As concerns surrounding water scarcity continue to grow, multiple readers have been questioning whether investing in water is a viable option. In this blog post, we will delve into the topic and explore the potential value of investing in water as a commodity that is becoming increasingly scarce. While water-related exchange-traded funds (ETFs) exhibit a similar setup to the S&P 500, there are two individual companies that stand out due to their chart setups. Let’s explore the details.

Water Scarcity and Value Appreciation

One fundamental principle of economics is that when a product or commodity becomes increasingly scarce, its value tends to rise. Water scarcity is a growing global concern, driven by factors such as population growth, climate change, and pollution. As the demand for water surpasses the available supply, investing in this essential resource becomes an intriguing proposition.

Chart Setups of Water-Related ETFs

While the charts of water-related ETFs exhibit similarities to the S&P 500, it is important to note that past performance does not guarantee future price action.

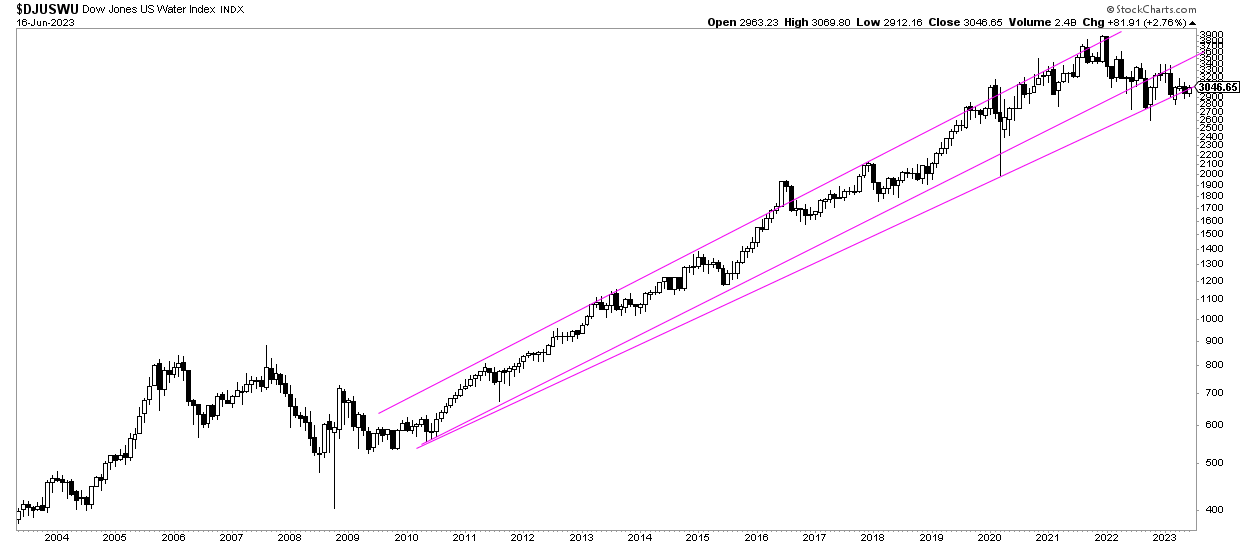

Let’s look at the Dow Jones US Water Index and one water ETF, in a top down approach.

We look at the monthly chart of the Dow Jones US Water Index, the monthly chart (longest timeframe). This chart has been nothing but phenomenal in terms of a slow but steady rise since 2010-2011. The index has risen 6x before starting the retracement in the first week of January 2022. It came down 20% since then.

What stands out is a rather important test of support right now, investors could like to give more time to this index to prove out that it can create a bullish reversal. IF it does so, it will come with a very nice long term entry opportunity.

