[Ed note: this article was updated on November 25th and contains all our latest insights]

In general, crypto assets are here to stay. They are all based on blockchain, a technology that is revolutionizing transactions. It is the internet of value, or internet of trust.

This article (report) is setup in a way that 20 investment tips are integrated throughout our insights and charts, in order to give readers the maximum value out of this report.

Blockchain is here to stay. It is the technology that is called “the internet of value”. While the internet created a place of info exchange, Blockchain records and exposes transactions in a way that services can make use of it. Think of notary services, payment systems, barter services, escrow services … the traditional internet did not bring those services to a better state, Blockchain will.

TIP # 1: Blockchain must be part of your portfolio. Do not overreact though and take positions in a gradual way. It is the type of investment that could make you a fortune in 7 to 10 years from now, similar to internet 20 years ago. Take a long term view.

Blockchain is in a similar state as the internet in 1997. As the hype got started the market was flooded with many useless startups and IPO’s. 95% did not survive the crash that followed. Blockchain and cryptoland will undergo the same. That is why you have to research in order to find that very small number of cryptocurrencies and Blockchain startups to invest some money in … say the Amazon’s of the Blockchain world.

TIP # 2: Most of the blockchain assets (cryptocurrencies, stocks, tokens) will be worthless in 5 to 10 years from now, similar to the dot com bubble. Carefully choosing your positions is imperative. Only 2% to 5% is worth looking into.

So, cryptocurrencies and Blockchain are not a get-quick-rich scheme. All investment laws continue to apply, so better think (at least) twice before taking any action. This report, written as a guide, will help you tremendously.

4 ways to invest in cryptocurrencies, tokens and Blockchain stocks

There are four ways to profit by taking long positions in cryptocurrencies and blockchain related assets, we can look at it as being 4 different crypto asset types:

- Cryptocurrencies

- Publicly traded stocks (IPOs)

- Crypto tokens (ICOs)

- Bitcoin options

Investors seeking exposure in cryptocurrencies and crypto stocks should do so with diversification in mind. So the point in all this is to take some small positions in, say, 2 of the aforementioned 4 asset types.

TIP # 3: Diversify your holdings over different crypto asset types. Choose one or two asset types (maximum two) that fit your risk and investment profile.

As with every high risk investment you better take some small positions and let the super growth potential work for you, which will result in an interesting result in terms of absolute value. That is far better than taking a large position with “get-quick-rich” mindset.

TIP # 4: Take small positions as these are extremely high risk assets. Risk hedging is recommended: take the base capital out of your investment once your position has doubled in order to retain “free” assets.

Let’s deep-dive into the 4 different crypto asset tips and share our investment tips.

Method # 1: Buy cryptocurrencies

Cryptocurrencies have literally exploded since early this year. Bitcoin came first in 2014, then crashed, and it rose again last year and this year but altcoins followed Bitcoin’s path this year. Altcoins are alternative cryptocurrencies like Ethereum, Ripple, Litecoin, and the likes.

UPDATE ON 25 NOVEMBER 2017: We see serious value in Ripple. It can take a while (potentially) until it continues its rise, but we strongly believe that Ripple will be an outperformer on the long term. They are the largest startup in the cryptocurrency world, they are owned by Google (Alphabet), they are acquiring world class customers and they are in the running to co-build the new payment system of the Federal Reserve in the US. Furthermore, we strongly believe that Ethereum will continue to outperform as detailed in this article. We start liking Lisk in the sub top (number 13 in terms of market cap at the moment of updating this article) as they deliver a framework in which allows users to build blockchain applications (solving the complexity problem in writing a blockchain use case). Litecoin is really great as it gets traction with its Lightning Network.

