Trading sessions in the month of July were painful to watch for commodities and precious metals investors. The Gold chart is showing a continuous decline after the price was rejected at $1850 mid-June. Just to make things worse for the nervous gold investors out there, we are heading this week into an FOMC meeting. So as the bearish headlines are flourishing on financial media, we want to take a moment and get grounded by the charts that matter (as opposed to news articles which are a lagging indicator). This should provide us and our readers with a clear perspective as to where gold is heading depending on key price levels. Similarly, we try to address the question whether our gold forecast 2023 is still in play or got invalidated?

Please start by reading our last post on gold and the FOMC.

No matter how tough it gets for (precious metals) investors it is imperative to stay positive.

You might counter-argue that it’s impossible to stay positive amid a bleeding portfolio. While there is some truth in there, it is also not true. Every situation, for investors, no matter how painful, comes with a gift of insights and knowledge. In fact, the more painful the situation, the more valuable the potential gift.

There is one exception to this: an investor or trader that has been reckless and lost everything is obviously going to have a hard time finding the treasure in the problem. Then again, being reckless by taking (too much) leverage or going all-in just in one market is never a good idea and no best practice.

In all other situations, there is a high probability you can recover. A positive mindset will help tremendously to ‘maneuver yourself’ out of any situation!

As per our 7 Secrets of Successful Investing: Without a positive mindset and attitude there is no success

Investors can get very negative when things don’t play out the way they desire. As if markets are there to please individual investors.

When negativity accumulates over time it is going to impact the mindset of an investor. This is a slow process which happens in the background, without noticing. The investor is unaware of an increased level of negativity.

If anything, success in markets is achieved with a positive mindset, no matter how bad it gets. Any loss incurred should motivate, not depress. Only positive investors have a chance to make it into the 1% of outrageously successful investors. Without a positive mindset you will never make it into the 1%.

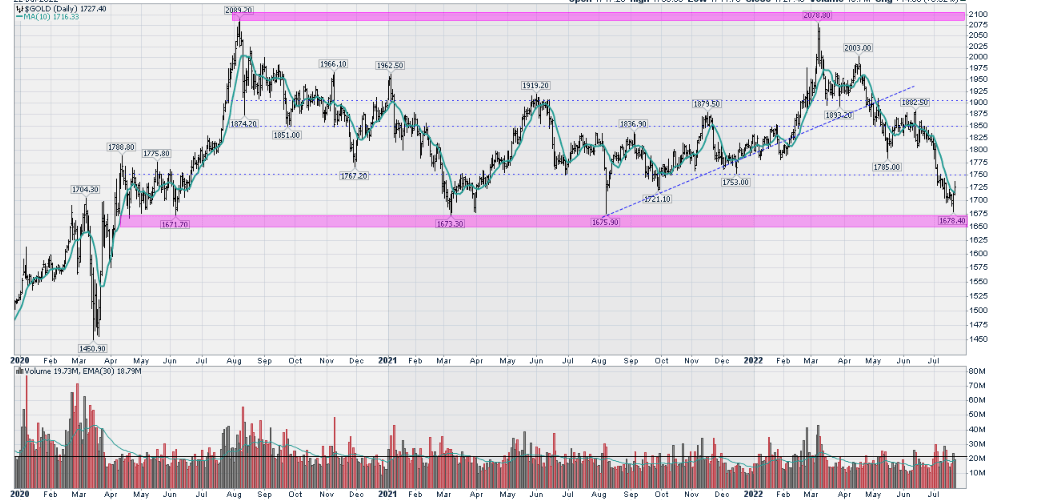

An Interesting Perspective On The Daily Gold Chart

The daily gold chart below shows how Gold price, even with the intense pressure to the downside that we have been seeing in 2022, is still consolidating. We have a long and strong consolidation channel that should lead to a strong move. Given the upwards price direction that preceded the consolidation, chances are the next explosive move is to the upside.

However, Gold price has to respect some key price levels for the materialization of this bullish scenario. $1700 has to hold and did so far. Even after a blip this week, the price quickly reclaimed that key level.

With the current strong inflation numbers, one would expect that Gold would perform better as a store of value. The rate hikes we have been witnessing across the globe haven’t been helping but really, the main reason for the downwards pressure on precious metals in general is the USD.

The US Dollar has been on a parabolic move to the upside. We believe this move is showing signs of exhaustions and could be coming to an end. We previously laid out the charts and details and published this week an update to where the US Dollar is heading: A Must See Bearish Pattern Forming On the US Dollar Chart.

If the upwards move is done in the USD, that means that Gold will make a spectacular bounce from the bottom of this multi year consolidation channel. This bounce would clearly lead to the materialization of our Gold price forecast for 2022 with a price target of $2500.

It also goes without saying that more than ever, proper risk management is of essence. The risk with Gold, at least mid term, is a break of that support in the $1700 USD. This week will be an important one for many asset classes.

Written by hdcharting.