XRP has been really hot in 2017 and 2018. It had THE single most bullish long term chart until November of 2020. Then came the SEC drama, and it took a long time for XRP to recover. Is XRP now turning into an attractive opportunity or is it still to be avoided? How does XRP relate to our crypto predictions?

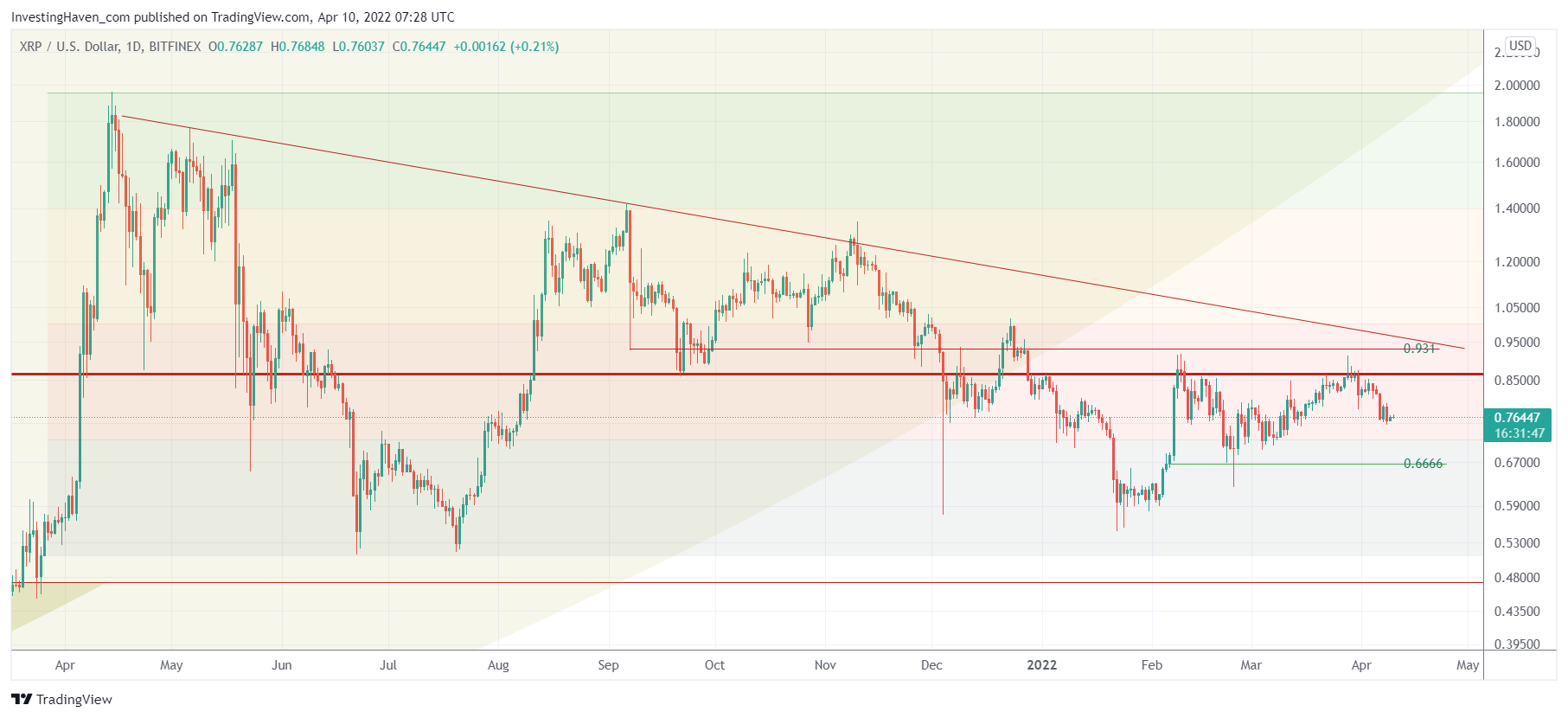

The essence of the answer is really to be found in the chart(s).

Stated differently, it is pointless to speculate on the outcome of the SEC lawsuit. There is no way of knowing how it will play out nor how the price of XRP will react to this, why even trying to take on the mental stress to speculate?

Instead, it’s wiser to look at the direction of XRP as per the chart and check it against the leading indicator BTC.

When it comes to BTC we said that we were closely Watching Bitcoin On Tuesday, April 5th. It turned out to be a bearish day, so short term it will be tougher for BTC to rise and it continues its consolidation. Long term, we still see BTC moving to 59k, ultimately it will move to new ATH but that’s not going to happen before summer.

The XRP chart, in the meantime, is printing a really nice long term reversal. Instead of speculating it’s better to analyze. And the beauty of chart analysis is that is can be super simple which it is in the case of XRP: once it clears 1.001 USD it enters a bullish area.

So, then, what about the outcome of the SEC case? Very simple, it will result into a chart structure above or below 1.001 USD, simple as that.

Once BTC confirms its support (as indicated 42.1k) and once XRP clears 1.001 USD (3 to 5 day closing basis) we believe XRP turns into an attractive crypto investment opportunity in 2022, regardless of SEC.

In other words, no need to make things more complicated than they are.

That’s how we try to assess opportunities in our crypto investing research service: simplify things and stick to our market calls. Give time to the market, and combine the hunt for unicorns with a stable auto-trading service on BTC + ETH.