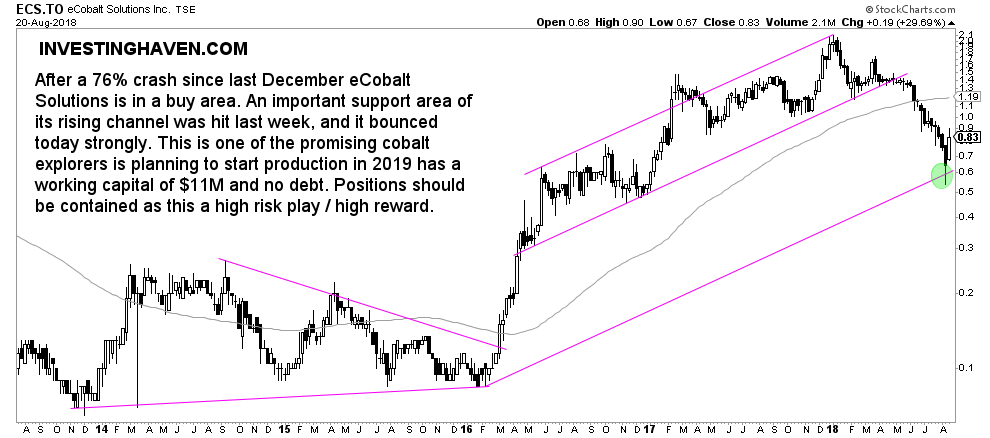

eCobalt Solutions is a small cap cobalt stock. It has a market cap of $130M at the time of writing. As the price of cobalt went through the roof in the last 2 years eCobalt Solutions became a 20-bagger. With the base metals group correcting strongly in 2018 the whole cobalt stock segment fell off a cliff. Times might be changing now, this is why. We believe that eCobalt Solutions is a great cobalt stock to buy in 2018 because it reached a point of selling exhaustion combined with its amazing market fundamentals.

At the end of this article we will do a forecast for the stock price of eCobalt Solution for 2018.

Why the coming months are crucial for eCobalt Solutions

Note that we wrote early this year this update on cobalt stock eCobalt Solutions eCobalt Solutions: High Potential Cobalt Stock In 2018 And Beyond, and below is a quote from this article.

The company is currently finalizing a new optimized feasibility study, building its production ready team and bulk sample shipped for pilot testing. The production is projected to start in 2019 and so far, the company has no debt. The risk associated is similar to risk associated with smaller caps and miners in exploration phases. There is no revenue yet, extreme volatility and vulnerability to sector / Industry performance and company news. For eCobalt Solutions, a key period is between Q2 and Q3 where the production decision will be made.

However, we recommend caution given the market cap and given the fact that the production hasn’t started yet. This is a high risk high reward play so positions should be kept small.

What stands out is the important period Q2 – Q3 2018 which we emphasized above.

Here is the good news: the company announced last week that it is on track to execute on its plan. The production decision will be made soon, and, so far, based on the pre-feasability and lots of interest from capital providers, we sense that the company will give green light to proceed.

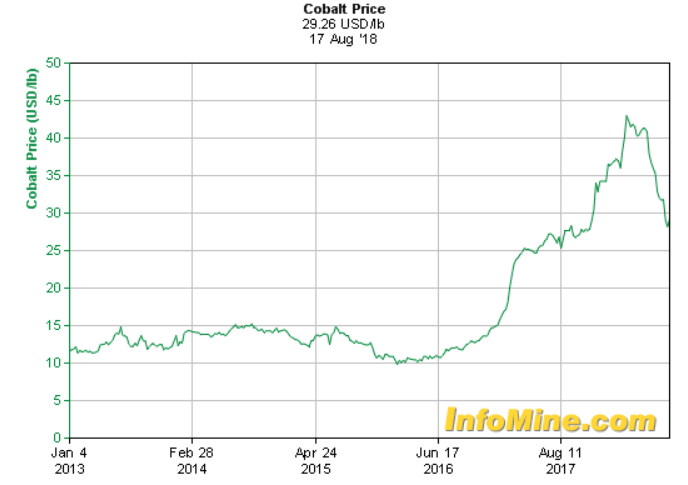

The cobalt price in 2018

Obviously all cobalt stocks are dependent on the price of cobalt.

In 2016 and 2017 the price of cobalt went through the roof. No wonder cobalt stocks did exceptionally well.

In 2018, the base metals group corrected strongly. The price of cobalt certainly was no exception there. But its seems that this sell off is taking a halt around current levels. Look at silver which is writing history, or copper which is near critical support. The USD also is close to the critical 100 points mark which will likely provide stopping power to its 2018 rally.

The price of cobalt shown below suggests that last summer’s consolidation area provides support.

eCobalt Solutions is a buy in 2018

The fundamental case for eCobalt Solutions, as well as the whole cobalt market, is of course the electric car boom that has yet to start. Batteries in electric cars will need cobalt, as well as lithium, so in the next decade we will see a structural imbalance (read: demand squeeze) for cobalt. That’s why we strongly believe that cobalt miners like eCobalt Solutions are a buy in 2018 after such a strong correction.

When it comes to the chart we get additional confirmation that eCobalt Solutions is a buy in 2018.

The rising (bullish) channels are in tact. The recent sell off visibly reached a point of selling exhaustion. Taking a small position at current levels is good investing practice for long term investors.

We forecast that eCobalt Solutions will be near the top of its lower channel by the end of 2018 which is around 1.50 CAD on below chart.