Overstock (OSTK) announced yesterday that it will sell its retail business by early 2019. It will retain the rest of its business which is primarily Medici Ventures, a blockhain division with tZero as the most known venture. In doing so it will become the largest pure play blockchain stock in the world in 2019. Although there are many blockchain stocks there are not many pure play blockchain stocks.

It was WSJ yesterday that announced this ‘breaking news’ on Overstock and its blockchain business. As expected there is lots of news on this topic of Overstock and blockchain, however there is no valuable news which adds relevancy to investors.

So what does InvestingHaven’s research team make out of this news? Our key take-way is that Overstock will become the largest pure play blockchain stock in the world in 2019, and we look at this both from a fundamental perspective as well as a chart perspective.

Medici Ventures: Overstock’s blockchain business

Overstock has a retail e-commerce business which it will most likely sell by February 2019 and a blockchain business with its subsidiary Medici Ventures. Assuming the capital associated with the sale of its retail business stays within the company as does Medici Ventures it implies this will be the largest pure play blockchain business in the world trading on a stock exchange.

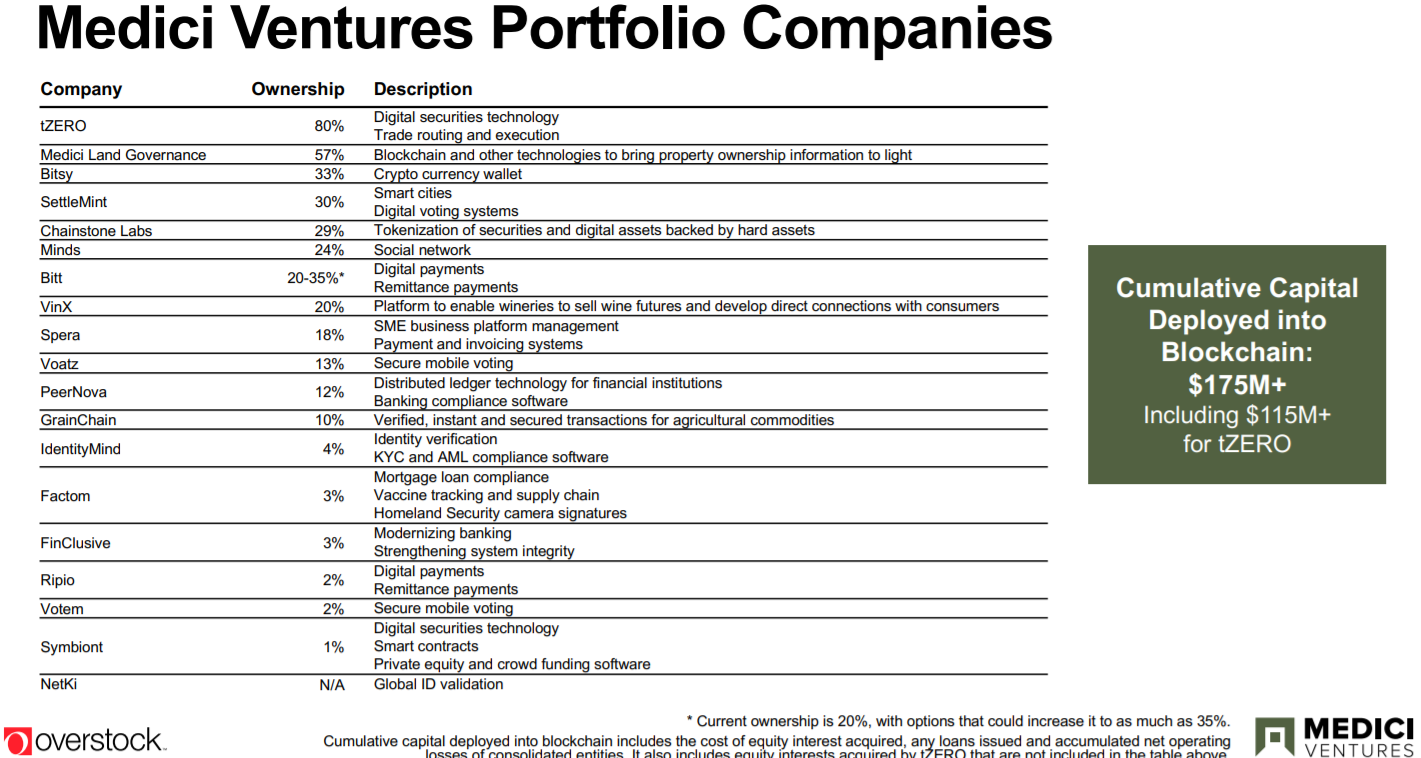

The business activities and blockchain companies in Medici’s portfolio are listed here.

Its blockchain businesses cover a wide range of industries: identity & social media, property & land, money & banking, capital markets, supply cain, voting.

Below is an overview of the blockchain companies in each vertical.

Moreover, the following table shows the % ownership that Overstock has in each company.

tZERO is by far the most visible blockchain company, and Overstock has the largest stake in it. It also attracted most of the investment capital: $115M from the $175M that was deployed into blockchain.

