These are interesting times for XRP holders. We signaled, exactly one month ago, that XRP has the most beautiful long term crypto chart (at the depth of the banking crisis, when XRP was trading at 0.38). Even though there is still risk from the SEC/Ripple case there is also a phenomenal XRP chart. Because charts don’t lie we will give the market the benefit of the doubt. The market knows more, much more. There must be a reason why XRP qualifies as the most beautiful long term crypto chart right now.

Before we look at the long term XRP chart, let’s replay our findings and writings in the last 2 months:

On Feb 5th, 2023: XRP: An Epic Buy The Dip Opportunity Might Be Underway (when XRP was trading at 0.4):

From a chart perspective, XRP continues to work on a long term triangle. Visibly, a W-pattern is in the making inside this triangle. Both are bullish chart characteristics, certainly when combined. We believe a buy opportunity is in the making in XRP. The next volatility window, mid-Feb to mid-March, should come with a ‘buy the dip opportunity’ provided that XRP respects the 0.34 level.

On March 25th, 2023: XRP’s Explosive Chart Setup Is Ready To Erupt (when XRP was trading at 0.44):

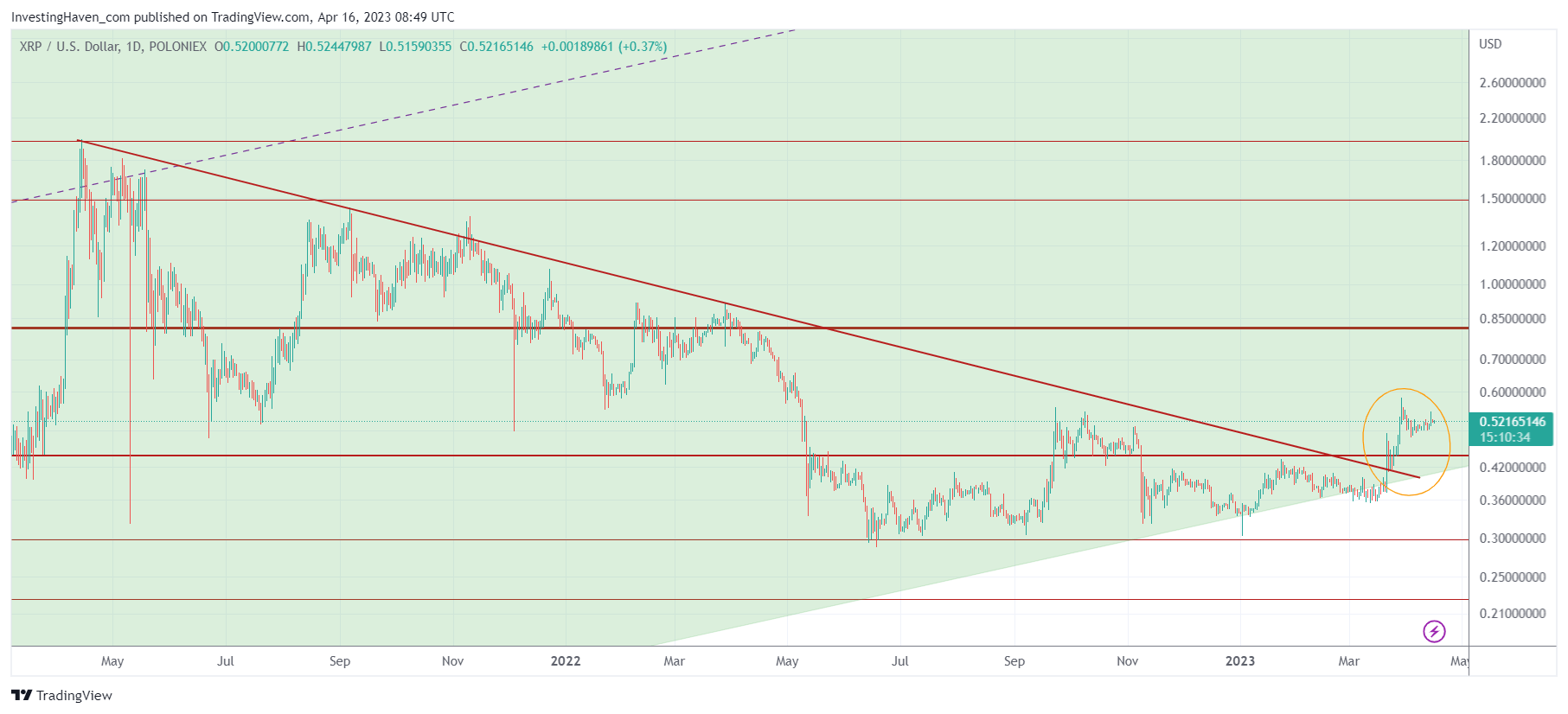

It couldn’t be clearer: an epic support structure is being created ‘as we speak’. Equally important, is how XRP is now flirting with the 2 year falling trendline. In fact, XRP is breaking out right now.

On March 29th, 2023: An Epic Breakout in XRP: Bullish Triangle Finally Resolved

In conclusion, XRP’s breakout from the bullish triangle is a very powerful chart event. It looks like XRP is ready to test 0.66. Whenever it breaks through 0.66, either short term or medium term, the higher levels between between 1.23 and 1.66 will become realistic and easy to achieve price targets.

