Sentiment has collapsed while large holders quietly increase exposure. Fear reduces competition for liquidity and often sets the stage for steep reversals.

Crypto sentiment has dropped into extreme fear again, with the widely followed Fear and Greed Index falling into single-digit readings this week.

Trading activity slowed, leverage declined, and retail participation weakened at the same time that blockchain data showed accumulation by larger wallets.

Several reports and on-chain analytics firms show a rare combination: pessimistic headlines alongside steady buying from experienced participants. This contrast often appears during transitional phases when markets shift from emotional selling to strategic positioning.

RELATED: Crypto Fear Reaches Capitulation Levels As $2.2B Is Liquidated

Why Extreme Fear Is Rising Again

Extreme fear reflects psychology more than price alone. Traders react to volatility, macro uncertainty, and rapid headlines, which pushes sentiment indexes lower.

Recent data shows reduced leverage across major exchanges and fewer forced liquidations compared with earlier downturns. This is important because panic selling usually requires heavy leverage unwinds.

Current conditions look calmer beneath the surface. Social sentiment remains negative, yet market structure shows controlled selling rather than widespread capitulation. Investors appear cautious instead of desperate.

This environment often forms when short-term traders exit while longer-term participants begin evaluating value.

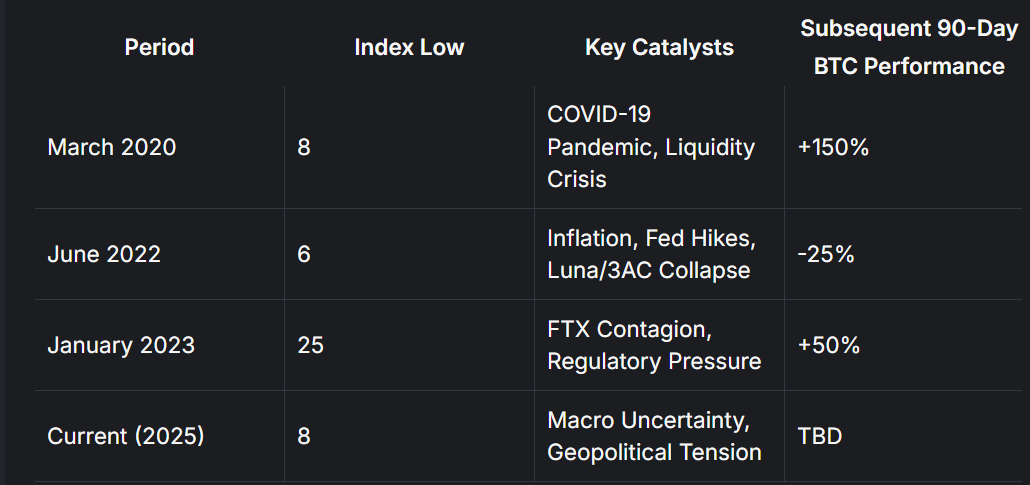

Historical comparisons seem to support this pattern. Previous single-digit sentiment readings in 2022 and 2024 appeared close to local market bottoms.

Fear alone never guarantees recovery, but it frequently signals exhaustion among sellers.

Evidence Smart Money Is Buying

Onchain tracking from Glassnode and Santiment shows growth in holdings among large wallet cohorts during recent declines.

These wallets tend to represent funds, early adopters, or experienced traders who scale into weakness instead of chasing rallies. At the same time, smaller wallets show slower accumulation or slight distribution.

Exchange data also indicates that sizable amounts of crypto moved off trading platforms into storage wallets over recent sessions. When coins leave exchanges, they become less available for immediate selling. This does not push prices higher instantly, but it tightens available liquidity over time.

This behavior explains why prices sometimes stabilize even when sentiment looks terrible. Large buyers rarely chase upward momentum. They accumulate quietly when competition fades and liquidity becomes cheaper.

RECOMMENDED: Why Bitcoin Keeps Failing At $70,000

How Fear Turns Into Opportunity

Fear changes market mechanics in simple ways. When traders hesitate, fewer aggressive buyers and sellers compete for orders. Large participants can build positions gradually without moving price too quickly.

Once demand increases, limited available supply can accelerate price movement.

Use three signals to help confirm whether fear is turning constructive:

- Exchange reserves should decline as investors transfer assets into custody or cold storage.

- Large wallet balances should rise consistently rather than spike once.

- Investment products and custody platforms should report steady inflows instead of short bursts.

When these signals tick true, markets often transition from slow consolidation to rapid expansion. Without them, sentiment rebounds tend to fade quickly.

Risks To Keep In Mind

Fear phases still carry risk. Negative news cycles can extend longer than expected, and macro shocks can trigger fresh selling. Scheduled token releases or institutional portfolio adjustments may also introduce unexpected supply.

Coverage from Reuters notes that broader financial volatility continues influencing crypto behavior, which means external markets still shape momentum. Traders who assume every fear reading marks a bottom often enter too early.

Risk management is also still important. Use gradual entries to reduce timing pressure, and volatility-based stop levels to manage sudden swings. Remember, markets during extreme fear reward patience more than speed.

YOU MIGHT LIKE: Did Goldman’s $153M XRP Bet Trigger 11% Drop?

Conclusion

Extreme fear creates uncomfortable conditions, yet it often attracts experienced buyers who focus on liquidity rather than sentiment.

Current data shows cautious retail behavior alongside steady accumulation by larger holders, a combination that has preceded strong recoveries in past cycles.

The shift from panic to positioning rarely happens loudly. It develops slowly, then appears obvious only after price moves higher.

Wondering which crypto to focus on right now?

Before you invest, you’re going to want to read our next premium crypto alert which will be published in the coming days. We will reveal key crypto assets to consider in 2026 with explosive potential.

Read our latest premium crypto alert here: Bottoming Patterns Everywhere?(Feb 15th)

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.