Cocoa is a small commodity that could be setting up for a big breakout in the months to come. It’s easy to see how there is a steadily increasing demand for chocolate and a change in the perception of how it affects one’s health.

Organic cocoa in particular is seeing an increasing demand especially from European markets. Based on a CBI forecast, the organic chocolate market should grow about 6.8% between 2021 and 2028.

The International Cocoa Organisation, ICCO , announced this year that Ghana is having production issues. Ghana is the 2nd largest Cocoa exporter in the world.

In Ghana, the latest information indicates that purchases of graded and sealed cocoa beans were very low year-on-year (down by 34% to 524,000 tonnes as at 31 March 2022) mainly due to unfavourable weather conditions that occurred in the country’s main cocoa growing regions

So as demand is definitely increasing in this market, the offer might shrink at least temporarily even as newer countries starting to join the rank of existing producers.

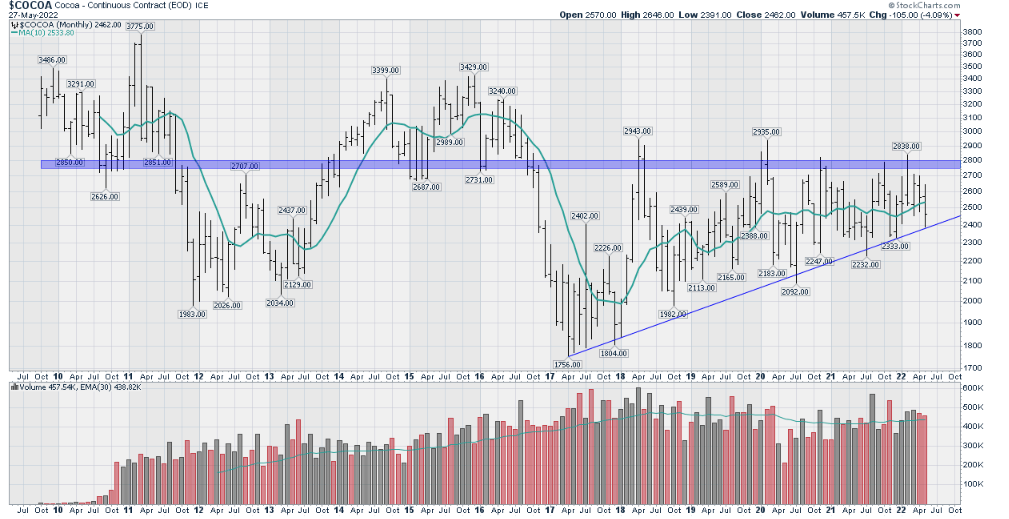

Cocoa’s long term chart: A very constructive setup that could lead to a strong performance

Cocoa’s price has been setting up nicely for years now. Since we like to cover commodities and our readers like to find out about breakouts early on, we thought we will share this interesting chart setup.

When looking at Cocoa’s long term chart below, we notice the following:

- A series of higher lows that started in 2017 and is still in play

- A strong resistance in the $2800 to $2900 area

This chart shows clearly that investors need to keep an eye on this hot commodity. In fact, Cocoa’s price is extremely bullish if it trades above $2850. The setup however, is invalidated if it crosses below $2300. Depending on the strategy, one could buy the breakout of the horizontal resistance or as close as possible to the rising blue trendline with proper stops. The second setup could be a choppy one.

Written by hdcharting.