XRP shows strong on-chain growth and new institutional support, but technical resistance and legal uncertainties suggest cautious, gradual buying is best.

XRP is currently trading around1.4, having swung between $3.69 and $2.08 in 2025 so far. With a consolidation since the high in june 2025 , the focus returns to whether this dip presents a buying opportunity.

Let’s dive into on-chain trends, institutional backing, and future outlooks.

Strong XRP Network Activity: A Green Light?

Earlier in 2025 Daily active addresses on the XRP ledger surged from ~32,000 to ~547,000—an eye‑popping 1,609% jump in 24 hours. Though price hasn’t skyrocketed alongside, this signals heightened usage and investor interest.

Historically, such activity precedes breakouts as new wallets enter the ecosystem.

More recently, we have seen a decline in active user transactions which could be a sign that more users are holding XRP currently. Once the next bull run in XRP continues, network activity is likely to increase again.

Institutional Momentum Through Futures

CME launched cash-settled XRP futures on May 19, offering both micro (2,500 XRP) and standard (50,000 XRP) contracts. First-day volume exceeded $19 million.

This milestone boosts liquidity, provides hedging tools for institutional capital, and fuels optimism about eventual spot ETF approvals.

Earlier in the year the USA announced that XRP would be a strategic financial asset for the USA which shows huge potential for the future of Ripple (XRP)

Technical Setups & Price Ranges

Technical sentiment is mixed: XRP has been trading in a range between $3.6 and $2.6 in the last few months.

A break below $2.69 may see XRP drop towards next support levels, however our analysis suggests a more likely scenario is a break above $3.2 and a continued rally for the end of 2025.

Forecasts & Risk Balance

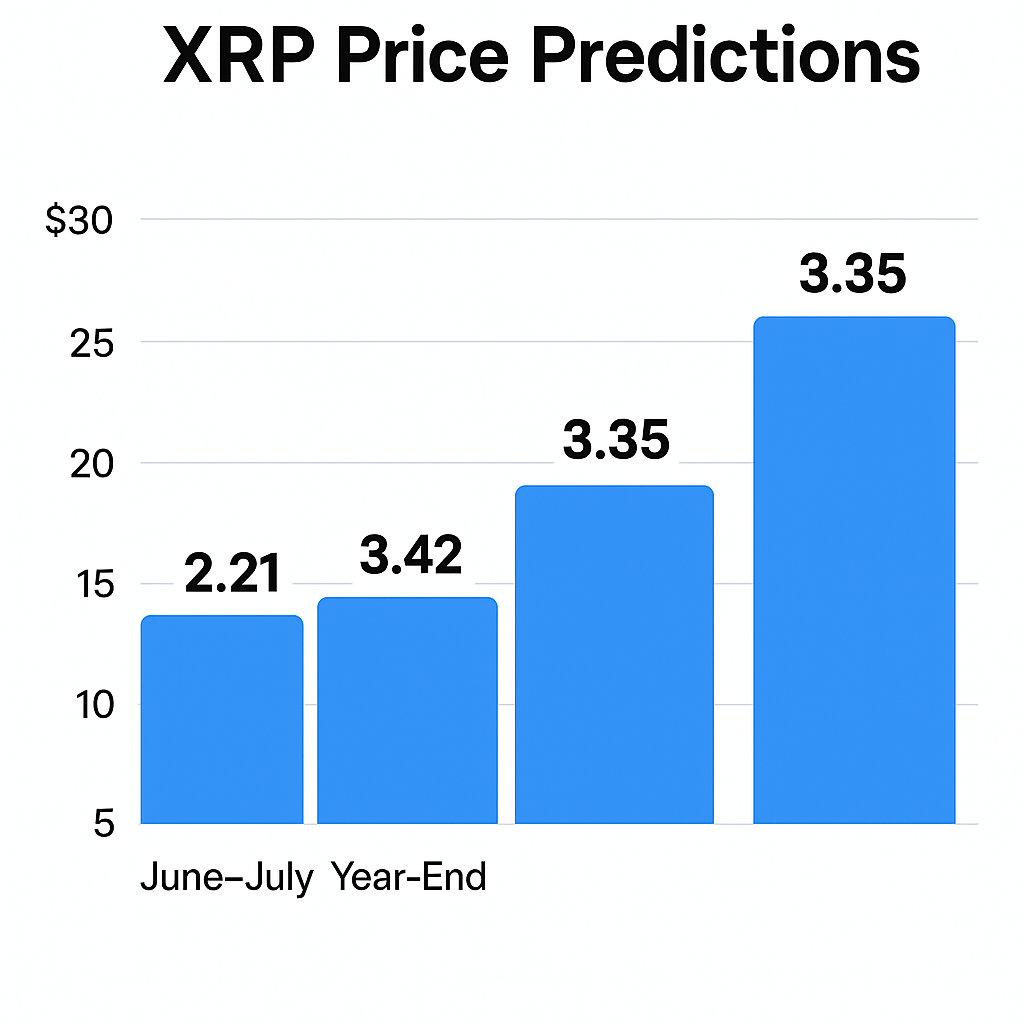

Consensus outlooks suggest a moderate rebound this summer—CoinCodex forecasts an average of $2.21–$2.42 in June–July, with potential growth to $3.35 by year-end (~+56%). Investing Haven predicts long-term bullish scenarios spanning $5–$9 by 2030 if adoption continues.

However, extreme forecasts (e.g. $27 by July) exist but hinge on unlikely catalysts.

Conclusion

XRP stands at a pivotal juncture. On‑chain engagement and institutional infrastructure have improved substantially, while price remains in a consolidation zone.

For risk-tolerant investors, a cautious entry around current levels ($2.10–$2.15) with dollar-cost averaging could pay off, especially if breakout confirms.

For those seeking lower risk, waiting for a clear move above the $2.30–$2.35 range—or resolution of pending regulatory catalysts—may be wiser. In short: this dip is intriguing—but not a slam‑dunk—making strategic, measured exposure the balanced path forward.

Wondering Which Price You Should Buy XRP?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

-

Proprietary 15-indicator methodology developed over 15+ years of market research.

-

Proven track record of spotting major turning points before markets move.

-

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)