The gold and silver market seem to be stabilizing around current levels. What’s next, and how much upside is there for this year? How close will the market get to our gold forecast 2019 and silver forecast 2019? We revise 5 charts that provide pointers to answer our questions. Note that we don’t look any second into news as there is no reason whatsoever to believe news articles will provide anything meaningful for investors. As per Tsaklanos his 1/99 Investing Principles it is just 1% of the news that has some sort of value to investors.

We look into our leading indicators for the precious metals market in this article, and combine this with our investing principles per our 100 investing tips.

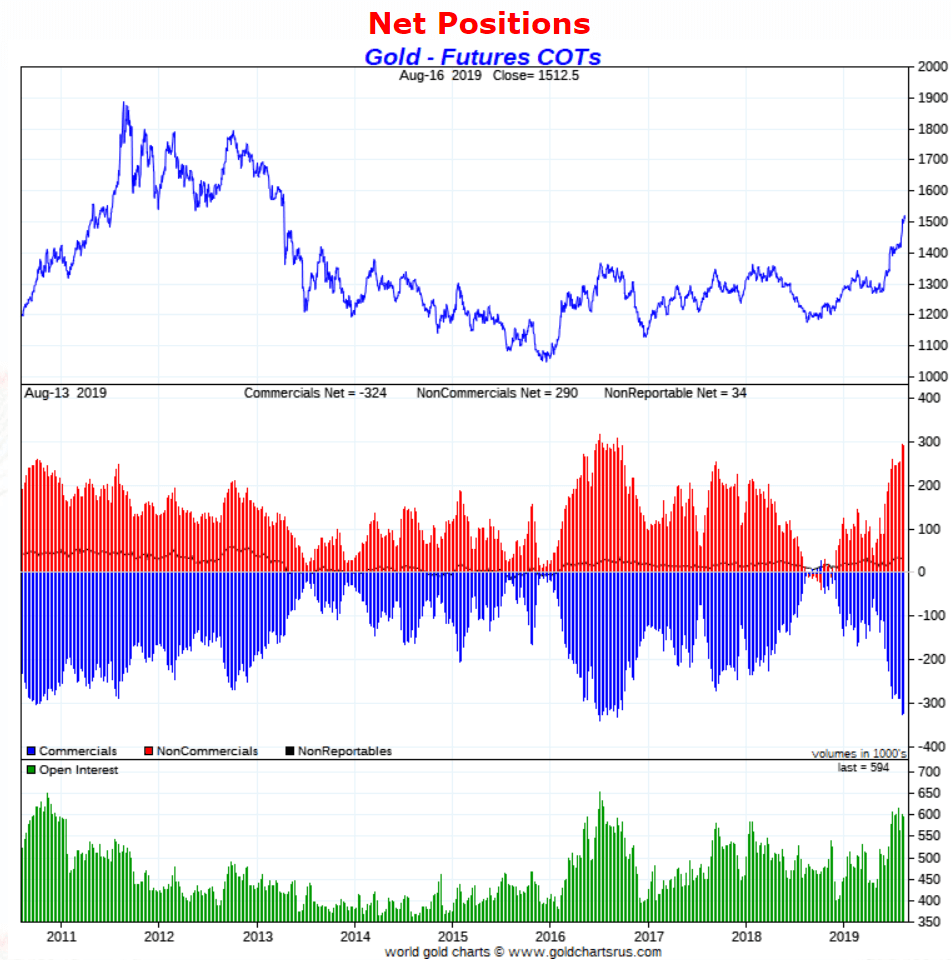

First, the futures market gives a view on the positions of large market participants.

The gold futures net positions as per the COTs of the last 9 years show extreme, both net positions as well as open interest. The gold price has not much upside potential in the short term is what this data point tells us. It does not tell us anything about the downside potential, it does not tell us when and how any correction might take place.

We can only reasonably expect a test of the breakout point around 1400 USD in the short to medium term, but that comes from chart analysis.

Second, the same data point for the silver market has a different take-away. The upside potential is certainly much larger than the gold price. The open interest is high. We expect some quick rise in silver as gold stabilizes, after which a correction should take place in both gold and silver.

Third, inflation expectations as per the TIP ETF looks breath-taking. The breakout in March of this year at 109.74 points was not only confirmed, but also largely exceeded anyone’s expectations to the upside. This is in favor of the precious metals market! In fact it has triggered a bullish wave in precious metals which even if TIP ETF would fall it might still keep the precious metals bull market in tact!

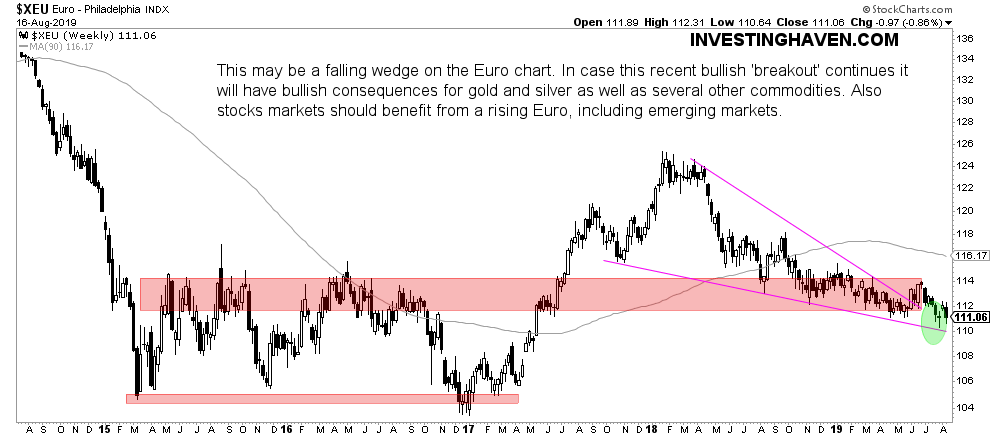

Fourth, as per out investing principle “any turmoil in markets starts in currency and credit markets” we must keep a close eye on the Euro, our leading indicator for global markets.

We see this falling wedge nearing completion now. As long as the Euro index stays above 109.50 points it will be supportive of precious metals!

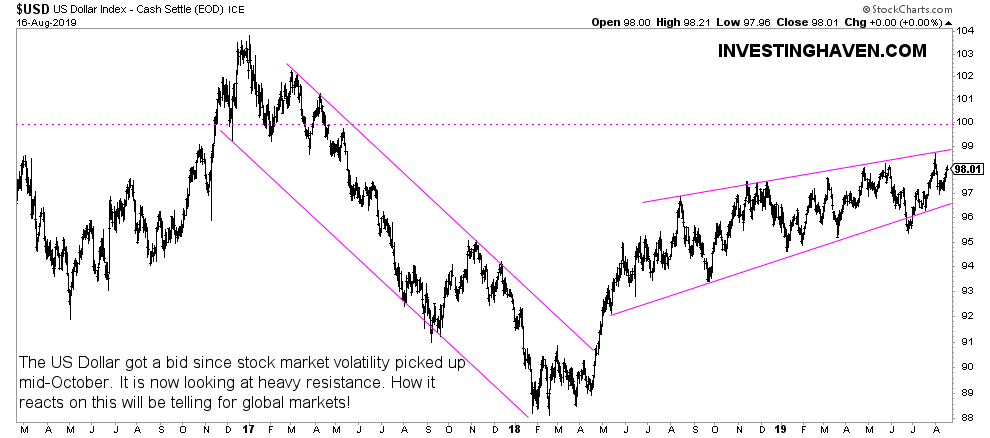

Last, the USD index looks to be moving to 98.95 points. That’s an upside of 1 pct. Above this the 100 level will act as very heavy resistance. So this setup also, at present time, looks supportive of precious metals.

Our thesis is simple: all leading indicators are supportive of the continuation of the precious metals bullish trend. A correction of gold to the 1400 level is likely, not imminent though. Silver has more upside potential, short and medium term! We have to re-evaluate once the correction starts, in the next few weeks or months.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 months. Subscribe to our free newsletter and get premium investing insights in 2019 for free.]