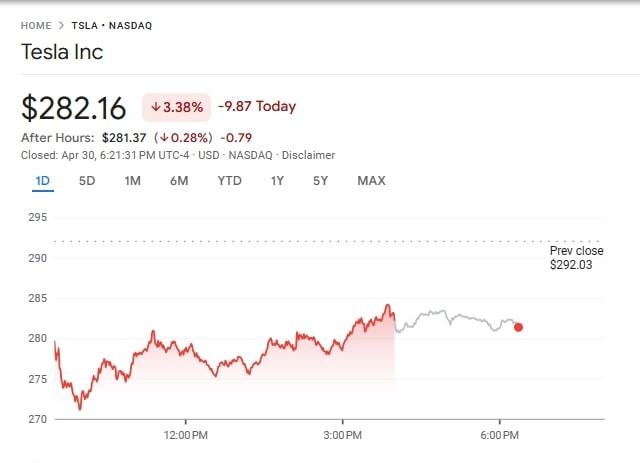

Despite the disappointing Q1 results, Tesla stock prices have been recording higher highs. Is Elon Musk’s company stock recovering, or is this a temporary rally?

Tesla Inc has been a bit of a disappointment for its investors this year, but its stock, more recently, has started showing some signs of life again.

Since early April, TSLA shares have rallied as much as 25%, leaving investors wondering if the EV stock will continue to recover in the months ahead, or is it going to prove a temporary rally only?

Interestingly, analysts are divided on that front as well, which makes TSLA a controversial stock. Some recommend buying Tesla stock at current levels as it’s trading at an unusual discount, while others argue there are too many headwinds facing TSLA this year to inspire an investment.

What Could Help Tesla Sustain its Upward Momentum?

Much of the year-to-date weakness in Tesla stock has been related to its billionaire chief executive, Elon Musk’s involvement in politics.

However, on the company’s latest earnings call, Musk confirmed plans of stepping back from his role in Trump’s Department of Government Efficiency (DOGE) to refocus on his EV company.

That effectively removes a major overhang from Tesla shares.

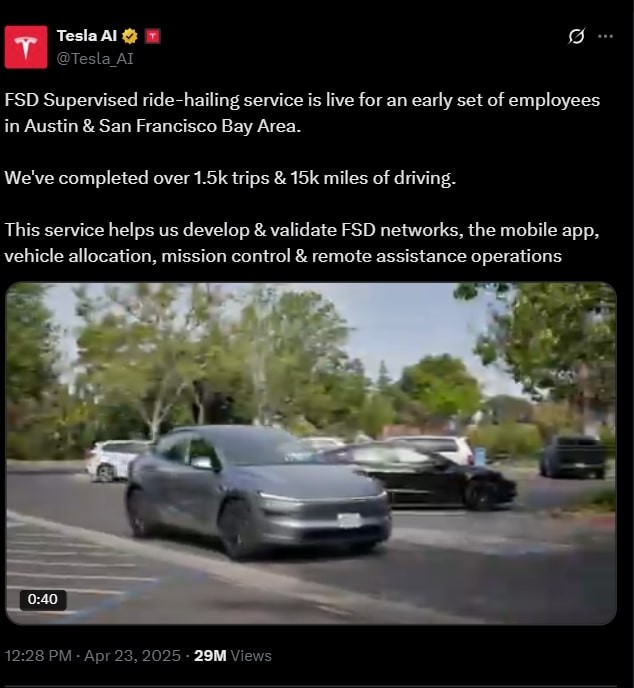

Plus, the electric vehicle behemoth is scheduled to pilot its robotaxi operations in Austin next month, which could help unlock significant further upside in its stock price.

A refreshed Model Y and a much-anticipated lower-cost Tesla later this year could serve as significant tailwinds for TSLA shares as well.

What Could Stall Tesla’s Momentum in 2025?

On the flip side, there’s a bunch of reasons to consider keeping on the sidelines in Tesla stock this year as well.

For starters, the automaker’s Q1 earnings confirmed it’s already dealing with a demand slowdown – and higher tariffs on imported vehicles under the Trump administration is not at all going to help on that front.

Plus, the new US government could choose to rescind parts of the Inflation Reduction Act (IRA) that incentivized purchasing electric vehicles. This could serve as a major blow to TSLA this year as well.

Finally, increased competition from Chinese rivals, particularly BYD, could stand in the way of Tesla shares commanding the sort of premium multiple they have in the past.

Caution Recommended

All in all, while there are opportunities facing Tesla stock at writing, they are being offset by just as significant headwinds as well in 2025.

Against such a backdrop, especially amidst a turbulent and uncertain macroeconomic environment, caution is warranted in buying TSLA shares at current levels.

The aforementioned internal as well as macro factors together could prove the EV stock’s recent rally a temporary one only.

Premium Momentum Investing: Gold, AI, Commodities & More

AI & Robotics. Gold & Silver. Commodities.

Markets don’t wait—Momentum Investing helps you get in before the big moves start.

This is InvestingHaven’s premium stock market service for spotting medium-term trends across key sectors—with risk-conscious strategies and hedging insights built in.

✅ Focus on top-performing sectors like AI, robotics, and metals

✅ Predictive volatility windows + smart hedging ideas

✅ Deep analysis of leading indicators to catch bullish momentum early

We don’t follow trends—we forecast them. And since 2024, we’ve added proactive hedging calls, like the August 2nd 2024 hedge, issued weeks in advance.