In this article which we published in the public domain 10 Investment Tips For Cryptocurrencies Investing we said that cryptocurrencies are here to stay and that some of them will grow, both in terms of usage and price:

- Cryptocurrencies investments are similar to investing to commodities

- Usage is growing as evidenced by the collective market cap

- Most people are unaware about cryptocurrencies, an absolute minority uses them

The more important questions is: which cryptocurrencies are still worth investing in, keeping the 5/95 rule in mind (see above).

The answer to that question is simple: ask yourself which problem a cryptocurrency solves. If it does not, you better categorize them as being part of that 95% that will disappear.

Just buying cryptocurrencies hoping that they will deliver an investment return does not make sense at all. The sweet spot for every investor is the ability to solve a problem: the bigger the problem that gets solved, the higher the potential value.

One of the sweet spots that cryptocurrencies can enable as a problem solver is to provide access to money and basic banking functions like wiring and paying. A fact that is unknown is that a huge amount of people globally do NOT have access to to these traditional banking services.

TIP # 5: A cryptocurrency MUST solve a problem in real life. Bitcoin is becoming a digital currency in retail. Ethereum is becoming the go-to currency in the crypto market (think of tokens, blockchain applications, and the likes). Ripple is solving the problem of very slow payments, think of the 3 to 5 days cross border payments. Litecoin is solving the problem of speed of crypto payments. Taking small portions of 2 or 3 of these cryptocurrencies which solve a problem (add value) is a good way to get exposure, in a low risk way, to cryptocurrencies. Don’t think of taking the risk of buying the “latest and greatest” cryptocurrencies which will potentially rise 1000-fold as they are likely to be useless in terms of adding value.

The challenge buying these cryptocurrencies is where and how to do that. The most reliable wallets, so far, have proven to be Kraken.com and Coinbase.com. Please understand there is always a risk of

TIP # 6: If you open an account on Kraken.com and Coinbase.com, you have to understand that you will need to get acquainted with how their system works (setting up trades and orders as an example) and also need to get a hardware wallet to avoid hacking. This requires some research.

There are hardly any ETF’s available, and the ones we found are either exclusive to high net worth individuals or do not track precisely the underlying cryptocurrency, think of the GBTC which we are NOT a fan of.

Method # 2: Buy publicly traded stock

The second method to get exposure to crypto assets is by buying stocks in publicly traded companies operating in cryptocurrency and Blockchain related activities.

Compared to the other 3 options we discuss in this article, this one remains the easiest way to gain exposure to crypto assets. Although it is pretty straight forward to buy these stocks, investing in these comes with a variety of risk and exposure levels ranging from extremely high to rather low.

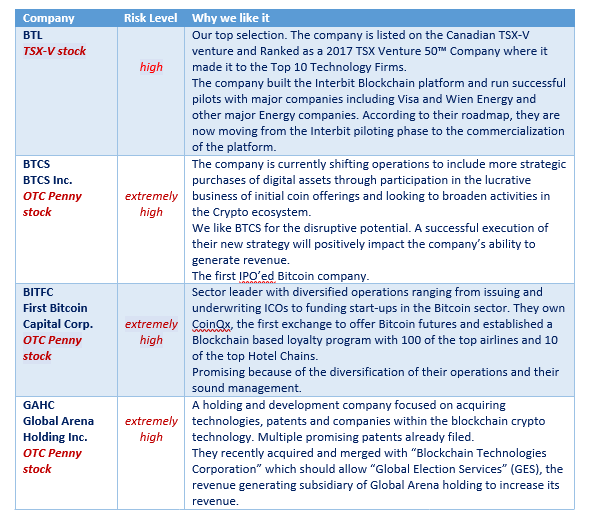

Pure play blockchain companies are nano and small caps, even penny stocks, they come with huge risk. Below we present the pure plays, followed by some large to mid caps which are seeking exposure in blockchain applications.

TIP # 7: Know what you are investing in and define your risk tolerance. Pure Blockchain technology stocks are Penny stocks and are extremely risky.

