XRP has surged in global crypto conversations even though price action remains restrained. Rising attention signals growing interest, but real demand still decides where price goes next.

XRP rarely sits at the center of the crypto conversation without a strong price rally.

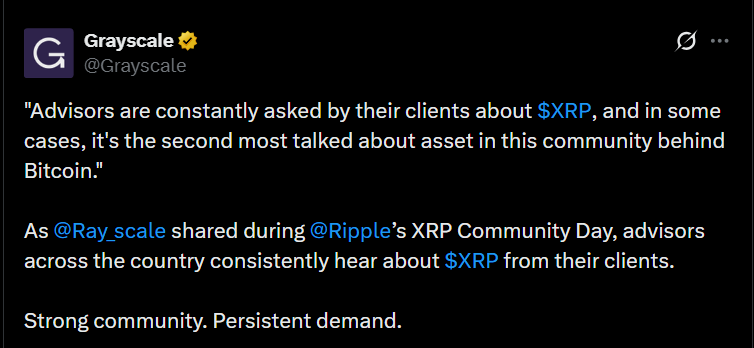

This week is different. A new report from Grayscales head of product and research shows XRP ranking as the second most discussed cryptocurrency after Bitcoin, placing it ahead of many faster-moving altcoins.

The shift comes at a time when markets remain cautious and liquidity feels tight. This contrast makes the trend interesting. When attention rises before price, markets often enter a phase where expectations build quietly before volatility expands.

XRP Price Prediction

Visualize future value based on annual growth.

RECOMMENDED: What Falling XRP Exchange Balances Could Signal for Future Prices

Why Everyone Is Talking About XRP Right Now

Conversation often moves before capital. When financial advisors begin receiving repeated questions about a specific asset, platforms and institutions start paying closer attention.

Recent survey data shows XRP appearing frequently in client discussions, which signals renewed curiosity from investors who previously ignored it.

This attention creates momentum of its own. Media coverage increases, online communities amplify every development, and traders begin positioning early. The result is a market environment where expectations grow faster than price.

That gap between attention and valuation can lead to sharp price moves once real money enters or exits.

ALSO READ: Hidden XRP Demand: Payment Flows Behind the Scenes

The Real Reasons Behind The XRP Buzz

Several developments explain why XRP suddenly dominates conversations. They include:

- Technology progress on the XRP Ledger

- Institutional exposure through investment products

- Community strength

Technology progress on the XRP Ledger

Recent updates introduced permissioned domains and improved compliance tools designed to help institutions operate within regulatory requirements. These changes make the network easier for banks and regulated firms to test without facing operational uncertainty.

Institutional exposure through investment products

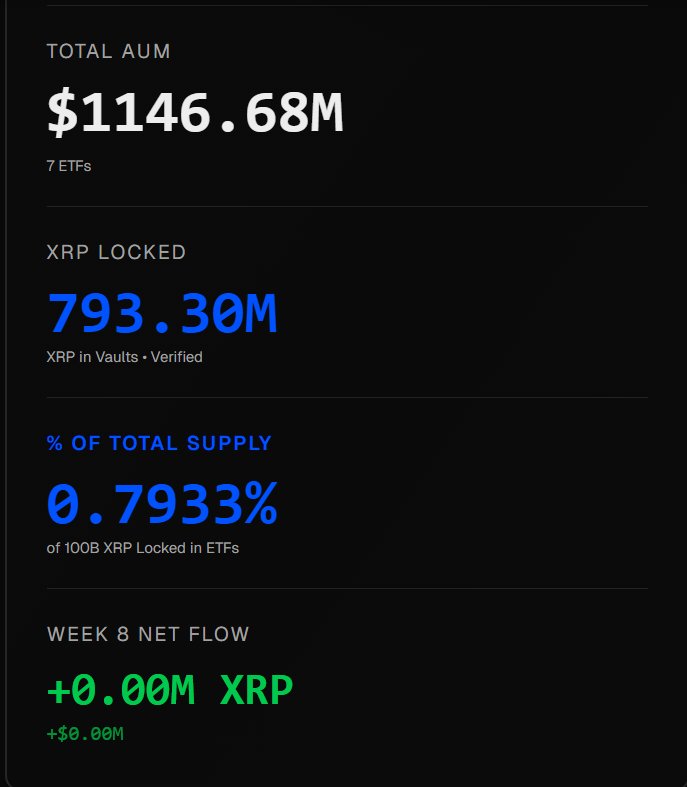

XRP-focused ETFs and tracked holdings now lock a measurable amount of supply, giving professional investors a familiar way to gain exposure.

While the total allocation remains modest compared to Bitcoin products, visibility alone increases credibility.

Community strength

XRP has one of the most active user bases in crypto. When institutional headlines appear, that community amplifies them quickly, pushing XRP into trending discussions across social platforms and financial media.

YOU MIGHT LIKE: Analysts Warn XRP Could Crash to $0.85 – Should You Be Worried?

How To Tell If Attention Is Turning Into Real Demand

High conversation levels can look impressive, but they do not automatically lead to price growth. You need to separate excitement from measurable demand.

Start with exchange reserves. If fewer tokens sit on exchanges, selling pressure weakens. Next, look at ETF inflows and large wallet activity. Consistent inflows suggest institutions are moving from discussion to allocation.

Trading volume alone does not confirm this shift because short-term speculation can inflate activity without reducing supply.

When declining exchange balances align with steady inflows, markets often move quickly because available liquidity tightens.

RECOMMENDED: Did Goldman’s $153M XRP Bet Trigger 11% Drop?

The Risks Investors Should Not Ignore

Rising attention also increases risk. Social excitement can push prices higher temporarily, but rallies built only on headlines tend to reverse fast. XRP still has a large circulating supply, which means sudden selling can slow momentum.

In addition, regulatory news or analyst outlook changes can quickly shift investor sentiment.

Infrastructure progress and institutional interest improve long-term prospects, yet markets still require sustained capital flows to maintain upward movement.

RELATED: When To Buy XRP? This Chart Might Help

Conclusion

XRP’s rise to the second most discussed crypto shows a shift in attention and not a confirmed market breakout. Interest from advisors, institutions, and communities has increased at the same time, creating conditions for larger moves if demand follows.

The key difference now lies between conversation and commitment. When infrastructure progress, institutional inflows, and shrinking exchange supply work together, attention can quickly turn into lasting momentum.

Until then, XRP remains a market watching point rather than a finished trend.

Should You Invest In XRP Now?

Before you invest in XRP, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest premium crypto alert here: Bottoming Patterns Everywhere?(Feb 15th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.