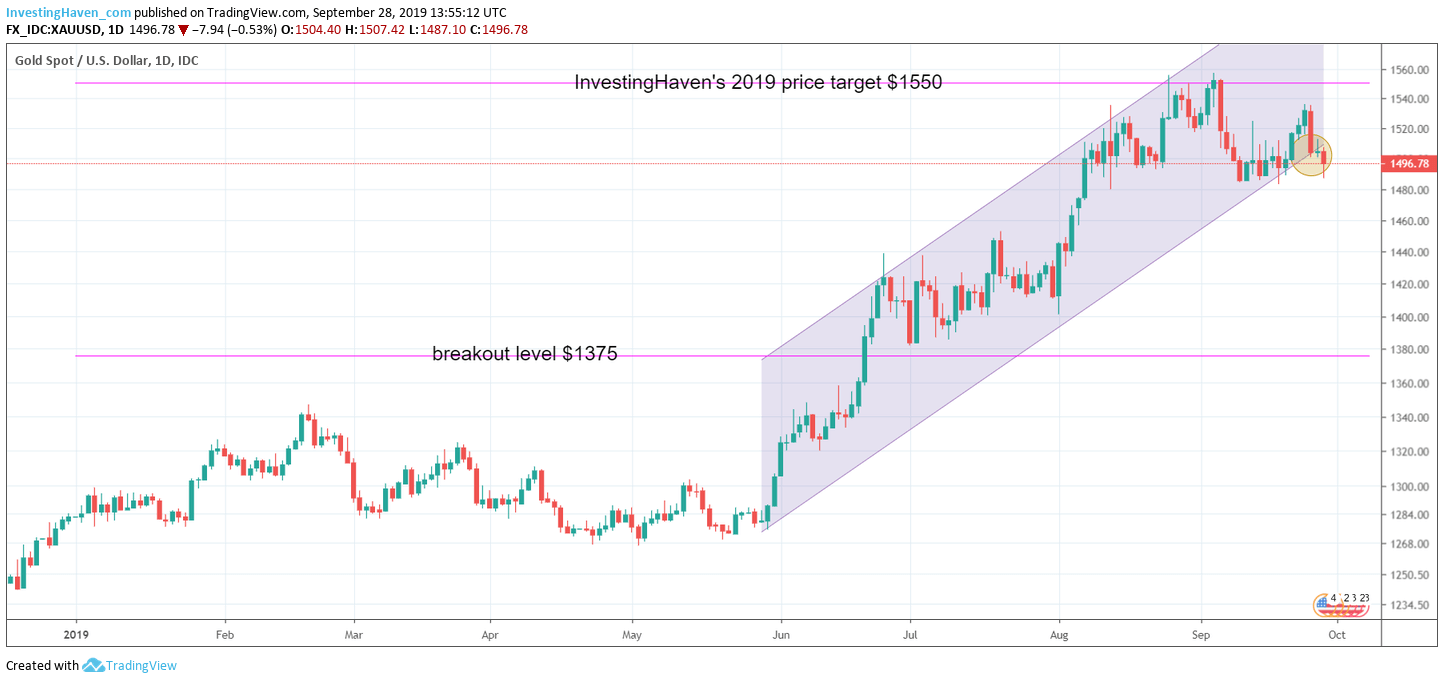

Gold is starting to break down. This is getting serious now. Gold’s uptrend that started in May of this year is ending. Either gold has to suddenly start rising or it takes its time to get back to its breakout level where it likely will become a screaming BUY opportunity going into 2020.

We have plenty of stuff to write about in our annual gold forecast which will be released in the next few weeks.

If anything the most obvious direction of the gold market is first down and then up again.

We believe that what we are seeing is a classic breakout followed by a textbook breakout test.

The breakout point of gold is as obvious as can be: $1375/oz.

The million dollar question is what gold will do at $1375/oz. In theory it can do either of the following 2 things:

- It can stabilize or even bounce are its breakout point. This will be a great sign that gold has an appetite to move higher in which case it will be an amazing buy opportunity.

- It can stabilize around $1375/oz and then violate (probably violently) this level to the downside. In that scenario we have to look for another dominant trend.

There is obviously the more neutral scenario in which gold remains flat between say $1360 and $1460 for a longer period of time.

How high is the probability that gold will be an outrageous buy opportunity for 2020 once it has fallen around $1375? We would say it is important enough to consider.

From a chart perspective the odds favor a breakout test, and the continuation of the breakout.

As said in our annual gold forecast we watch our leading indicators which the Euro, gold’s COT evolution and inflation expectations. Based on the trends of those 3 variables we will try to forecast what gold may do in the next 12 to 18 months.