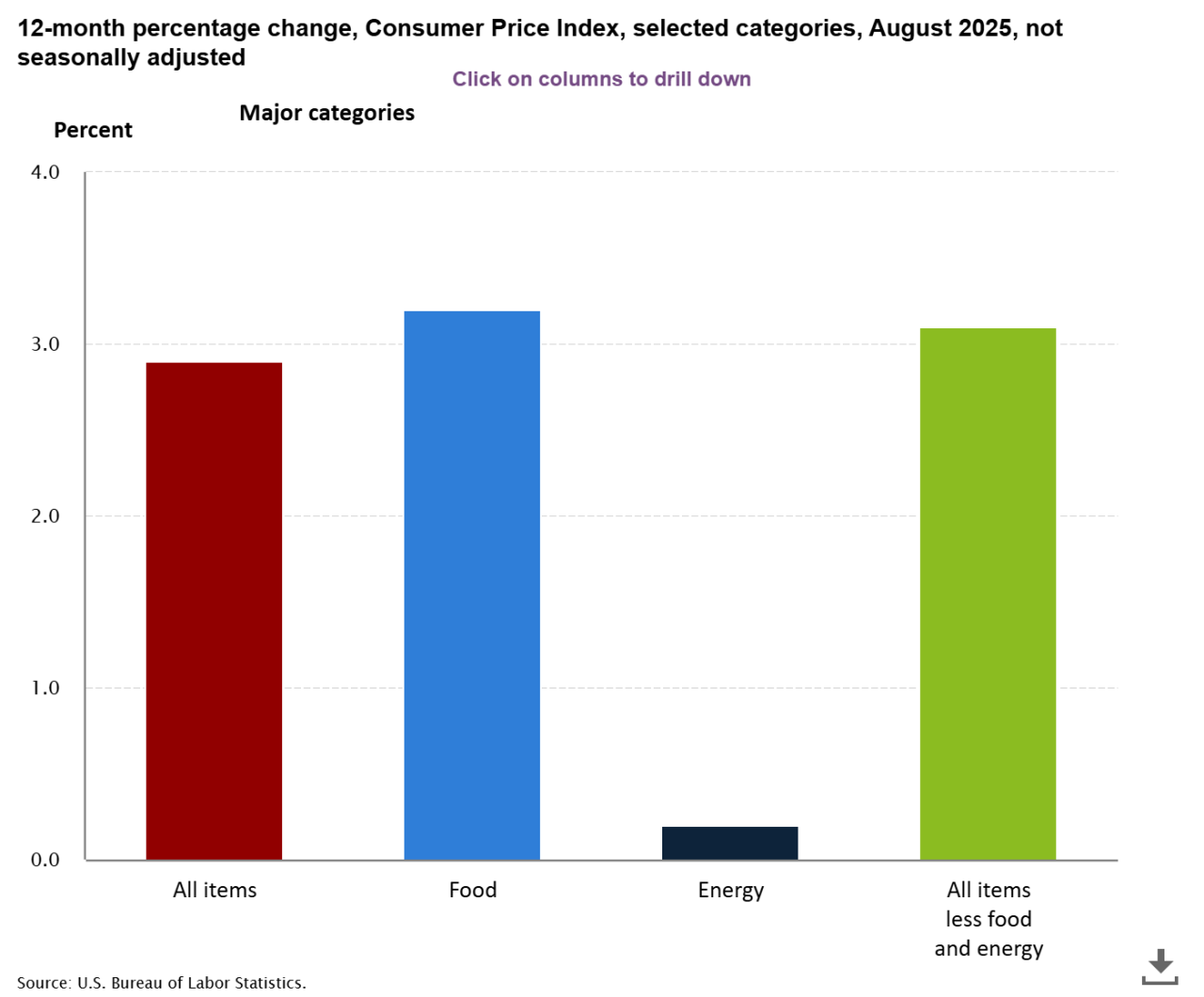

A surprise CPI or Fed signal can flip the dollar and yields. That flip can trigger fast repricing in BTC, ETH, gold and silver.

This week hinges on one clear risk; a CPI (Consumer Price Index) print and Fed language that can change market odds in hours.

A hotter than expected United States consumer price index will push the dollar and yields higher and squeeze risk assets. A softer print will lower yields and reopen buyers for crypto and precious metals.

RECOMMENDED: Gold Eyes $4,000–$5,000: Momentum Fueled by Fed Outlook

Macro Trigger And Market Pricing: CPI, FOMC And Market Odds

The next U.S. CPI release schedule is posted by the Bureau of Labor Statistics (BLS), and market participants will use that timestamp to line up trades and options hedges.

The BLS lists the next CPI release on October 15, 2025, at 8:30 A.M. Eastern Time.

The CME FedWatch tool shows where futures price the likely path for Fed moves, so watch any quick shift in implied probabilities after the print.

RECOMMENDED: Crypto Treasuries Boom – Is a Bitcoin Supply Shock Coming?

Transmission To Assets: USD, Yields, Volatility And Market Reads

When CPI surprises on the upside, the dollar and nominal yields tend to rise and safe-haven flows shift, which often pressures Bitcoin and Ethereum while lifting real yields versus gold.

Over the last 7 days BTC sits about 5.5% lower and ETH about 10.6% lower, numbers that show how sensitive crypto has been during recent macro shifts.

Gold has rallied this month and trades near multiweek highs, reflecting markets pricing more Fed easing over the year.

RECOMMENDED: Bitcoin (BTC) Fed-Cut Odds Collide with Spot-ETF Flows

Two Trade-Ready Scenarios And Trigger Levels

- Bull case, soft CPI or dovish Fed tone: DXY falls 0.5% and 10-year yield drops 15 to 25 bps, buyers re-enter BTC above immediate resistance and gold holds support, signaling a risk-on recovery.

- Bear case, hot CPI or hawkish tone: DXY rises 0.5% and 10-year yield jumps 15 to 25 bps, BTC and ETH test key supports, and gold may struggle despite higher nominal yields.

Which Crypto Should You Invest In Right Now?

For alerts on the key crypto assets that are primed for investment right now you should consider Join the original blockchain-investing research service — live since 2017.

InvestingHaven alerts come from a proprietary 15‑indicator methodology built over 15+ years of market experience.

You’ll be following the service that identified major turning points through crypto winters and bull runs alike

Act now and see why thousands trust us to deliver signals before markets move.

This is how we are guiding our premium members (log in required):

- Silver Rally Fueled by Absent Speculators (Sept 20)

- What Happens When Silver Hits 50 USD/oz? (Sept 13)

- Monster Basing Patterns in Precious Metals Resolving Higher (Sept 6th)

- Must-See Monthly Gold & Silver Charts (Aug 31)

- The 5 Most Important Silver Charts For H2/2025 (Hint: Very Bullish) (Aug 23)

- Silver – Speculators Keep Exiting The Long Side. What Does It Mean? (Aug 16)