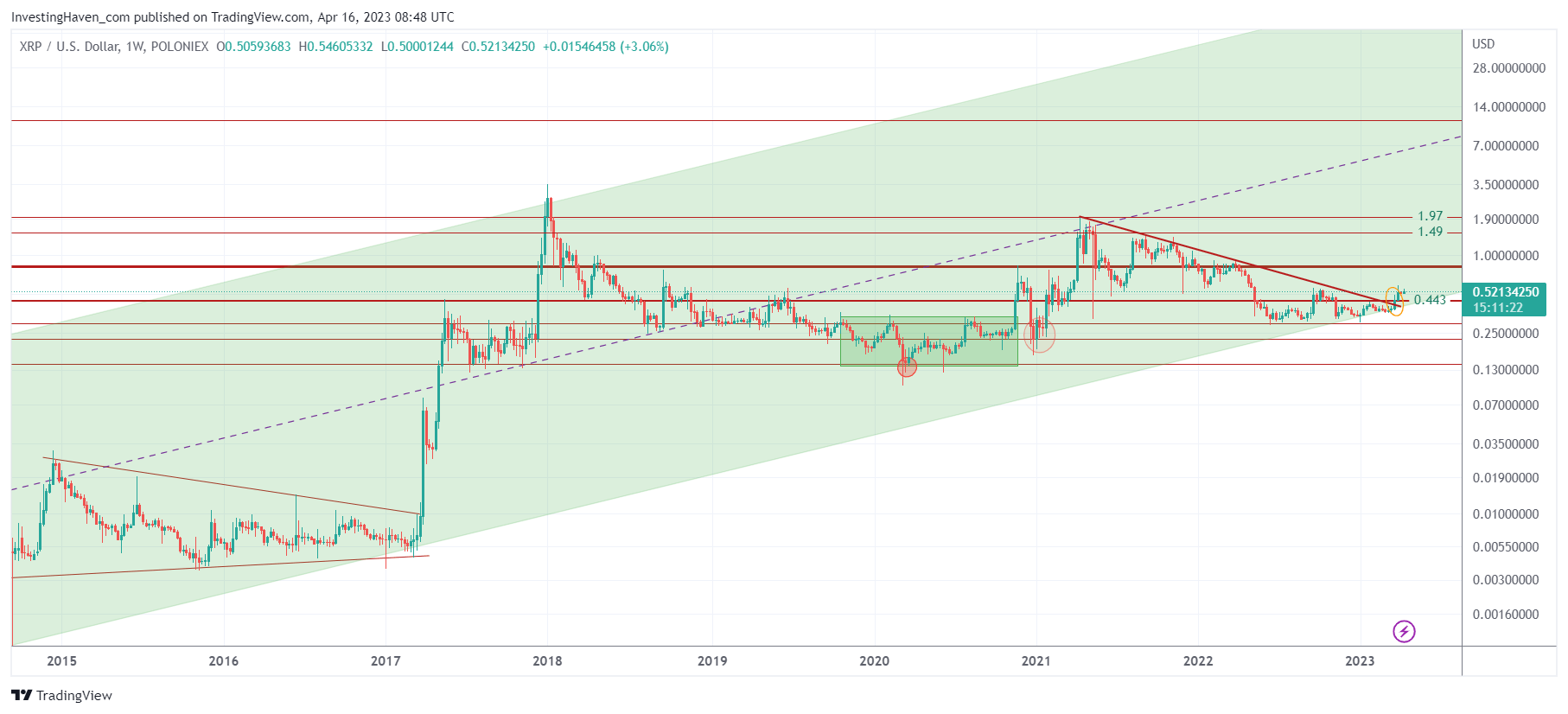

Let’s look at the up to date charts now, starting with the longest timeframe: the weekly since inception.

The giant W reversal that started back in 2018 is absolutely powerful. With the recent breakout of the 2-year falling trendline it is clear that the 4th and last leg of the W-structure is now well underway. This means that the bull run will start slowly, initially, until the acceleration point is reached. That’s when an aggressive move will start. That’s not now, also not next week, maybe in a few weeks or a few months.

The daily timeframe of the same long term channel shows the breakout. It is now confirmed because XRP has registered more than 13 days above the 2-year falling trendline.

A few points that we mentioned in the past in recent writings:

Q: What to think about the fact XRP has essentially ‘done nothing’ in the last 5 years, other than bouncing in a wide range, while many other tokens trade 10x above their pre-Covid levels and pre-2017 levels?

A: It’s very simple: the longer an orderly consolidation, the higher the upside potential. It’s a very easy dynamic, however extremely difficult to understand and apply. We believe that 99% of investors don’t understand it and are not able to apply it as a portfolio principle.

Q: How to mitigate the SEC lawsuit risk against Ripple?

A: Very simple, there is an easy way around it. An entry and exit strategy to mitigate the SEC/Ripple risk while leveraging the opportunity that is present on the chart.

How exactly? That’s what we explained in our March 19th alert called ‘Is XRP about to stage a secular breakout‘, available in our crypto research area. You will have instant access after signing up.