Gold: Overbought Short Term, But Could War Drive Prices Parabolic?

Gold did very well lately. Gold performed so well that it entered the top of an 18-month rising channel. While...

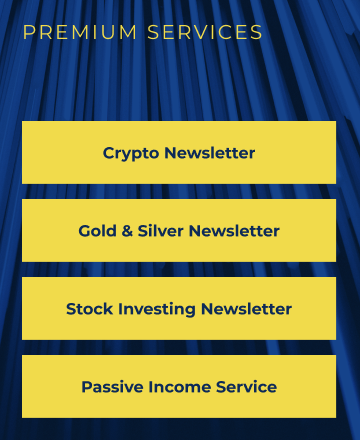

Read moreConnect with InvestingHaven

Our Crypto Forecasts

Our Must-Read Forecasts

Investing Tips

Markets & Stocks

The AI Sector’s Hidden Gem: The Stock That Is Set to Soar Amidst Sector Rotation

AI stocks continue to outperform. Within the AI space, rotation is occurring. One AI stock, in particular, is about to...

Silver, Lithium & Commodities

Gold: Overbought Short Term, But Could War Drive Prices Parabolic?

Gold did very well lately. Gold performed so well that it entered the top of an 18-month rising channel. While...

Forecasts

A Silver Price Forecast For 2024

Silver will move higher in 2024 because the top in Yields is confirmed. Silver and Yields are inversely correlated. Our...