Robinhood backs its long-term crypto optimism with $51 billion in custody assets and ownership of Bitstamp.

While trading revenue fell 38% in Q4 2025, the company is expanding beyond retail transactions into institutional and global crypto infrastructure.

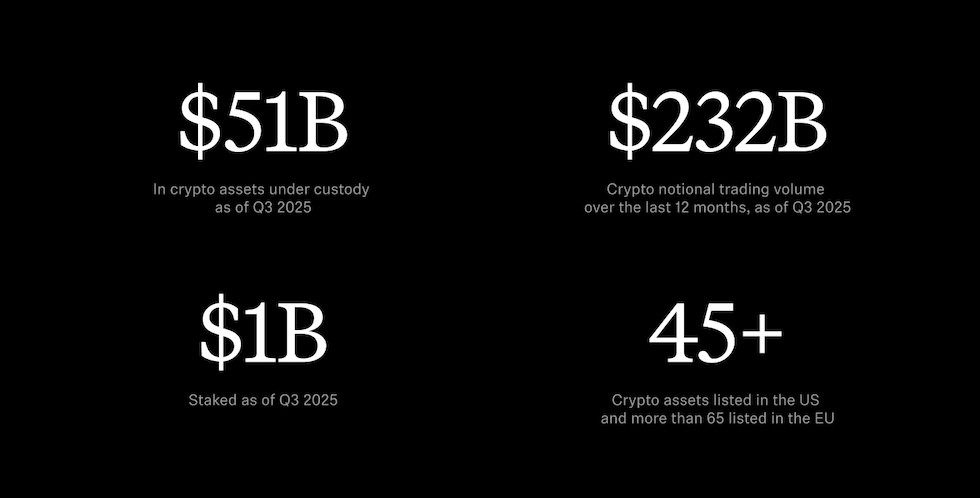

Robinhood holds about $51 billion in crypto assets under custody and processed $232 billion in crypto trading volume in 2025. In June 2025, it completed the $200 million acquisition of Bitstamp, one of the oldest crypto exchanges.

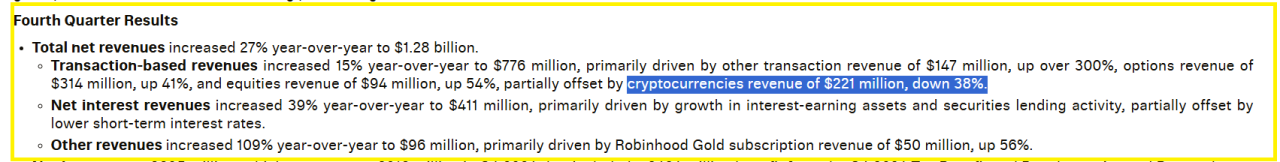

At the same time, crypto transaction revenue dropped to $221 million in Q4 2025, down 38% year over year.

These numbers show that revenue swings with market activity, but the company is expanding its crypto footprint.

In fact, the company’s CEO Vlad Tenev just told CNBC he is “very bullish” on crypto for the long run, indicating strategic moves and growth across Robinhood’s crypto business.

RELATED: Goldman Sachs Reveals $2.3B Crypto Exposure

Why Vlad Tenev Is Bullish On Crypto

In his CNBC interview, Tenev made a clear distinction between short-term trading cycles and long-term industry growth.

He said Robinhood is “very bullish” on crypto over time and emphasized continued investment in products and infrastructure.

Robinhood continues to expand its crypto offerings and integrate them into its broader platform.

Tenev pointed to the decision to acquire Bitstamp as a key step that gives Robinhood global licenses, institutional clients, and deeper liquidity.

This shows that Robinhood wants to participate in more parts of the crypto value chain. These include retail trading, custody, institutional execution, and exchange services that offer additional revenue streams. That shift supports the long-term optimism that Tenev expressed.

RECOMMENDED: Michael Saylor Just Pledged To Buy Bitcoin Forever Despite A $12.4 Billion Loss

Robinhood’s Crypto Business Today

The company’s crypto position is not small. Robinhood reported about $51 billion in crypto assets under custody as of late 2025.

That figure represents customer holdings on the platform, and it creates a base that can generate ongoing fee income.

In 2025, crypto notional trading volume reached $232 billion. This shows active participation, even though volumes fluctuate with market conditions.

The Bitstamp acquisition closed in June 2025 for about $200 million, added institutional infrastructure and international reach.

Instead of relying only on retail traders in the U.S., Robinhood now has access to professional clients and global markets.

This has also helped Robinhood diversify its revenue sources. Retail trading tends to spike during rallies and cool off when markets lose momentum. Institutional flows can be steadier and less dependent on hype cycles.

Owning exchange infrastructure also allows Robinhood to capture more of the transaction stack.

ALSO READ: Is Bitcoin Finished? Washington Rejects Bailout As Price Plummets

The Revenue Reality

Despite the long-term buildout, short-term numbers show pressure. Crypto transaction revenue fell to $221 million in Q4 2025, a 38% decline from the previous year. This drop means slower trading activity as crypto prices pulled back from earlier highs.

When volatility falls or prices drift lower, retail traders become less active. That directly affects Robinhood’s transaction revenue. The company’s earnings remain sensitive to market cycles.

Bitcoin traded in the mid $60,000 range during this period, while Ethereum hovered around $2,000. These levels are solid historically, but they do not create the same surge in speculation seen during sharp rallies. Lower excitement translates into fewer trades.

Tenev’s bullish stance does not deny this reality. Instead, it suggests that infrastructure built during quieter periods can generate stronger returns when activity returns.

What Comes Next For Robinhood Crypto

Tenev has signaled continued product expansion and deeper integration between crypto and other parts of the Robinhood platform. The company is also positioning Bitstamp as a core piece of its global crypto strategy.

If you need to understand Robinhood’s future in crypto and why its view matters, focus on these three metrics for now:

- Crypto assets under custody. If that number rises consistently, customer engagement is improving.

- Bitstamp institutional volumes. Growth there would confirm that the acquisition adds meaningful scale.

- Crypto transaction revenue trends. Stabilization or growth would show that the business is gaining resilience.

Robinhood’s broader strategy now focuses on building infrastructure, expanding globally, and capturing more revenue per transaction. This approach does not eliminate earnings swings, but it creates more ways to generate income across cycles.

YOU MIGHT LIKE: 10 Giant Companies That Hold the Most Bitcoin You’ll Be Surprised Who’s on Top

Conclusion

Vlad Tenev’s long-term optimism is supported by $51 billion in crypto custody, $232 billion in annual crypto volume, and the acquisition of Bitstamp. Revenue still rises and falls with market activity, but Robinhood now has deeper crypto roots than at any point in its history.