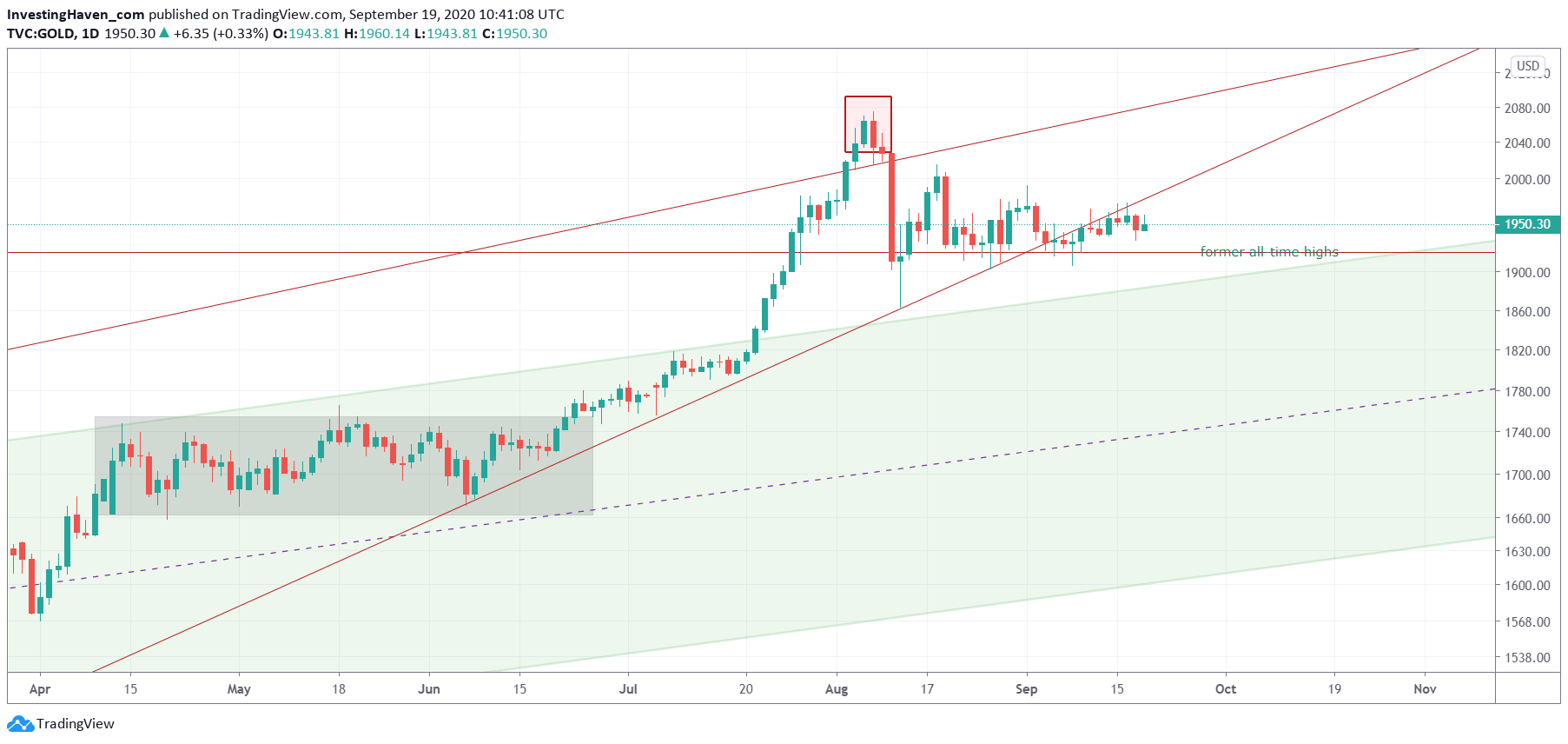

Gold is now confirming its love affair with its former all-time highs. We did notice this a few weeks ago in our piece Gold Falling In Love With Former All Time Highs. It was an observation back the, it is a confirmation right now. Gold keeps on moving around the 1930 USD level for some 6 straight weeks now. This might be a great setup for gold to move higher from here, even though not immediately. If this happens the gold market will crush our already bullish gold forecast for 2021.

The point we made a few weeks ago:

All we can say is that (1) this is a unique setup (2) former all-time highs will be acting as a pivotal area.

We need a wait and see approach here.

So why we do repeat ourselves? If last week’s commentary was relevant, what is new to talk about gold this week?

One very, very important development is worth mentioning. Gold is calming down.

Is this important?

It is crucially important, not simply important.

Not only because we want to be buying, as investors, when a market is calm. But more importantly a calm market reveals mostly the ‘calm before the storm’.

So yes, there is no news on the gold front, but at the same time breaking news.

The fact that gold is ‘consolidating’, that’s what it is doing in the end, is not really newsworthy.

Or is it?

We believe it is, for 2 reasons:

- A market that calms down is a good thing. Tension is not a setup for a bullish outcome, mostly for a bearish outcome.

- More importantly, even though very subtle, but we start seeing a slight improvement in recent days. Gold is setting higher lows, in a very subtle way, as it is calming down and ‘hovering’ about its previous highs.

The set up in gold is improving.

We need to start paying attention now. This may result in a move higher … it *may* happen, we don’t know for sure … but this chart certainly is screaming ‘watch me‘.