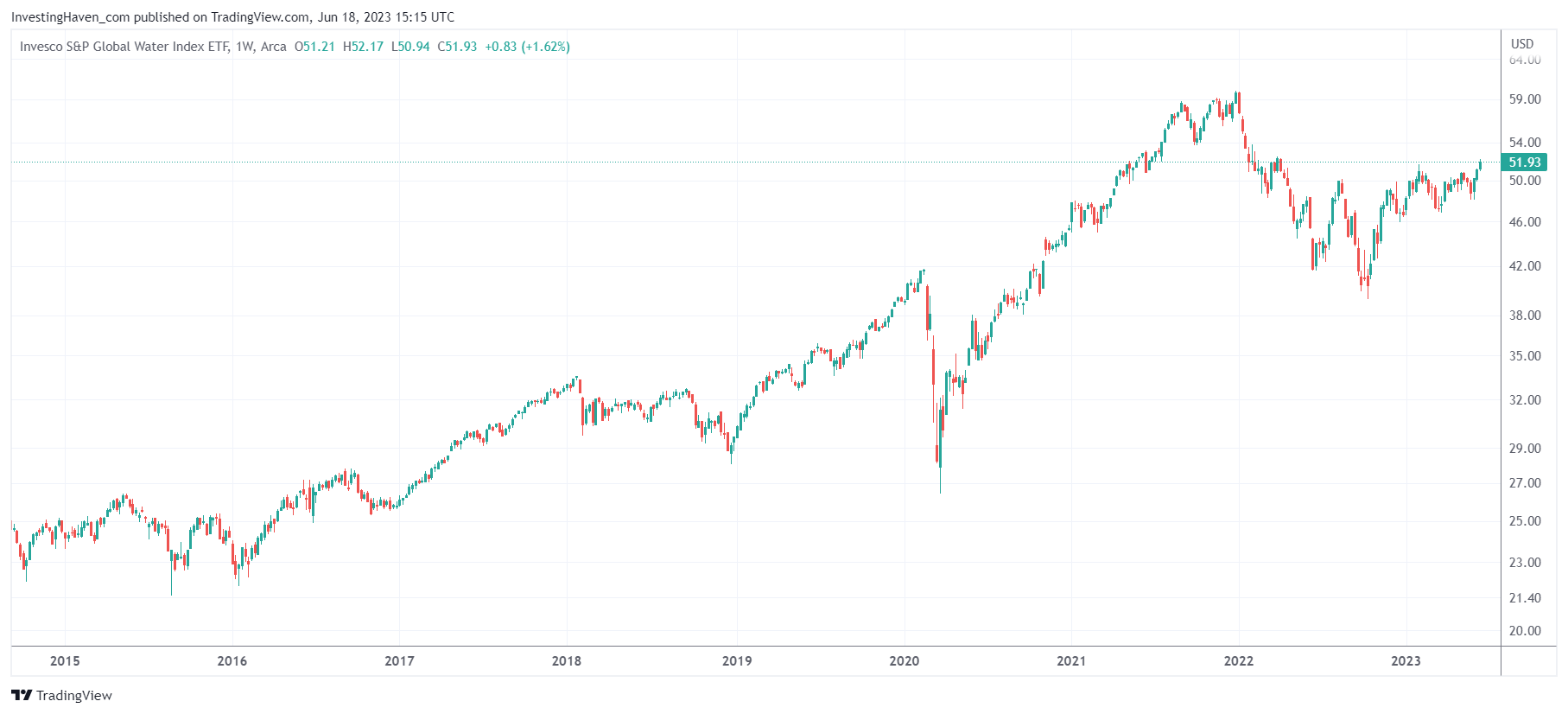

The Invesco S&P Global Water Index ETF (symbol CGW) is tracking primarily US based water utilities stocks. What can be seen from the weekly chart, on 7 years, is a pattern similar to the S&P 500.

However, within this context, two individual companies have displayed noteworthy chart setups, indicating potential investment opportunities.

American Water Works Company

American Water Works Company (symbol AWK) has shown a bullish long-term reversal pattern on its chart. This reversal appears slightly stronger than that of the S&P 500, suggesting the company’s potential for sustained growth. This makes it an intriguing candidate for investors seeking exposure to the water sector.

Note that American Water Works Company is part of the Invesco S&P Global Water Index ETF shown above, it is one of the key holdings in that ETF.

