There must be a reason why silver has such an insanely bullish reversal on its daily chart. There is hardly any other market that looks as powerful as silver. Strange, because gold isn’t that powerful. What could be the reason? As investors we shouldn’t care too much about reasons, all we care about is maximizing our profits and minimizing losses. That said we might have found a ‘reason’ why silver is so strong: electric vehicle demand. Will EV demand push silver to our 2021 forecasted silver target? It might be.

Earlier this year the Silver Institute published a research about silver’s usage in automotive industry, and focused also on EV’s (source). The conclusion of their 18 page report:

Overall, this all suggests that global silver automotive demand last year was around 50Moz (1,600t), against over 58Moz (1,800t) in 2019 (reflecting short term COVID damage). It cannot hurt to reiterate that we have received a wide range of estimates of silver loadings per vehicle from our industrial sources and so, to begin with, we have adopted a relatively cautious level for these loadings. As further research is conducted, we may well be obliged to revise these estimates and it would not surprise if they were raised.

Looking ahead, in light of the developments covered in this report, we forecast uninterrupted gains over the next five years, with automotive silver demand by 2025 currently forecast to approach 88Moz (2,500t). Notably, by that time, the use of silver in the automotive industry could match the performance in the PV market. That will be a noteworthy development for global silver industrial demand and, by extension, the global silver market.

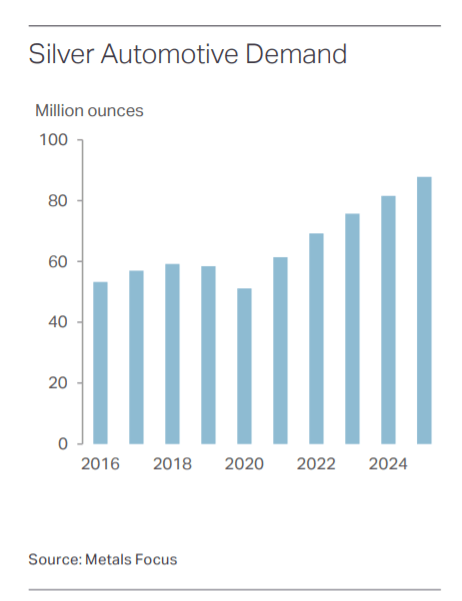

This is the chart from their report:

You might argue that this is not a disruptive trend change, certainly not in 2021. Further out, considering the growth from 2020 to 2025 *might* be more interesting and *might* push prices higher.

We believe there is a reason to think of it differently:

- Silver has a precious metals component and an industrial component. Also, silver is a tiny market: small changes in demand can drive prices seriously higher/lower.

- In the precious metals area we clearly see that gold is holding up. This is not bullish in and on itself. It simply helps silver hold up as well. So there is some sort of baselining effect.

- However, the industrial demand as shown on the above chart has a first push higher in 2021 (against the lower 2020 demand), but in 2022 demand goes significantly above any prior year. And this is the point: he market is always 6 to 9 months ahead of developments in the real world.

So is the silver market waiting for ‘validation’? Is silver waiting to validate that this industrial demand in 2022 is indeed going to exceed any prior year, and that the projected path (above chart) is true?

If so, then it’s a matter of time until the silver price will start reacting to this. It is a matter of getting gold to a better shape, and the correlated markets (USD + bond yields) to a state where precious metals can thrive.