Below is an overview of crypto stocks. This is, indeed, a very short list. This will grow over time, as the industry matures, but right now it is a small space, probably because many startups just create tokens and do an ICO (Initial Coin Offering) which is extremely easy to do (also unregulated) as opposed to a complex IPO.

Our favorite long term play is BTL and we recommend buying it on the dips.

TIP # 8: Crypto stocks need continuous research. Even if we like BTL a lot we continuously research the activities and progress of the company. It MUST deliver, and, if not, you cannot trust the future value of the stock. Note that BTL is the only non-OTC company on this list.

UPDATE ON 25 NOVEMBER 2017: We see a new trend in publicly traded blockchain stocks. Every company that announces it will engage on the blockchain starts rising like crazy. Think of Overstock.com, Fintech Select, Marathon Patent Group. It is amazing how fast they rise: multi-baggers in a matter of weeks! What this means, to us, is that a small group of investors understand very well how strong blockchain will become; they have funds available to buy whatever is blockchain related. This is the start of a mega bull market. Now is the time to acquire a portfolio of blockchain assets, risk free ideally (buy 50% of shares once your investment has doubled), and add as you see the blockchain companies you invested in are growing on the blockchain.

==> This also implies that the stocks listed in the above table are subject to change. At the moment we write this update, we still like BTL Group very much but become cautious on the other 3 companies. On the other hand we would put Overstock.com in our favorite list.

As these stocks are extremely high risk plays timing becomes important. Wait for the dips, they will come in any case. Use the chart as your compass. Moreover, there is a fair chance that your positions will be in red at a certain point. How to deal with that?

TIP # 8: Prior to initiating a position, ask yourself what would you do if the value of the equity you bought decreases by 50%? Are you able to hold through that drop and wait for the price to recover (that is if it recovers)?

- Would you be inclined to sell at a 50% loss to preserve the rest of your capital? If so set tight stops to cut losses early on or even reconsider if Crypto investing is the right choice for you. You can also opt for Blue chip stocks included below as a less volatile option.

- Would you be able to hold through the steep dip? If so, consider our next tip: For how long will you be able to hold?

Crypto stocks are almost an asset type on their own. They have their own rules, do’s and dont’s. Below are four important tips which you should read as guidelines on how to invest in those stocks.

TIP # 9: Identify your objectives and timeframes when trading these very volatile stocks. Traders with short timeframes and lower risk tolerance are better off scalping for smaller more frequent gains.

TIP # 10: For significant gains, Buy the strong dips, offload at extreme peaks. Be patient, do not over trade. Carefully plan your entries are to mitigate risk and score the highest returns on investments. Don’t buy after the stock has tripled in value or right after news were published and the stock price spiked. Instead wait for the stock to back test support or pick a higher low.

TIP # 11: When deciding which stocks to trade, be extremely selective and only use intrinsic value creation as the criterion.

TIP # 12: There is a strong correlation between these Stocks and the Cryptocurrencies market. We noticed that they move in tandem and tend to strengthen and weaken with cryptocurrencies. They also tend to positively correlate with the Nasdaq.

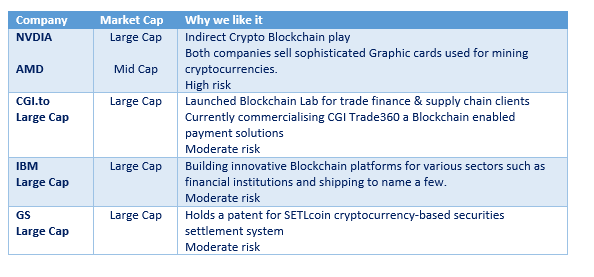

Other than the penny or small cap stocks there are of course also existing large of mid caps developing crypto and blockchain applications. Think of the IBM’s of this world. The fact that those companies are spending time, money, effort in blockchain is the ultimate confirmation that the technology is here to stay !