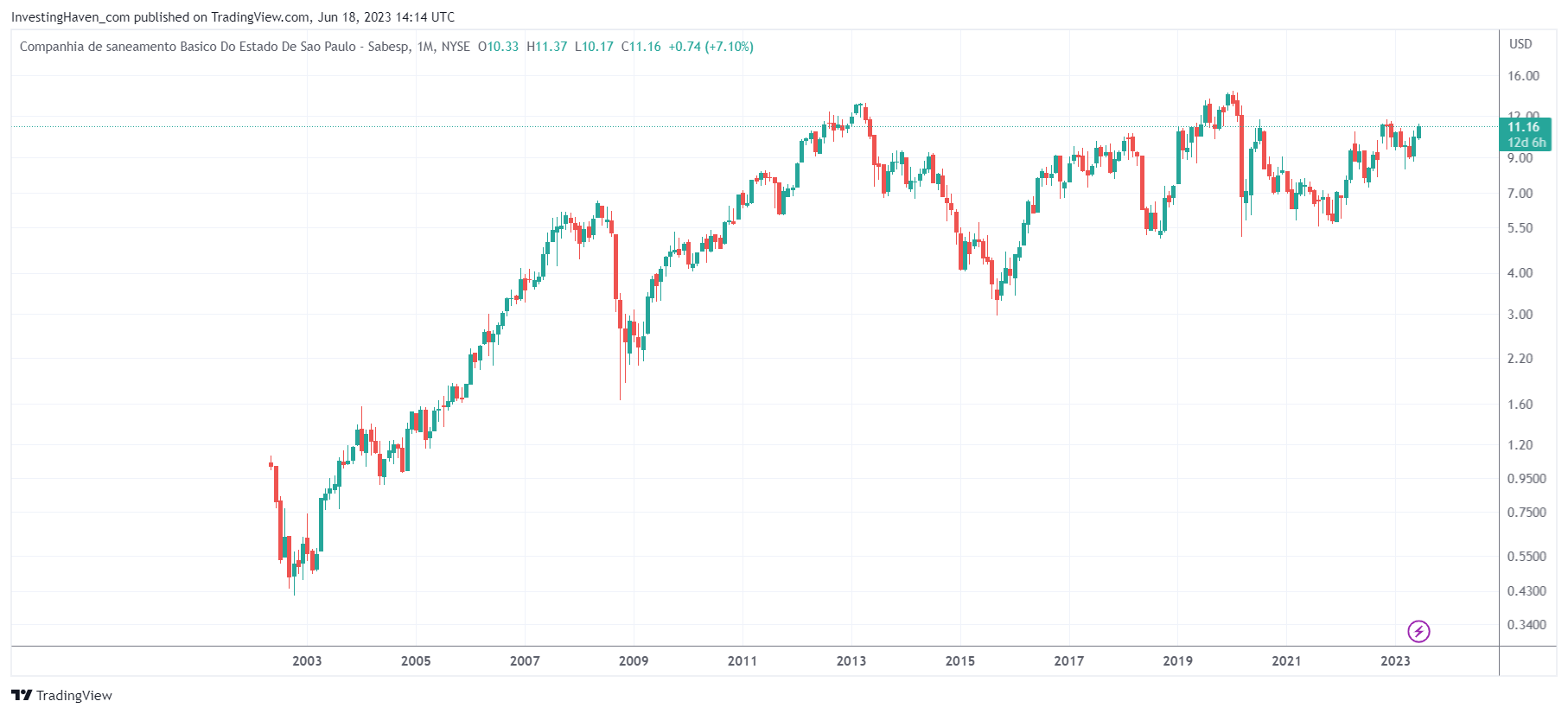

Companhia de saneamento Basico do Estado De Sao Paulo

Companhia de saneamento Basico do Estado De Sao Paulo, also known as Sabesp, symbol SBS, has been consolidating for the past ten years. This extended consolidation phase indicates a significant buildup of energy. If and when Sabesp breaks out from its ten-year base, it has the potential to trigger a powerful rally, making it another company worth considering for water-focused investments.

Considerations for Water Investments

Investors should approach water investments with careful consideration. Water ETFs typically do not offer the same level of leverage compared to investing in broad market indices like the S&P 500. However, the potential for sustained growth in the water sector makes it an attractive long-term investment opportunity.

When considering individual companies like American Water Works Company and Sabesp, investors must conduct thorough research and analysis. Factors to consider include the companies’ financial health, competitive positioning, growth prospects, and the regulatory environment in which they operate. Understanding these nuances can help investors make informed decisions about allocating capital to the water sector.

Conclusion

Investing in water, a commodity that is becoming increasingly scarce, holds potential for long-term value appreciation. While water-related ETFs may not provide leverage comparable to broad market indices, individual companies such as American Water Works Company and Sabesp present unique investment opportunities. American Water Works Company’s bullish long-term reversal pattern and Sabesp’s consolidation phase provide compelling reasons to consider these companies. However, investors must conduct thorough research and analysis to assess the financial health and growth prospects of these companies before making investment decisions.