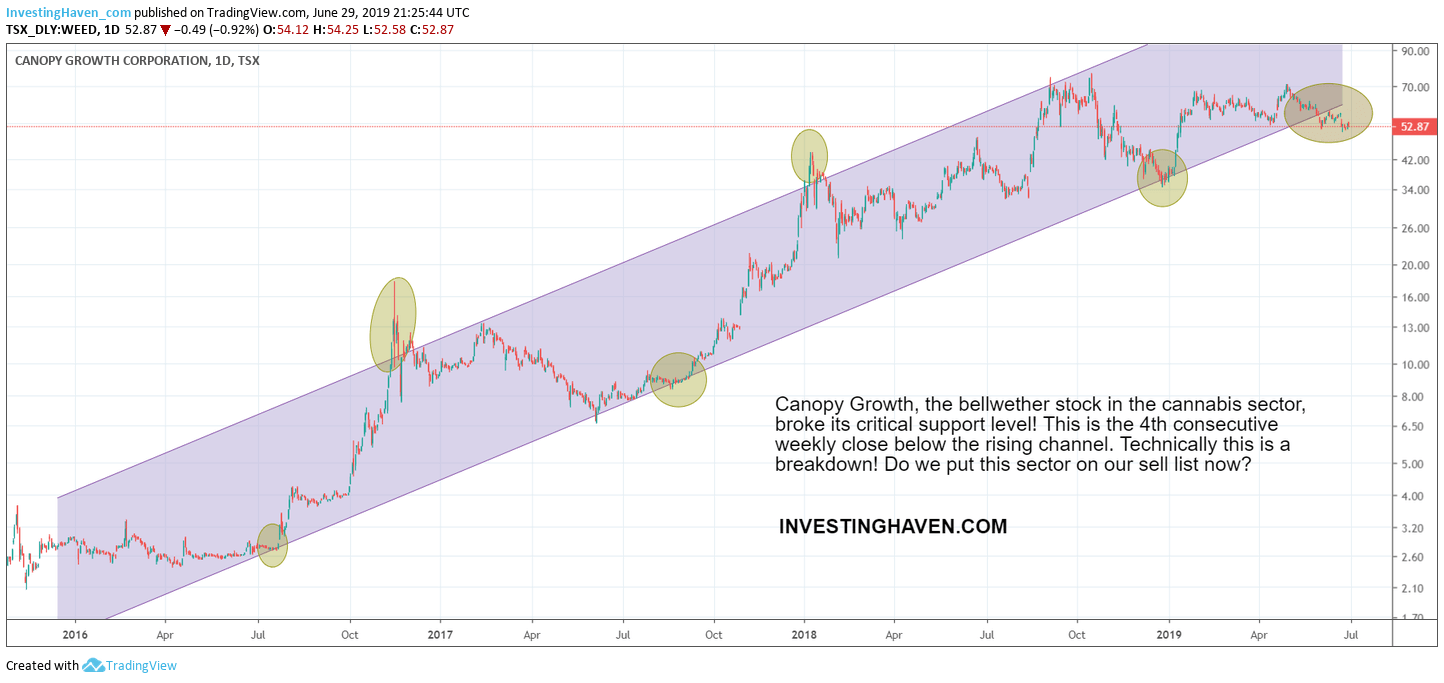

Last week we wrote about the cannabis market and the start of the breakdown of market leader Canopy Growth (WEED.TO). This week was crucial, is what we said in Cannabis Stocks At or Below Crucial Support. What do we conclude now that Canopy Growth has confirmed its breakdown: sell the whole cannabis sector?

First of all, a breakdown is a breakdown, we are not going to deny this. The chart of Canopy Growth does not look constructive especially after 4 consecutive weeks trading below its rising channel.

Based on this we now have to make a call: is this a sell for Canopy Growth only or for the whole cannabis sector?

If we flash a sell on Canopy Growth only it would imply we would deviate from our investing principles which is something we don’t take lightly. In the end our investing method is really based on discipline in the first place, and rules are not designed to break them.

What we are looking at is 3 things:

- Broad markets conditions are set to improve. As said in Green Light For Global Stock Markets Going Into 2020 we believe we are heading into a new risk-on cycle. This would favor stock markets in general, but high beta stocks (like cannabis stocks and tech stocks) in particular. The opposite is true as well: as we were for some 18 months in a risk-off cycle it would have been odd to see a strong and continued move in high beta stock segments because conditions were simply not right.

- Canopy Growth has reported excessive losses, which do not necessary reflect where the cannabis market is headed. Most cannabis stocks work hard to drive up revenues as well as improve earnings.

- In assessing individual charts of many dozens of top cannabis stocks we conclude that most cannabis stocks have fallen to their Dec 2018 lows. A minority is stuck somewhere halfway between their March 2019 highs and Dec 2018 lows. As broad markets indexes are nowhere near their Dec 2018 lows it means that the cannabis sock sector has seriously underperformed, and may be near a major bottom (or the start of a major breakdown).

So what do these circumstances mean for our cannabis market call?

We tend to think that we cannot make a call for the whole market, and do not rely on Canopy Growth’s chart breakdown to flash a sell for the whole sector. This is what we are looking at:

- There are some really solid companies out there, with proper management and great financial progress! We think of Organigram Holdings (OGI.V) and Aurora Cannabis (ACB.TO) as leaders of the sector as said in our Aurora Cannabis Stock Forecast. Some other companies though are pure crap. So we are looking at a mixed market and have a hybrid picture.

- The sector is pretty immature so our principle of the market leader dictating the dominant trend for the whole sector may not be as applicable in an immature sector.

- Fundamentally, there is enormous growth in this sector, globally. Prospects are great for the winners!

- Last but not least, too many cannabis companies were too aggressive in raising capital in recent months. This has damaged shareholder value, and we are frustrated about this. Emerald Health Therapeutics is such an example, and there are many more.

Therefore, taking all this into account, we do NOT flash a sell on the cannabis sector.

In the light of improving broad stock conditions, and consequently a great set of conditions for high beta stocks, we believe a select group of cannabis stocks will outperform later in 2019 and going into 2020! We believe select top cannabis stocks offer a buy opportunity right now, not a sell. We believe we are near a major bottom for select cannabis stocks.

Canopy Growth’s breakdown is not representative for the sector, is what we conclude. And this is a very high risk call as we will be criticized if this call appears to be wrong. Still we feel strong about this.

One specific case we will analyze in a separate article later today is Emerald Health Therapeutics. It is a more complex situation, so stay tuned.