total ETH now sits locked in staking contracts, meaning those coins rarely enter active trading. This reduces circulating liquidity and makes price more sensitive to new buying or selling pressure.

Recent data also shows steady withdrawals from exchanges as large holders move assets into long-term storage.

Fewer coins on exchanges often support price because immediate selling supply shrinks. Yet there is another side to this trend. When liquidity becomes thin, sudden selling pressure can push prices down quickly because fewer buy orders exist to absorb the move.

In simple terms, supply tightening increases both upside potential and downside speed.

ALSO READ: Why BlackRock Is Bullish On Ethereum Despite The Price Stall

What Futures Traders Are Signaling

Derivatives markets often reveal trader sentiment before spot prices move. Futures open interest has declined in recent weeks, meaning leverage has cooled after earlier volatility. Funding rates have also stayed low, showing hesitation from both bullish and bearish traders.

This creates sensitivity to momentum shifts. If ETH begins rising while funding turns positive and open interest slowly rebuilds, short sellers may close positions, creating upward pressure.

If price drops below $1,900 while funding remains negative, liquidation cascades could accelerate the decline.

The market currently looks balanced but unstable, which explains why traders focus so closely on this single price level.

Simple Trade Scenarios To Watch

There are two scenarios that will determine how ETH’s price plays out going forward:

- Bearish scenario – a strong daily close below $1,900 could trigger momentum selling toward $1,600. Traders often place risk controls above $2,050 to avoid false breakdowns.

- Bullish scenario – ETH must hold support and reclaim $2,150 with rising volume. This would signal renewed demand and could open a path toward $2,500.

Many traders use the 4-hour chart for entries while relying on daily closes for confirmation, keeping risk tightly managed in either direction.

YOU MIGHT LIKE: Ethereum Shatters $120B Staking Record – Can ETH Hit $4,000?

Conclusion

Ethereum’s market structure has narrowed to a single decision point. Locked supply, exchange outflows, and cautious derivatives positioning have created conditions where the next price level may unfold quickly once direction becomes clear.

Whether buyers defend $1,900 or sellers break it will likely determine Ethereum’s trajectory for the coming weeks, making this level the most reliable signal traders have right now.

Should You Invest In ETH Now?

Before you invest in Ethereum, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest premium crypto alert here: Bottoming Patterns Everywhere?(Feb 15th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.