TIP # 13: If you don’t like the extremely high risk plays of the small cap and penny stocks it is worth picking one of the existing large to medium cap software companies that is working on blockchain applications. Our estimate is that the first real success stories of blockchain applications will appear in 2018 and 2019. So researching this space is what investors have to do, nobody has the answer right now on which software company will become a leader in blockchain space.

The blockchain trend is here to stay. It will develop over the next 5 years. Do not chase any stock but carefully research what is happening and which companies will be leading.

TIP # 14: Do not chase any blockchain stock. Take your time to research and pick the winners over time. This trend will last another 5 years.

Method # 3: Tokens (ICOs)

Tokens are the newest hype. They are extremely risky because they are unreglulated. Every small team of tech geeks and some marketing accumen can create a token, announce their ICO (Initial Coin Offering) and get Ethereums worth millions in no time. At least, right now, but that will not last forever.

TIP # 15: The point is this: ICOs are hyped right now, and they come with extreme risk. Several of these ICOs are pump-and-dump schemes. Do not get seduced by the ICO website. Think of the fact that only (maximum) 5% of these startups will survive. You can hold two or three tokens, not more. Think of tokens as stocks of a startup that did not make it yet to the stock market; so it’s the level below the OTC market.

The most appropriate way to ride the ICO wave is to wait and see. Once a new project goes live it will get hyped. The “fear of missing out” (FOMO) is big, but it’s a pitfall. The drawback of buying tokens too fast is that they are not liquid. What is it worth having tokens which are valued sky high if you cannot sell them?

TIP # 16: Tokens from an ICO are illiquid by default. Wait purchasing until (1) the first rally which sends those tokens sky high is over and (2) until they appear on an exchange so they become liquid.

The same intrinsic value rule which we described in section (1) applies to the tokens as well: 95% will disappear, only maximum 5% will survive and create value over time.

TIP # 17: Only a handful of blockchain startups which release an ICO will survive. Investors better wait to get a confirmation of the value that is created by the startup before purchasing tokens.

We have found that Bittrex is an optimal way to buy tokens. It is a public exchange, like the stock market for ICOs and tokens. However, it has a high technical complexity.

TIP #18: Mind the complexity of trading at Bittrex. You send to send bitcoins or ethereums which is an error prone process (by making a mistake in the process you can loose your bitcoins or ethers). Buying tokens on Bittrex also comes with specific techniques. You have to either ask someone who has gone through this process OR foresee sufficient time before engaging in the first positions if you want to do-it-yourself.

The blockchain startups with the most promising technologies and projects should be monitored closely. Their success is not set in stone; as with every startup they have to undergo an immense number of challenges before they will make it into a company.

We have made a selection of the Bittrex traded tokens which are worth your attention. We are NOT saying you have to purchase all these tokens. The point is that this is your longlist, and you have to monitor both the activities of the companies as well as their charts.

Our longlist of tokens at the moment of writing, ordered according to our preference. Prices of the coins can we found on coinmarketcap.com. Readers should continuously research this field to find new and promising startups / tokens as things move very fast in this space.

UPDATE 25 NOVEMBER 2017: We would add two tokens on our favorite list. One is Lisk, meantime 13th in terms of market cap, available on Bittrex. The other one is Power Ledger, also available on Bittrex, and tipped by one of our readers (for which we are very grateful).

OmiseGO. An Ethereum-based financial technology for use in mainstream digital wallets, that enables real-time, peer-to-peer value exchange and payment services. Very high potential, can be very disruptive, exists since 2013. Drawback is that it may be too disruptive so needs some time for breakthrough applications. The company website https://omg.omise.co/

Dash stands for digital cash. This platform enables peer-to-peer payments. It is the anonymous version of Bitcoin. The platform is being developed for 3 years now (version 12) and has a big team and community. Technically, this is a great foundation. From an end user perspective the question is whether Dash will outperform Bitcoin. The startup is close to getting traction but they need user applications now. Given their low cost development machine which is in place this could be a high flyer provided their service is picked up by some merchants as a payment method.

