Crude oil is by far the worst performer in the commodities complex. And the crude market is not likely to recover in the short term, long term obviously it will go back to previous levels. But what about the rest of the commodities space? Interestingly the inflation/deflation indicator suggests a major bottom is being set. Most likely the great decade of de-leveraging from 2011 to 2019 is now coming to an end. Long term commodities should do well, and gold is the first commodity to lead its ‘peers’ higher.

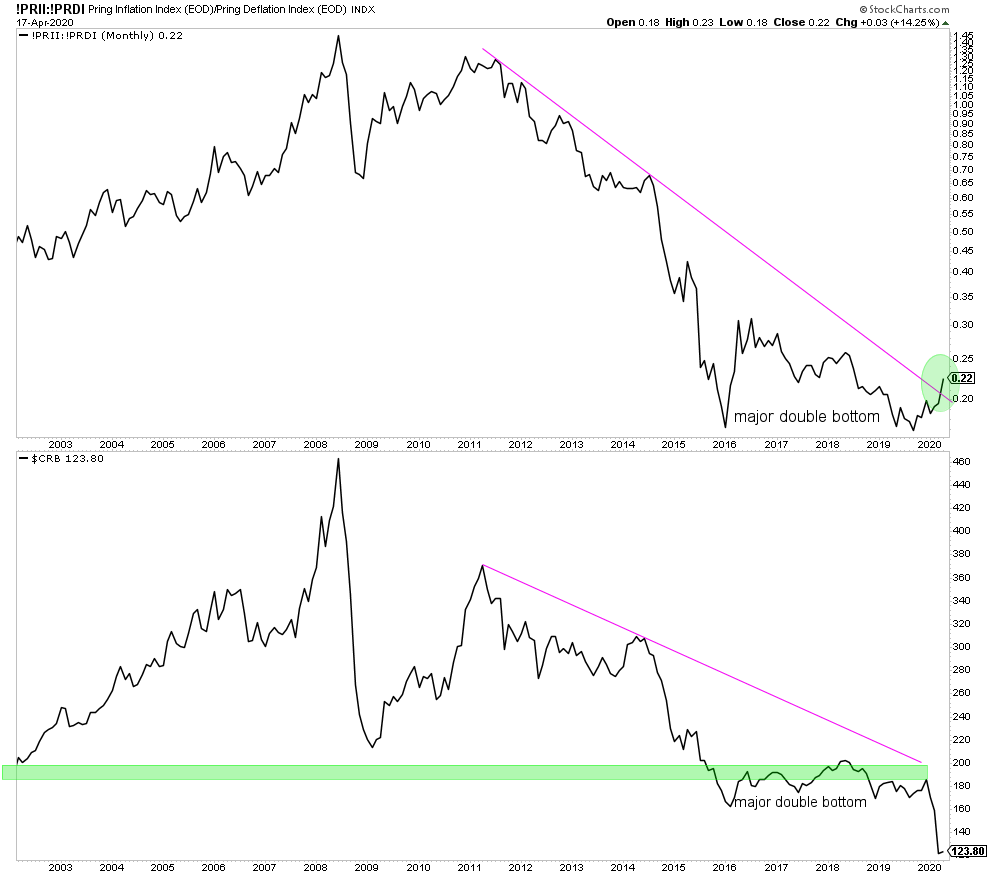

The inflation/deflation indicator from Martin Pring has a clear message: a major double bottom. It’s the upper part of the chart embedded below.

So then why did the CRB index break down (lower pane of the chart)? Because it has a high weight of crude oil. And as we know crude is ultra weak on once-in-a-generation type of overproduction.

So it’s not really relevant to only look at the CRB index to understand the state of commodities.

Interestingly, the exact opposite of this major double bottom is what we saw between 2008 and 2011: a major double top. Since then commodities went through a major crash. Some call it the decade of de-leveraging.

Is the opposite now starting? Most likely, though history does not repeat, but it rhymes.

We play the gold market and take a hedge against the crude oil market. We expect these positions to do very well in the next 4 to 8 weeks.