It is getting ‘nasty’ out there in the world of gold miners. They are literally hanging on a cliff. This obviously is due to the sell off in both gold and silver in this last trading week. We are not going to forecast anything here, as short term forecasting is a fool’s game. Our gold forecast and silver forecast are long term forecasts. All we can do is observe, and know if and how we should protect ourselves from more damage in case we are long this market. The opposite is true as well: we want to know if and when to go long in case we don’t have a position.

Last week the gold market broke what was a promising setup.

That’s what happens after an FOMC meeting: volatility shakes out everything and everyone.

We showed the gold chart on 3 timeframes in our article Gold Needs Time, How Much More Time?

The gold charts are worth your time, and the gold futures market chart is equally insightful.

We came to this not so inspiring conclusion from those 4 gold charts:

- That said we conclude that the gold market needs time, more time.

- How much more time?

- If the gold market has to recover based on its chart it might be lots of time.

Remember, gold is a leading indicator for precious metals miners. We better apply the same conclusions from the gold charts to precious metals miners.

And the precious metals miners is simply confirming that conclusion, no divergence there.

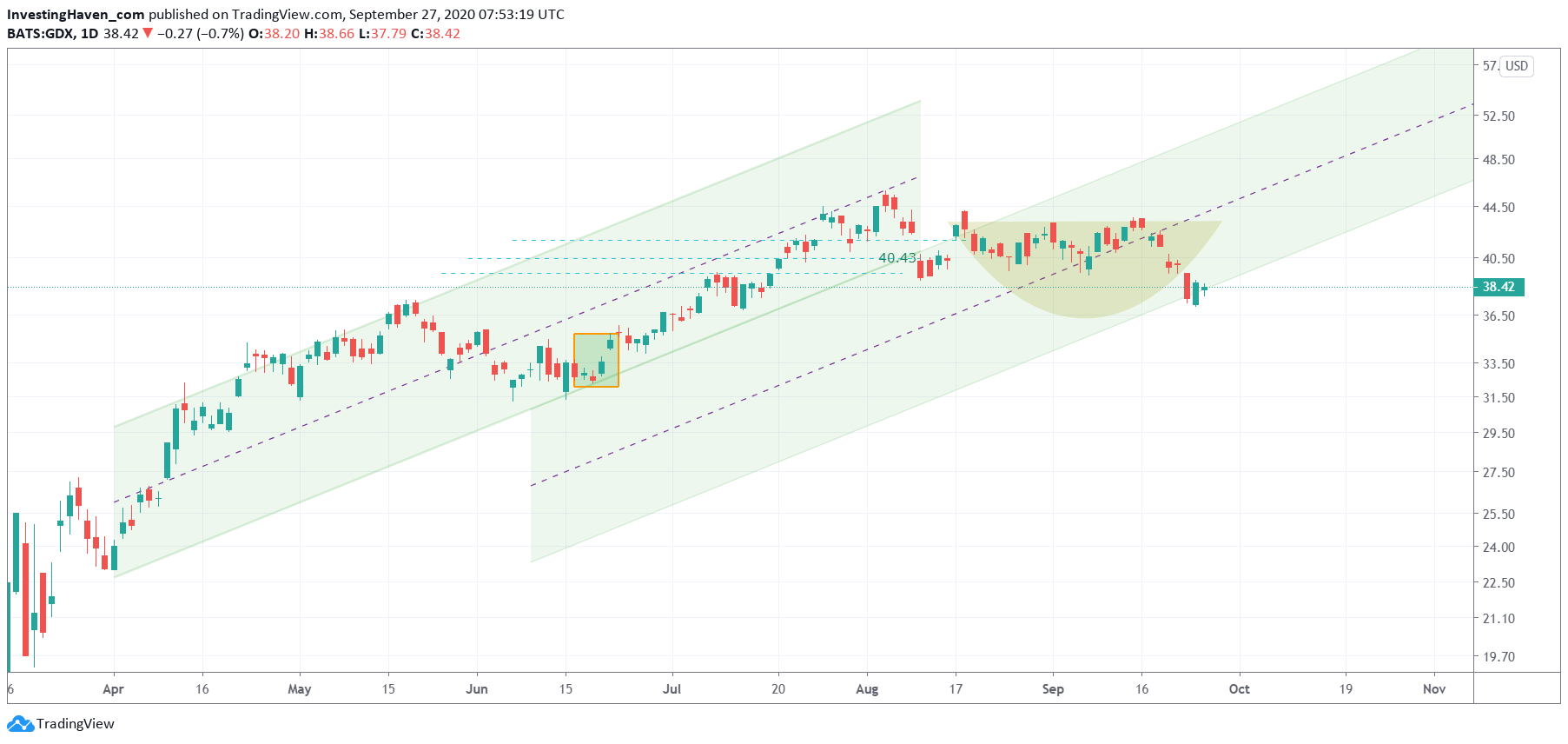

If we look at the daily GDX ETF chart, below, we see how a promising reversal setup (yellow reversal) was invalidated last week.

In a few days these precious metals miners are now back to the support level of a forked channel, right below an important horizontal support level.

Does not give lots of confidence, does it.

One week can break a market, easily.

For now, no action in the precious metals market, is the simple conclusion. Until we get bullish signs.

In the meantime we keep on tracking this market very closely. A bullish reversal can take place, and given more fiscal stimulus potentially coming up it would certainly change the gold market pretty fast. We should not count on it though, and certainly not anticipate it.

If the gold market will recover based on additional fiscal stimulus as per Powell’s recommendation on CNBC Fed calls for more fiscal stimulus it might recover much faster. But, again, we better don’t wait for this, we better monitor and react (as opposed to anticipating).