Overstock: fundamentals of the largest pure play blockchain stock in 2019

The most likely path, going forward, is that the e-commerce business unit is sold, gets out of Overstock and that Overstock will become Medici Ventures. This was not communicated by Overstock, this is our forecast. The name Overstock will also have to change, logically.

So what are the fundamentals in a world in which Medici Ventures is the only business activity in Overstock?

If anything, there will be sufficient capital upfront, at the moment of the sale of the company. But blockchain businesses are still burning cash at this point in time. Overstock’s CEO admitted it openly: “I do not care whether tZERO burns $2M per month at this point in time” he said. He also added “we think we’ve got cold fusion on the blockchain side” which is of course the whole point.

In other words, according to Overstock’s CEO, his blockchain companies are close to the tipping point where they will start creating revenue as opposed to only burn cash.

This, of course, is an extremely important aspect in assessing fundamentals of Medici and Overstock as a pure play blockchain stock. And it is one that is extremely hard to forecast. Nobody really knows when blockchain ventures (with the exception of crypto exchanges) will start generating revenue.

Moreover, as per the SEC filing that came with the latest earnings report, we see a long list of risks that were identified by Overstock. Many of them are blockchain related. We picked out the 2 that we considered the most important ones:

- the possibility that blockchain technology may be adopted more slowly than we anticipate;

- the difficulties tZERO will face in attempting to generate revenues from blockchain-based applications of any nature;

On the flipside there must be a good reason why Overstock’s CEO is announcing the sale of its e-commerce business, and its move to a pure play blockchain stock, at this point in time, not earlier and not later. He must have a plan in place. He must see the signs of traction and/or continued interest in attracting investing capital … or both. He is one of the few people that is really deep into the blockchain developments, also as it relates to Wall Street, so he must have deep insights.

Note that, in terms of timing, tZERO will launch to the public before the summer of 2019. Most likely, Overstock has planned the sale of its e-commerce business right at a time when its first large scale blockchain business tZERO goes live. No coincidence here.

Overstock’s CEO Byrne is either totally crazy with his announced move or on its way to become a true innovative blockchain business genius. We tend to believe the latter. This is a forecast more as an educated guess says InvestingHaven’s research team.

Although there is plenty of risk with Overstock’s move we believe it is a calculated risk. Long term we believe Overstock as a pure play blockchain stock will do well, although we realize that much will depend on tZERO’s succcess.

Yes, the potential fundamental value of Overstock may be huge, as they will have first mover advantages in the ‘Security Token Offering’ wave which may be lead by tZERO. But there certainly is an above average level of risk at play here.

Overstock: chart of the largest pure play blockchain stock in 2019

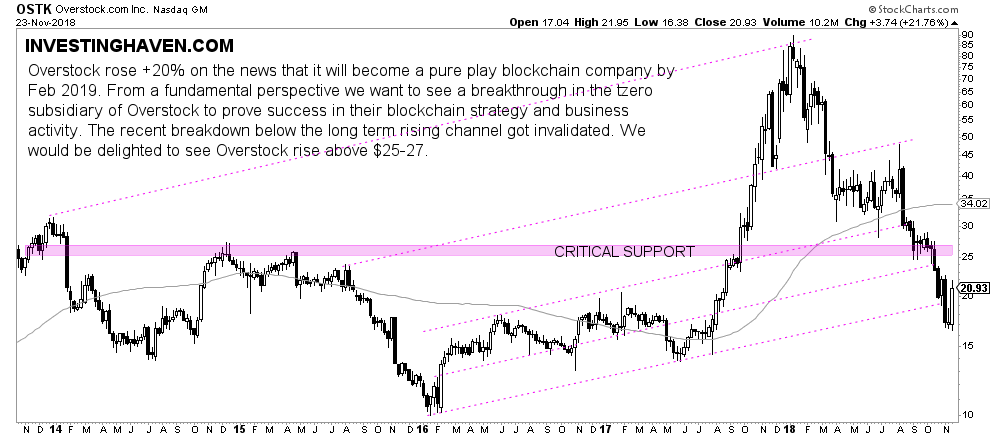

Investors clearly liked the news that Overstock is about to become the largest pure play blockchain stock in 2019. The stock chart of Overstock shows a failed breakdown, at least for now. Considering the short ratio is still very high blockchain bulls want to see a confirmed failed breakout implying Overstock needs to trade above $19 this year.

The stock chart below on 5 years shows the huge speculative peak of last year as well as the serious decline this year.

What will 2019 bring?

Much will depend on the news that Overstock’s tZERO will bring. Will they announce new fresh investing capital? Will they successfully launch tZERO and which prospects for revenue will they communicate? Which will be the price at which the company will sell its e-commerce business, and how much net capital (after deduction of costs and, potentially, taxes) will go as capital to the company?

Moreover, as blockchain stocks are strongly correlated to Bitcoin’s price, we believe Bitcoin’s price will be an important influencer of Overstock’s price as well.

These are the important aspects which will play an enormously important role on Overstock’s stock price. It is really hard to do a forecast for 2019, but we believe Overstock is a great long term play as a pure play blockchain stock!

Want to know more on blockchain stocks? We reveal much more detailed and actionable insights, as well as forecasts, on blockchain investing in our premium crypto research service. Subscribe now to our blockchain & crypto investing research service >>