The airline industry is suffering because of massive travel cancellations. The chart of airlines stocks is flirting with a breakdown scenario: a bottom or 20% more downside. Peak fear is hitting markets. Now is a time to stay calm, and look for the direction markets are going as opposed to trying to be the top player in the game. The airliners are hit very hard, but so are crude oil stocks. It is even that bad for crude oil stocks that they are now back to 2009 stock market crash lows.

If airlines are leading the way lower, it ‘makes sense’ that the stocks ‘fueling’ airplanes will follow their path.

Crude oil prices are moving lower, sharply, and are hitting secular support right above 40 USD/barrel.

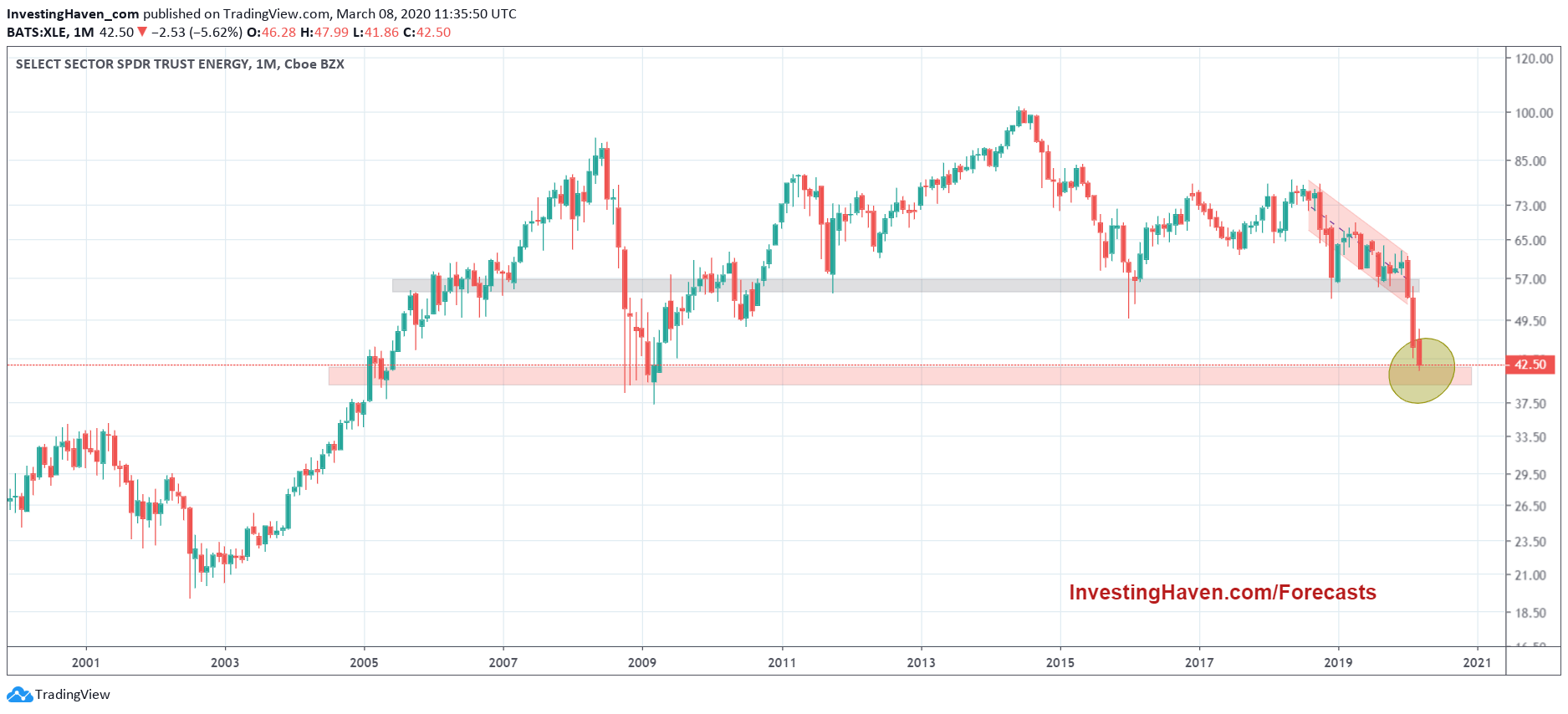

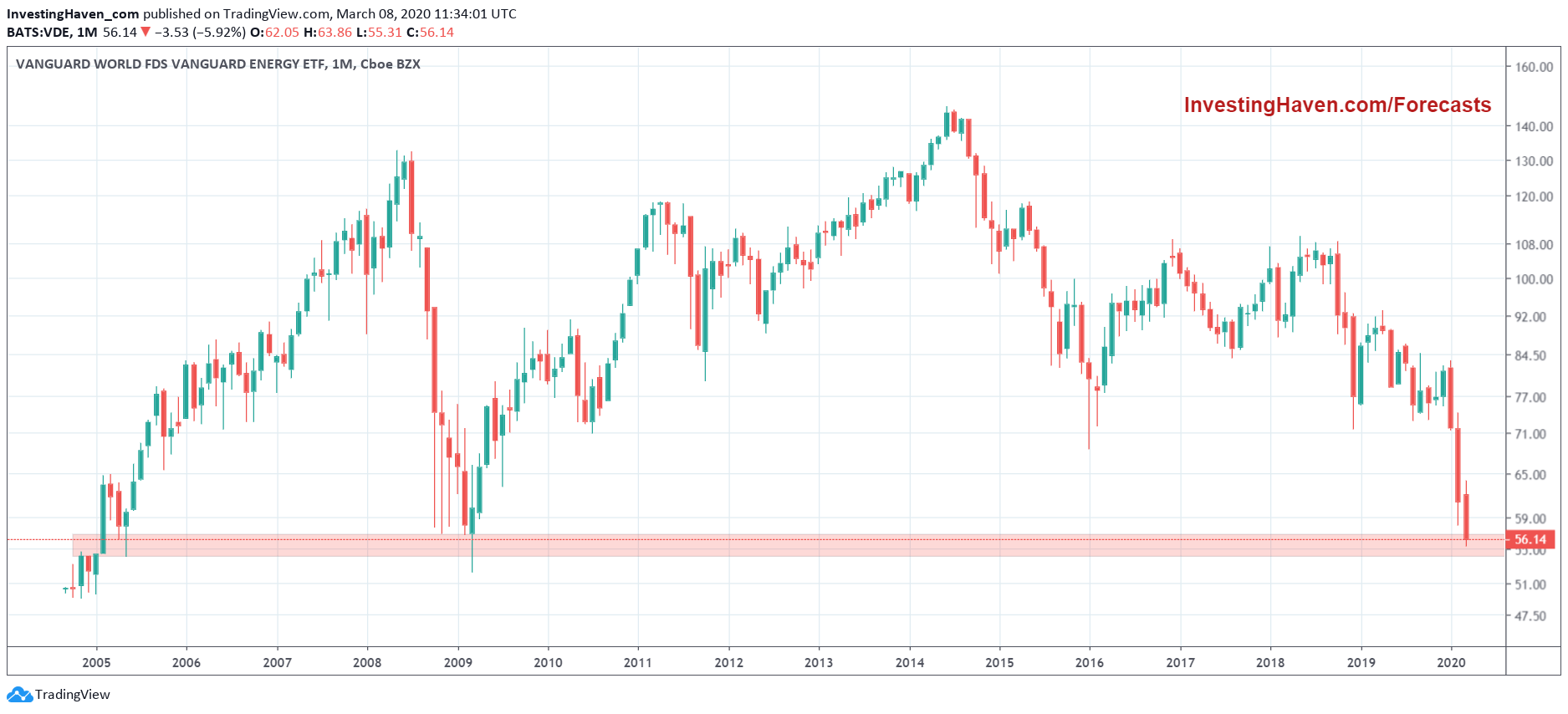

So do crude oil stocks. They even hit 2009 stock market crash lows. Well, almost, there is still some 10% of downside potential if we measure the sell off lows in February of 2009.

Above is the VDE chart. Its holdings are primarily oil companies.

Below is the broader XLE chart, including a broad array of energy stocks. This chart shows also a test of 2009 lows is starting now.

It also shows that the energy sector was trading much lower in the first years of this century. The VDE chart above has a much rock solid bottom below the 2009 lows.

We better pray that current levels hold in the next few weeks. If not the energy sector may drag down the entire stock market. Next week will be important, and we will be closely watching the crude oil stock sector.