Major banks see silver holding above $80 in 2026, with bullish scenarios stretching far higher. If demand stays firm and key price levels break, $90 becomes a realistic short-term target.

Silver trades around $82 per ounce as of February 13, 2026, after a powerful rally last year. One leading Wall Street bank expects an average price around $81 this year, while another has outlined aggressive upside cases that stretch well above $100.

This wide range in forecasts means volatility is high and opportunity is real. If the current structure holds, $90 is the next logical level.

OUR FULL PREDICTION: A Silver Price Prediction For 2026 2027 2028 – 2030

Why Banks Are Bullish On Silver In 2026

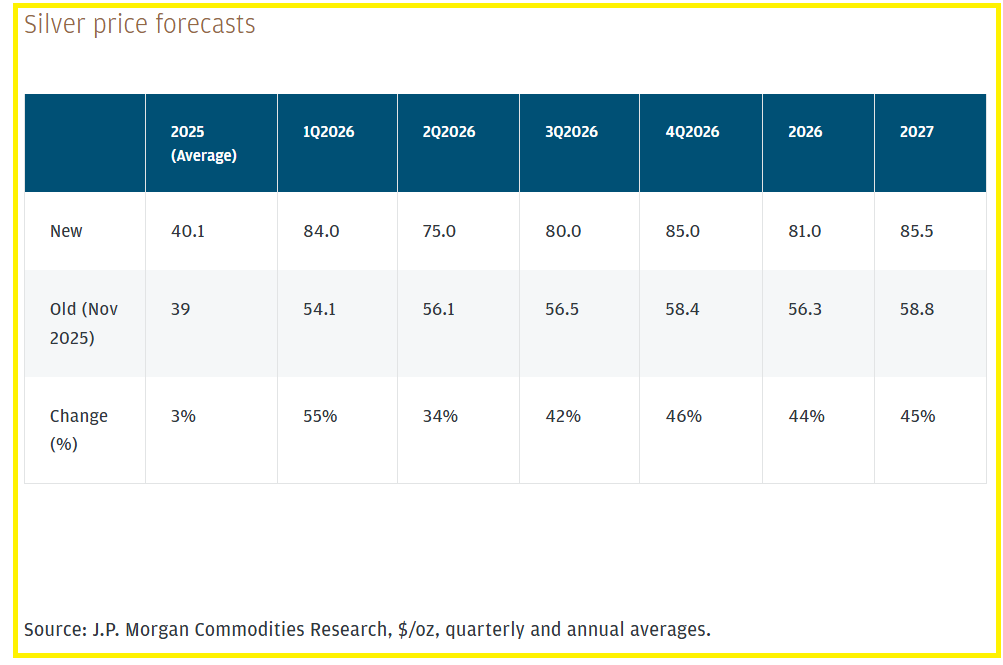

J.P. Morgan expects silver to average roughly $81 in 2026. This is not an extreme outlook, but it confirms that last year’s surge has not fully reversed.

Bank of America published more aggressive scenarios. In strong demand cases, its models show silver reaching $135. In rare stress scenarios tied to tight supply and heavy investment flows, the bank’s projections climb as high as $309.

These silver price forecasts are likely based on strong sentiment and growing appetite for the precious metal. Industrial demand remains strong, especially from solar panels and electronics.

Investment demand also jumped after 2025 gains, with more money flowing into silver funds and physical holdings. At the same time, mine supply has not expanded fast enough to flood the market.

Put simply, demand looks solid while supply growth remains limited. That imbalance creates the foundation for higher prices.

YOU MIGHT LIKE: Silver Becomes The Most Crowded Commodity Trade Ever As $922 Million Floods In

The Key Price Levels That Point To $90

Forecasts are useful, but price action tells you when momentum returns.

Silver has built strong support between roughly $72 and $80. Buyers stepped in repeatedly in that zone. As long as price holds above it, bulls remain in control.

On the upside, traders focus on resistance around $85 to $88. A sustained move above that range opens the door to $90. Once $90 breaks on strong volume, momentum traders typically step in, and $100 becomes a realistic extension.

The opposite is also true. If silver falls below $72 on a weekly basis, the bullish setup weakens quickly.

Right now, the structure favors a push higher, but confirmation requires strength above $85 and then $90.

RECOMMENDED: Can Silver Hit $200 An Ounce?

Best Ways To Invest In Silver Now

Your strategy should match your risk level.

One of the simplest way to invest in silver now is an ETF like the iShares Silver Trust, which tracks the metal’s price and trades like a stock. It offers liquidity and ease of entry.

Silver mining stocks also provide more upside potential because profits can expand faster than the metal price itself. That leverage cuts both ways, so swings tend to be sharper.

You can also look into options strategies which typically allow defined risk. For example, call spreads limit upfront cost while keeping upside exposure.

This approach suits traders who expect a breakout above $90 but want controlled downside.

Finally, physical silver remains a long-term hedge with no counterparty risk, though storage and liquidity are factors to consider.

For most investors, a tactical allocation of 2% to 5% of a portfolio balances opportunity and risk.

What Could Stop Silver From Reaching $90 In The Short-term?

There are several risks that could stall the rally:

- Higher interest rates increase real yields and often pressure precious metals. A stronger U.S. dollar also weighs on prices.

- Large liquidation events, such as margin calls across markets, can trigger sharp selloffs even when fundamentals look strong.

- A sudden surge in recycled supply or unexpected growth in mine production would ease supply pressure and limit upside.

You should closely watch these factors because silver tends to move quickly when conditions shift.

ALSO READ: Silver: This Leading Indicator Shows Potential Massive Reversal

Conclusion

Silver is trading at a critical level in early 2026. Conservative bank forecasts place it around $81, while bullish models extend far beyond $100 under tighter supply conditions. The technical setup shows $90 as the next major test if resistance breaks.

If you are willing to accept volatility, the opportunity for profits is here. However, you will need to practice disciplined sizing, careful level tracking, and understand that silver rarely moves in a straight line.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts: