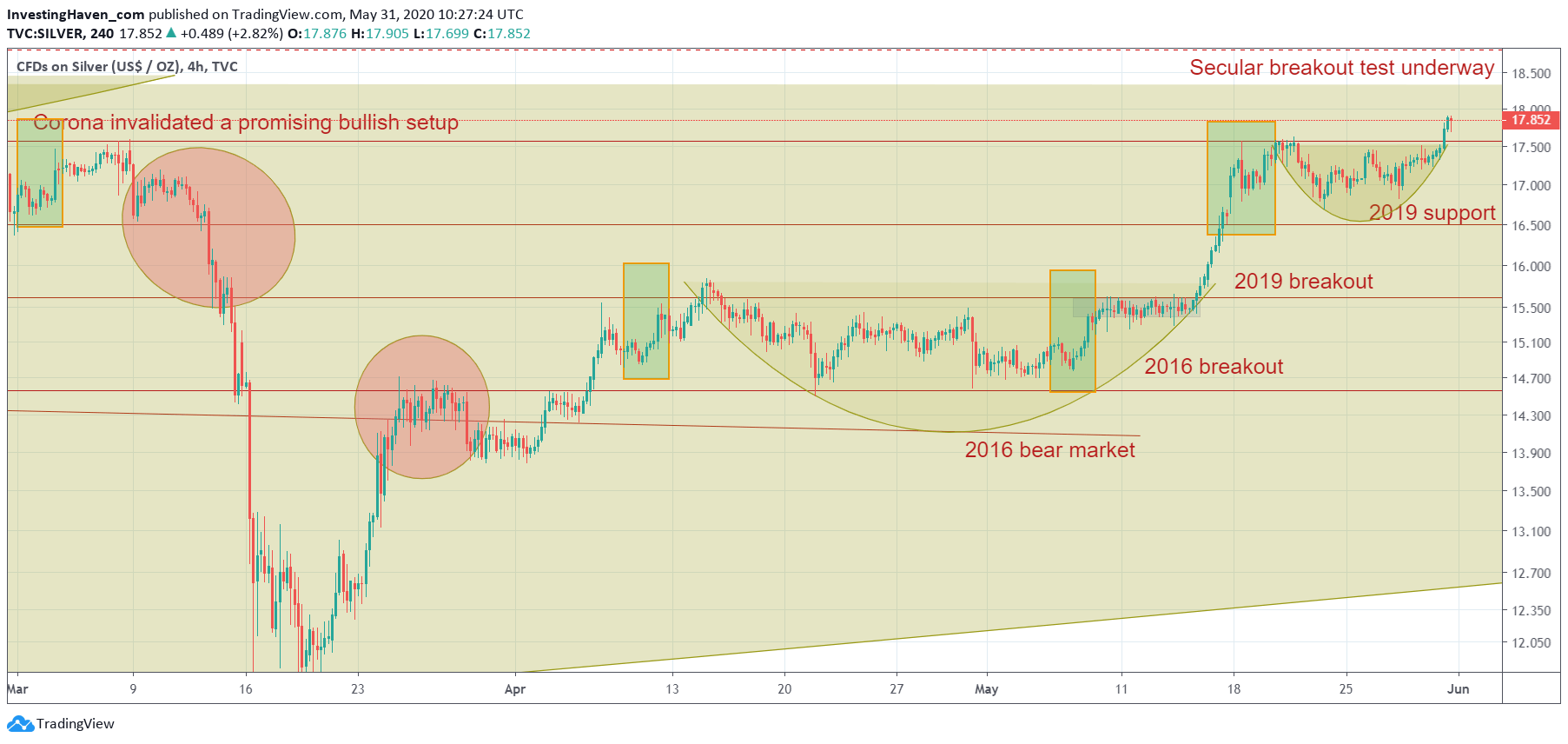

Silver has one of the most beautiful chart setups across the hundreds of markets and sectors we continuously track. The short term timeframe shows a spectacular recovery from the silver Corona crash lows. This week we got a hidden signal from the silver chart, one that a handful of chartists know about, that makes us very bullish on silver’s prospects. Is this hidden signal going to help silver break out of its short term consolidation (reversal)? It already did, on Friday.

A few weeks ago we published Precious Metals: Silver Ready To Take Over The Lead Over Gold? That article featured a silver chart that we only share with our premium members, particularly the ones in our Momentum Investing service.

Readers liked our silver article and special chart a lot, as the article went viral. Within two days we saw many tens of thousands of readers on that silver article.

This was our silver outlook (quote from that article, published May 2nd):

It looks like silver is ‘sandwiched’ between two important trendlines. But the reality is that the silver price is setting a reversal right between its 2019 and 2016 breakout levels.

This is a bullish setup until proven otherwise.

Will silver outperform gold going forward?

It *may* happen. But the point is this: in any recovery it is gold leading silver higher, not the other way around. Similarly, silver outperforms gold once there is sufficient ‘momentum’ in the precious metals market.

Here we are again, today, with an update on the same silver chart as well as a hidden signal on that chart.

No worries, silver bullish, this is a bullish signal. A small charting secret that has a reliability of 95 to 98%. It appeared on the silver chart, earlier this week. It was for us the trigger to know for sure that silver would break out of its short term consolidation, and to believe that the consolidation was much shorter than the one between mid-April and mid-May.

The million dollar question is whether silver can continue its uptrend. We believe so, and this is why:

- Our hidden signal occurred right at the short term breakout level right below 17.5. This suggests this short term breakout is powerful, and will bring silver to 18.5 to 19.0 USD.

- Moreover, as gold tends to lead silver higher, as said above (from our previous article(s)) we see good upside potential in gold. Most likely when silver hits 18.5 – 19.0 gold will still be rising. It will be the decisive push higher for silver.

The end of the silver uptrend is not in sight, on the contrary, this silver bull run has legs.

In our Momentum Investing service we focus extensively on precious metals. Curently we hold one precious metals stock, since last Friday, with a very promising setup. We might look to rotate profits into a smaller precious metals miner, presumably in the silver space, at a later point in time.