If anything gold miners have been extremely strong post-Corona crash. Will strength continue? If so how far can gold miners go? Will this depend on the price of gold, and do we need prices higher than what we explained in our gold forecast?

All valid questions, and let’s address them one by one.

First, we look at the HUI gold mining index in this article. Note that this is one of the 4 leading gold mining indices, so the HUI chart cannot be read in isolation.

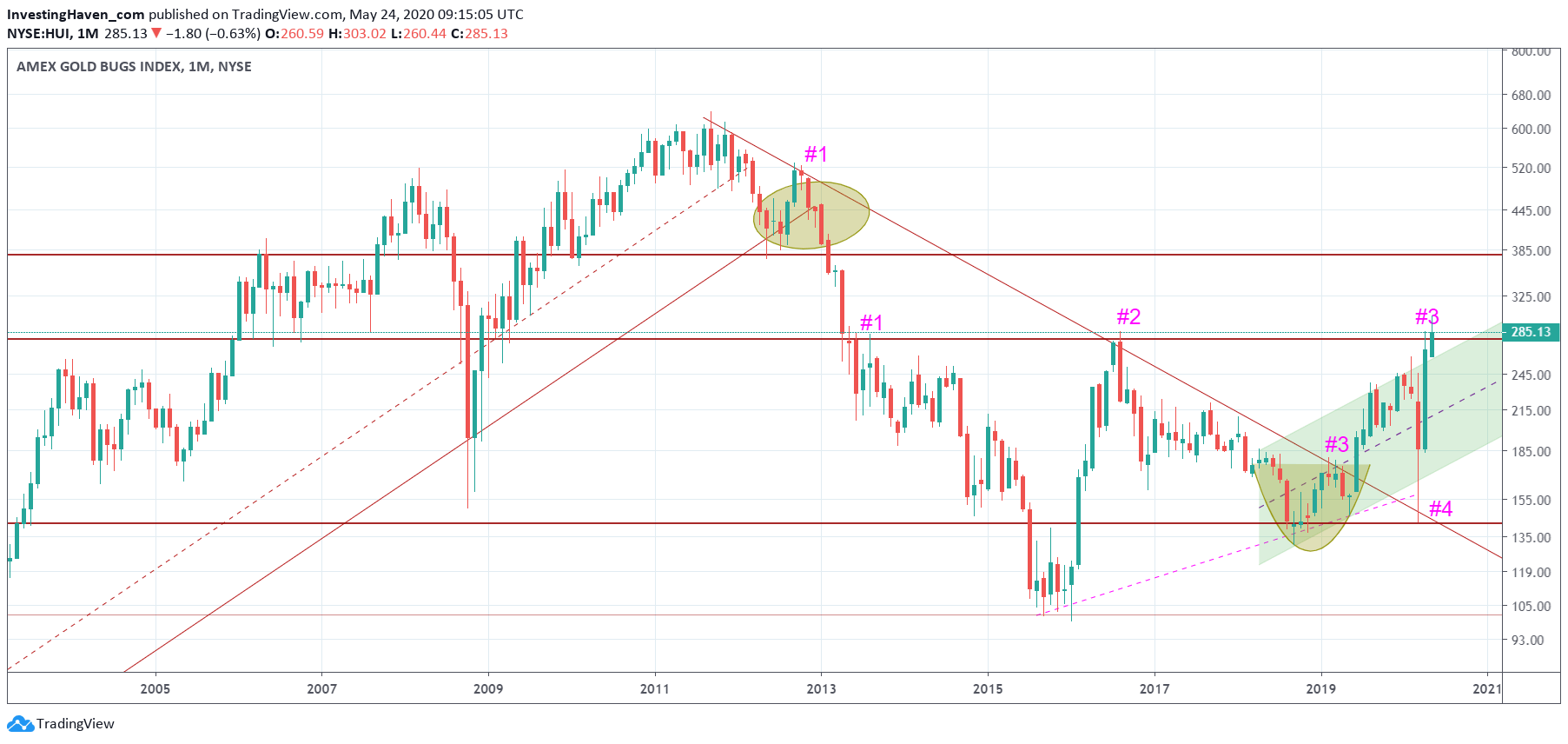

The long term monthly chart shows how this is attempt #3 to break out of a 7 year bear market. So far it looks like the breakout is happening. However, we need 3 consecutive weeks of trading above 280 points.

Second, the Corona crash resulted in a strong sell off in gold miners that brought gold miners to the bear market trendline (#4on the chart). This was a very brutal sell off, but the wick on this monthly chart confirmed that it was a successful bull market test. It certainly did not feel like a successful test, it felt like the end of the world. In hindsight though we now understand what this sell off meant in the bigger scheme of things.

Third, the upside targets of the HUI gold mining index are pretty attractive. If (that’s a big IF) the ongoing breakout continues we may see 385 points later this year. That’s 30% upside.

The most important observation though is that the price of gold is almost near all time highs but the HUI index trades 50% below all time highs.

It all starts with a confirmed break above this historic level which is 280 points in the HUI index. Once this happens we expect a historic bull run in gold miners. Until then we have to closely monitor the intent of gold, silver, and precious metals miners to understand if and when this historic breakout will be confirmed.

This is a great opportunity for investors to position themselves for a rally in undervalued gold miners.