==> Update November 25th 2017: this one has really outperformed since we wrote this article initially

TenX Pay Token makes cryptocurrencies spendable anytime anywhere. It is a smooth service which is already operational. They are supported by by Paypal, Citi, etc.

==> removing this one from our list on November 25th 2017

Patientory was incorporated in 2015. They solve a real life probem: security of health information. They will launch in September 2017 a patient app. The question is whether the team is a top notch team to get the company through the startup phase, we have our reservations on that. Read more on https://patientory.com/blog/

==> downgrading this on November 25th 2017

Storj has a working product with a very affordable price. They solve a real life problem: safe storage. However, they are fighting in a market which is dominated by giants like Dropbox. Also, Filecoin, a competitor, got much more funds from their ICO (200M vs 30M). Our reservation is on the fact that we do not see how widely their service is this used, there are no user data available anywhere. Read more https://storj.io/index.html

Stratis is essentially a development team with very specific blockchain skills. There is no specific disruption in terms of applications or use cases that the startup is offering. That is also our drawback on Stratis, though their track record looks amazing. That is why this is not a token like the other ones. More at https://stratisplatform.com/

==> downgrading this on November 25th 2017

iEx.ec provides distributed applications running on the blockchain a scalable, secure and easy access to the services, the data-sets and the computing resources they need. They have a very technical (engineering) team, their roadmap looks good, though very technical. They joined EEA recently and they solve a real life problem (decentralize cloud). But we have our reservations on what exactly their product / market combination is: who are the customers and what are they willing to pay in such a crowded cloud space? More at http://iex.ec/

==> downgrading this on November 25th 2017

TIP # 19: Tracking your longlist and shortlist of tokens, not only their price but also their company (startup) progress, is mandatory before and after taking any position in any token. That is to ensure you have bought tokens from a startup that is delivering intrinsic value.

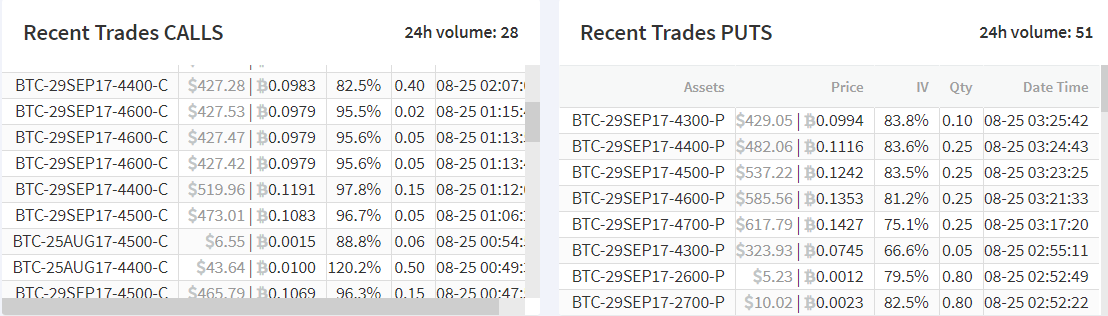

Method # 4: Bitcoin options

Another method to gain exposure to Cryptocurrencies is through Bitcoin options. This is a method for sophisticated investors willing to take higher risks.

It is currently possible to trade Bitcoin options using international exchanges. American exchanges will soon be able to offer Bitcoin Options as well during the fall of 2017.

Current state, these option are volatile, expensive and tricky to trade.

TIP # 20: Investors with high risk tolerance can use Bitcoin options to call the market and make significant gains if right. Think prior to upcoming tech events or news with potential positive or negative impact on Bitcoin price.

Investors can use Bitcoin options to hedge their Bitcoin holdings, but only if they have experience with trading options.

NOTE:

Please let us know if you would have any question. If you need additional research, and more subscribers are asking the same type of question, we will followup with another report which answer your question(s). Please send an email to investinghaven@gmail.com