Gold was among the top performers in the last 2 weeks, partially driven on continuous monetary and fiscal stimuli from governments around the world to stimulate the local and regional economies. Unsurprisingly, on Friday, gold retraced, and it looks like there is a little bit more downside in the cards. We expect a week with a small pullback in the gold market. Yes, this is a great opportunity to add to gold positions, especially because the gold market is even more bullish that our 2020 gold forecast.

The daily gold price chart is one of the 15 exclusive gold charts we shared last weekend.

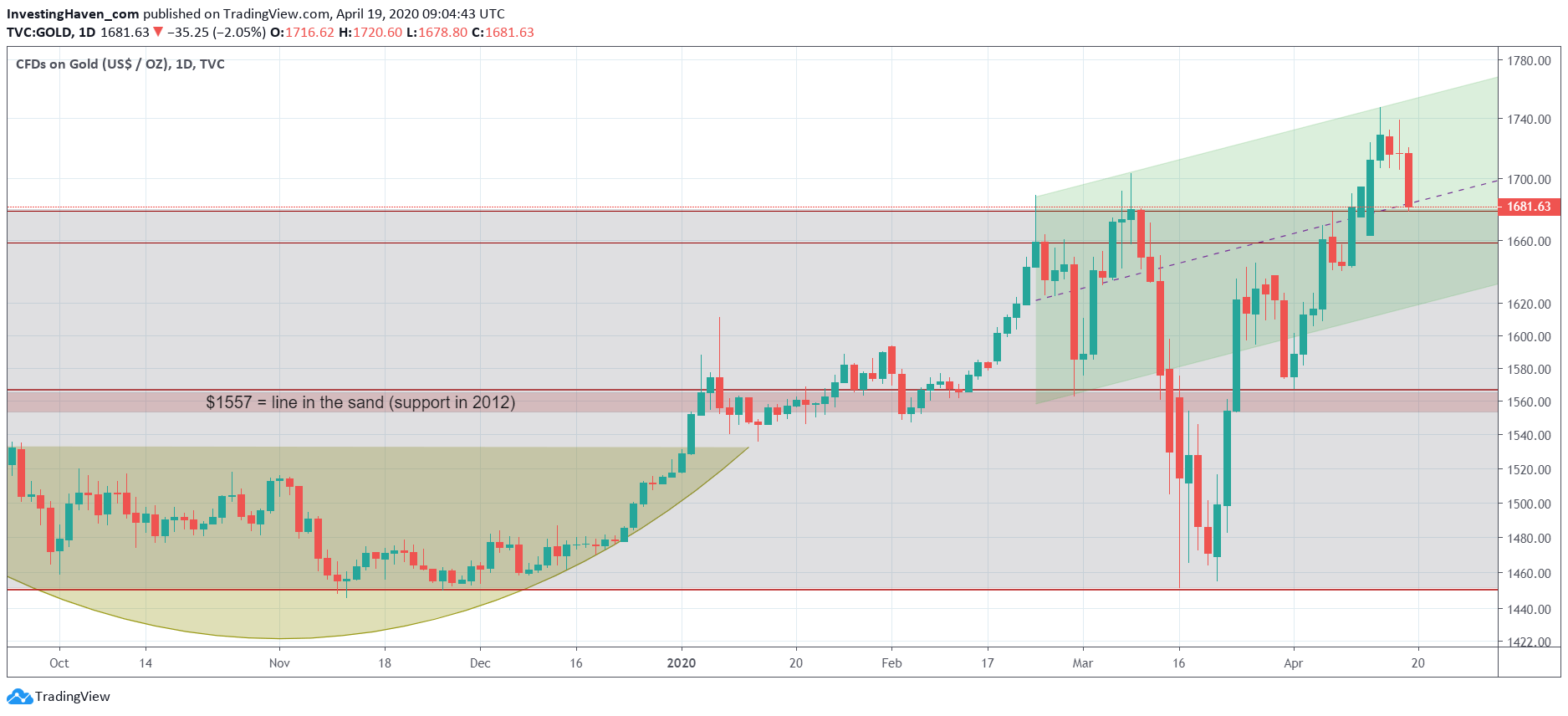

It requires advanced charting skills to dissect the trends on this chart. This is what we see:

- The line in the sand is 1557 USD. Above that level there is a strong bull market. Note that we did predicted a gold price of 1555 USD in Sept of 2018, to materialize in 2019. That price target was resistance in 2019, and became support in 2020.

- The dominant pattern is the consolidation indicated in grey on this chart. Note how the crash sell off in March was nothing more than a test of the support point of the consolidation (very, very precise).

- Since Friday April 10th the gold market is ‘breaking free’ from this consolidation. It clearly wants to move higher. The gold market is ‘working’ to make the green channel (at the right) its dominant trend. The writing for this was on the wall, particularly because the ‘wicks’ which were set on Feb 24th and March 9th forecasted this new channel. Yes, those wicks carry critically important information, predictive information, but it may take weeks to months before that ‘prediction’ materializes.

Very short term, as in ‘next week’, we expect a consolidation with a small pullback in gold. This will set the stage for a sustained move higher with a first target of 1799 USD.

Gold miners will do well. They are close to breaking out, and we are confident that this breakout has some 50% upside potential.