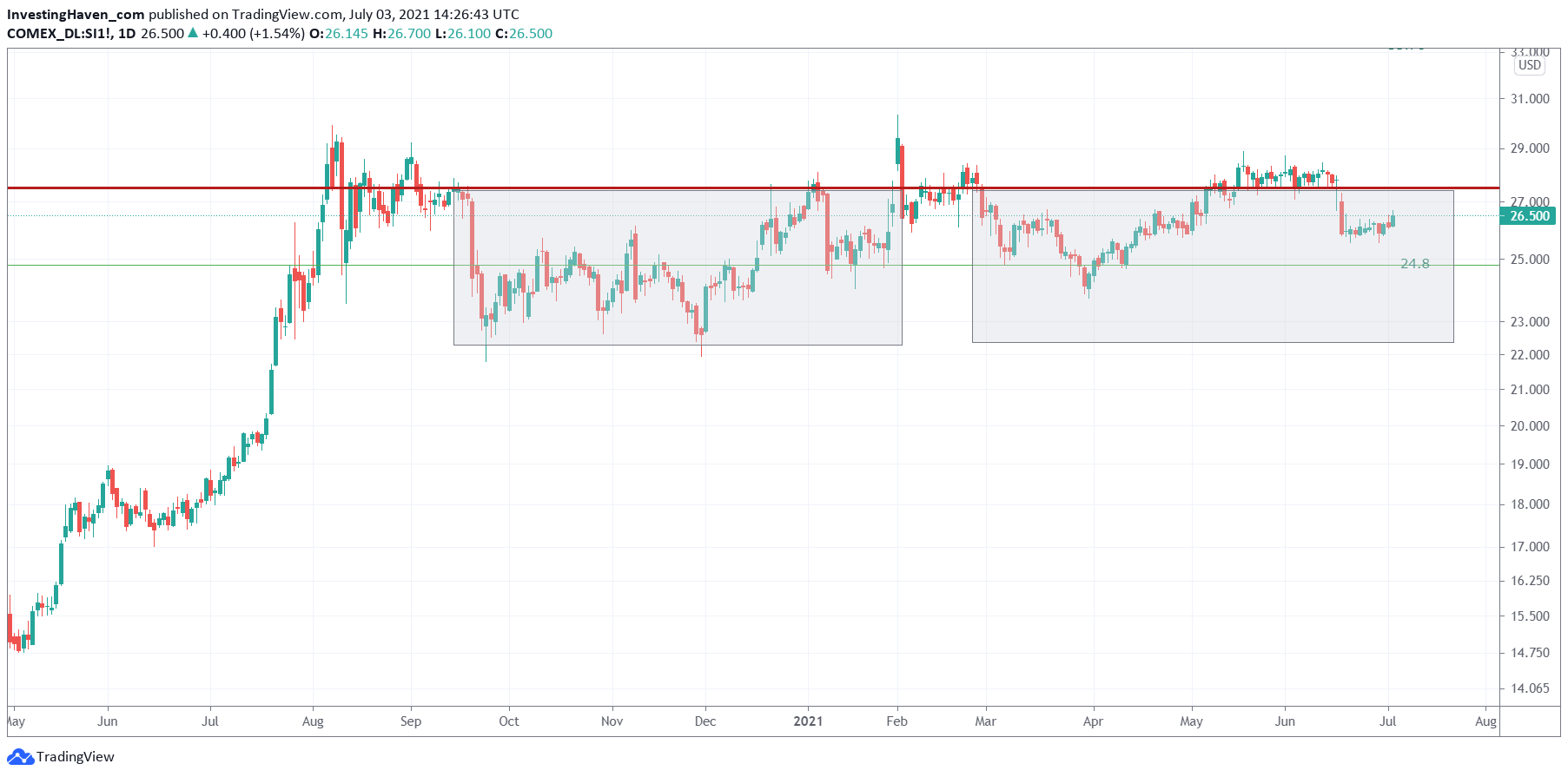

Silver might do crazy things this year, is what below chart says and the above ‘fundamental’ analysis might be confirming this.

While one might have concluded that silver ‘broke down’ 3 weeks ago we believe that the opposite is true. Silver continued its bullish reversal, and is now even more powerful than a month ago.

Why? Because the longer a consolidation goes on provided that crucial support levels are respected… the stronger the upside potential.

Our theory of a double cup-and-handle looks to be confirmed.

Silver is printing an ultra-bullish reversal, and it will be bullish until proven otherwise (break below 23 USD, very unlikely).