our gold forecast for 2021 is already achieved, much faster than expected. While this may be great news for gold bulls, we would caution for prices that rise too fast (that’s a general statement which also applies to precious metals). Similarly, when it comes to our market forecasts we prefer a gradual evolution of a market to our predictions, not a sudden move. That’s why we are not too comfortable currently with the precious metals market. Particularly the gold market starts looking pretty complex, not a time to be too brave with gold positions, no matter how much we like gold and how bullish we are long term.

Fundamentals in the gold market are solid.

But in the end all that matters is price.

As said many times: fundamentals suck because they don’t help timing an investing position. In the end, timing is the only thing that matters to investors. As per our 100 investing tips:

‘Timing is not the most important thing, it is the only thing.’ This implies that timing an entry point as well as exit point is by far the most important thing for an investor to do well. ‘Timing is the only thing‘ means that it is more important than reading news, analyzing fundamentals, following gurus, and so on. Excellent charting skills are a prerequisite to apply this principle!

With that said let’s turn our attention to the gold price chart.

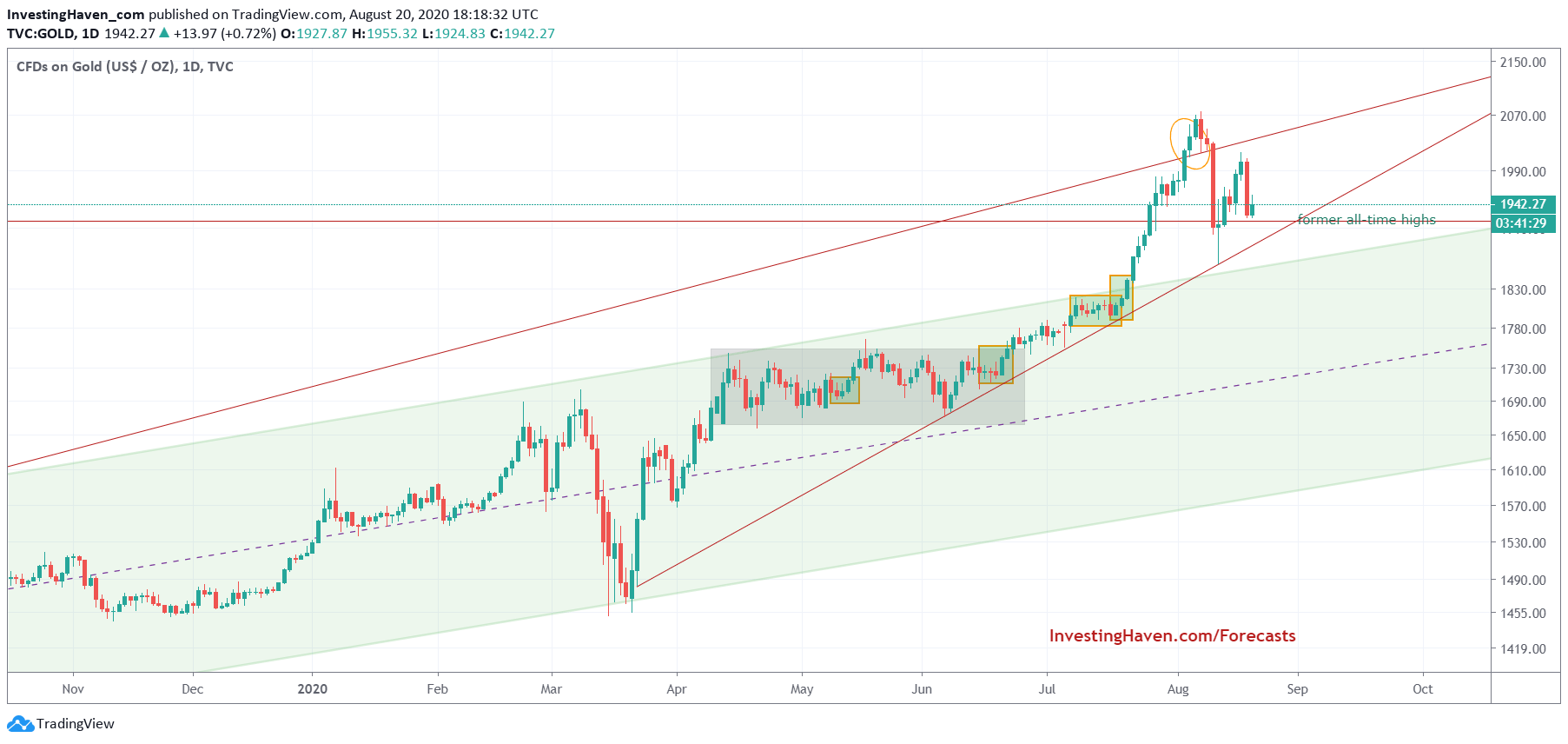

Note the very unusual setup of the gold chart:

- The gold price is way above the rising channel, which indicates its price has risen too fast too high.

- Gold still trades above former highs, which is great if it continues to provide support.

- There is sort of wedge type of triangle created by price action over the last 2 years.

All in all we need additional confirmation that gold can continue to trade above former highs around 1900 USD. Once there is sort of stabilization / consolidation above this area we would be buyers (again) in the gold market.

Instead of betting on it, we decided to give the gold market the time it needs to exit the area of tension. Within our Momentum Investing portfolio we exited our gold mining position without a profit/loss. However, we are following the precious metals very closely, and are ready to re-enter if conditions are supportive of a solid entry point.