The price of gold bounced strongly on Friday amid a sell-off in markets, primarily driven by fear about the failure of SVB Bank. Is gold acting as a safe haven (similarly, silver)? If so, is this a temporary bounce? We believe the bond market has the answer to this question. We also believe it is so much more than a short lived bounce. This is why.

While the SVB Bank failure is a real drama, the fastest bank run in history, beating events that occurred 2008 Global Financial Crisis, it is not the fundamental driver for gold.

There is a much more important evolution going on currently. It is the bond market.

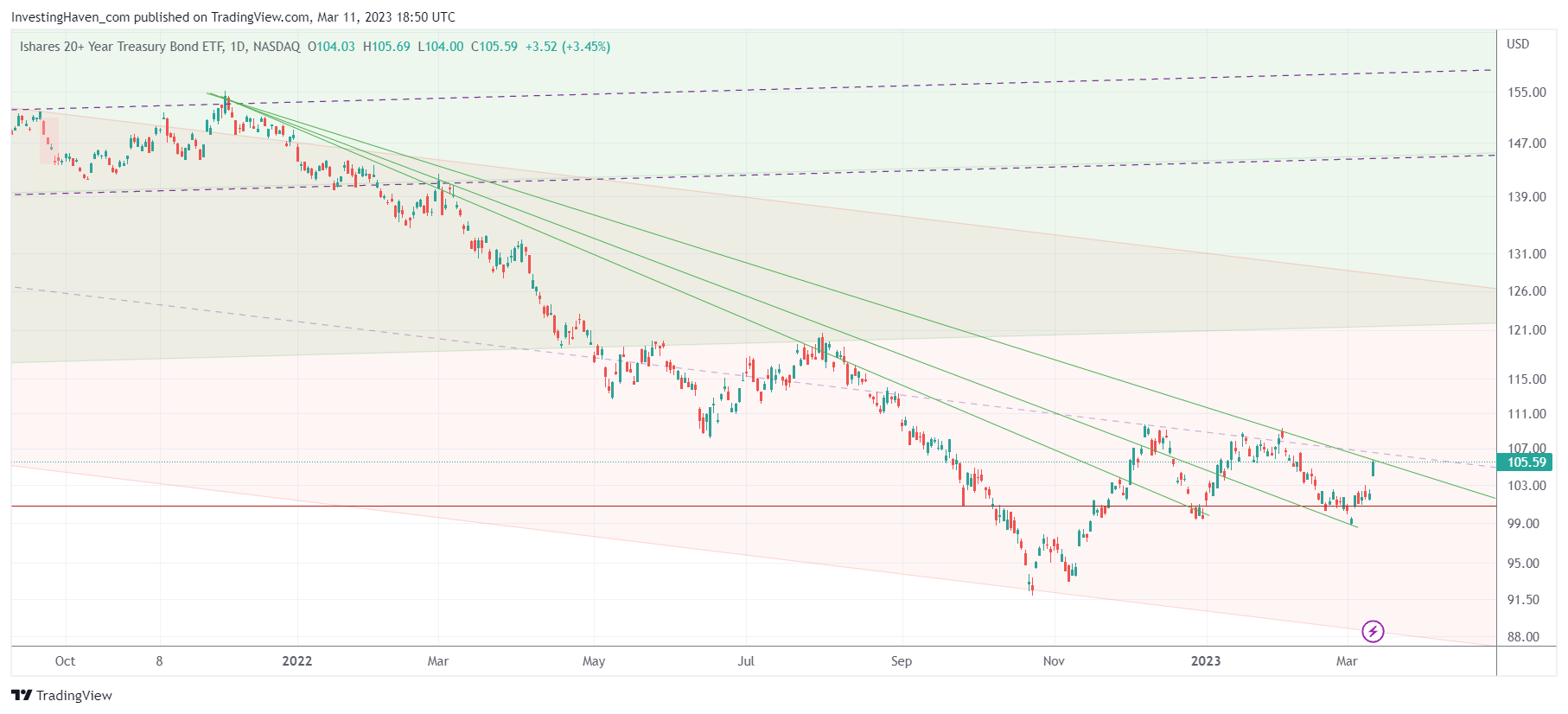

The chart below is TLT ETF, a proxy for 20 year Treasuries.

Gold is strongly correlated with Treasuries. It is also inversely correlated with the USD.

What we see unfolding in markets right now is resistance in the USD. Since Thursday, we also observe a rise in Treasuries. Both suggest that the market believes that Fed MUST stop its aggressive hiking campaign. Whether the Fed will listen or not is another question, we will know by March 23d (next FOMC meeting).

The market now believes that aggressive rate hikes should stop. That’s why rates dropped and Treasuries rose sharply on Friday. Important to know: SVB Bank fell victim of the crash in Treasuries.

The TLT chart confirms a bottoming formation in Treasuries. Not a regular bottoming formation, but a really strong one.

As seen on the chart, the 3d falling trendline is being tested. A cup and handle type formation is in the making within those 3 falling trendlines.

If and when this 3d trendline is cleared, we will know for sure that bonds want to move higher. That’s the ultimate confirmation that gold will move higher, in tandem with Treasuries.

Once gold has cleared 2000 USD/oz it will start a journey based on by intrinsic drivers. For now, it still needs an external driver which is the combination of the USD and Treasuries.

We are bullish gold, consequently we are uber-bullish silver. Got quality silver junior miners? Sign up to Momentum Investing for our top silver miner selection.