Gold miners broke down last week. And if there is no thing investors should never do: never, ever feel in a hurry if a market breaks down. It’s a recipe for disaster. Gold miners may ‘only’ have some 10 to 15 pct downside potential, but it might become worse. Why feel in a hurry if a market is looking for a bottom? As per our market forecast explained in great detail in our gold forecast and silver forecast, both precious metals are expected to do well next year, but in the first part of the year.

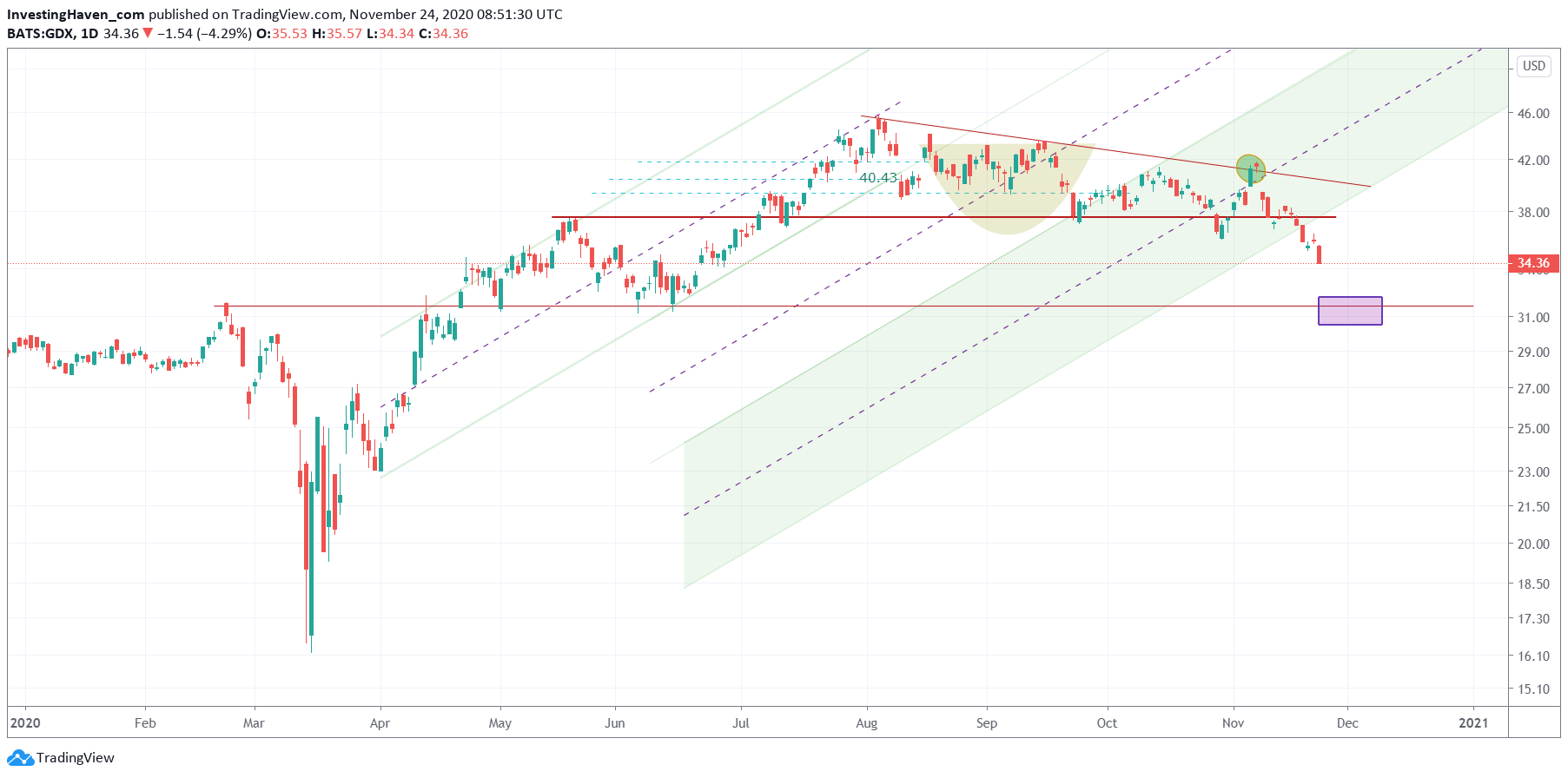

The gold mining chart GDX ETF is a mess.

It’s clear that this is a rounded bearish formation, and these patterns take time to complete and to improve.

There is no reaon whatsoever to try to get into gold miners at this point in time.

The first downside target is 30 to 31 points. One might argue that’s a great moment to get in, and put a buy order at those levels.

We would argue that’s not the smartest thing to do, and a great recipe for sleepless nights. Why? Because the 30 area may or may not hold, there is nothing on this chart that gives us confidence that 30 points will hold for sure.

Better is to wait, simply wait. As per our 100 Investing Tips For Successful Long Term Investing waiting is one of the toughest things to do, for most investors.

The gold and silver (mining) space has to calm down first, in looking for a bottom, after which we want to re-assess opportunities.

In our Momentum Investing portfolio we sold our last gold mining position on November 9th. Since then gold and silver miners have been trending down. Our timing was great, and we are convinced we’ll get back into precious metals miners … but not in the near future …