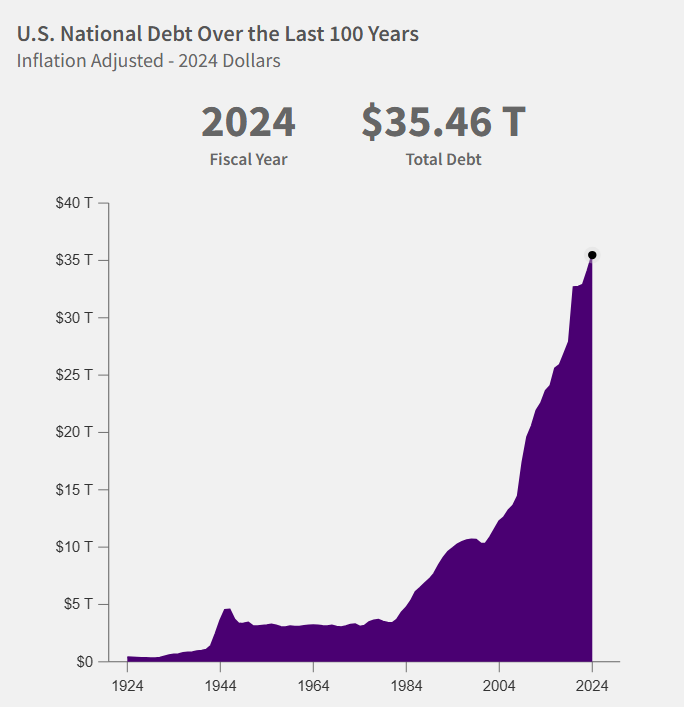

Rising federal debt changes institutional allocations. Crypto may receive flows, though its safe-haven record remains mixed.

U.S. gross federal debt reached roughly $37.5 trillion in mid-2025, according to Treasury data. CBO projections show federal debt held by the public climbing toward 118% of GDP by 2035, shifting the baseline for safe-asset demand.

Why Higher Debt Changes The Safe-Asset Calculus

Large deficits require heavier Treasury issuance, which can lift yields and increase volatility in nominal safe assets, prompting investors to reassess crisis allocations.

Political brinkmanship over fiscal choices raises event risk and short-term uncertainty, accelerating reallocation decisions by institutional treasuries and sovereign funds.

Recent reporting on record debt milestones shows how fiscal signals can change liquidity preferences.

RECOMMENDED: Crypto Treasuries Boom – Is a Bitcoin Supply Shock Coming?

Concrete Channels Moving Cash Toward Crypto

Stablecoins form a growing layer of dollar liquidity, and a substantial share of stablecoin reserves sits in short-term Treasuries and repos, linking crypto plumbing to government debt markets.

The stablecoin market totals several hundred billion dollars, providing scale for material flows.

U.S. money-market funds hold more than $7 trillion in cash-like assets, a pool that could rotate into risk assets if yields fall or if investors chase higher returns.

Corporate treasury allocations, improved custody services, and regulated institutional products create direct on-ramps for that cash to enter crypto markets.

READ ALSO: Best Crypto to Buy in Q4 2025 – 5 Coins Ready to Explode

Why Crypto Is Not A Turnkey Safe Haven

Academic and empirical work finds Bitcoin as a safe-haven inconsistent; it has fallen with equities during some crises and diverged in others.

Operational risks, custody failures, and evolving regulation further constrain crypto’s flight-to-safety role compared with gold or Treasuries.

RECOMMENDED: Best Crypto to Buy Today: Remittix Breaks Out With “PayFi” Potential

Conclusion

Rising U.S. debt increases incentives to look beyond nominal Treasuries, and crypto could capture part of that demand if stablecoin flows and money-market redeployments shift.

Watch three indicators: stablecoin reserve composition, weekly money-market fund assets, and CBO debt signals to judge whether crypto’s role moves from speculative asset to conditional safe haven.

Don’t Miss the Next Big Move – Access Alerts Instantly

Join the original blockchain-investing research service — live since 2017. Our alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience. You’re following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)

- What Happened This Week? Leading Indicator Analysis and 7 Token Charts. (Aug 16th)

- Crypto Shows More Resilience Than Expected. A Bullish Impulse May Be Underway. (Aug 9th)

- Prepare To Buy The Dip In Crypto (Aug 2nd)

- Alt Season 2025 – Progress Update (July 26th)