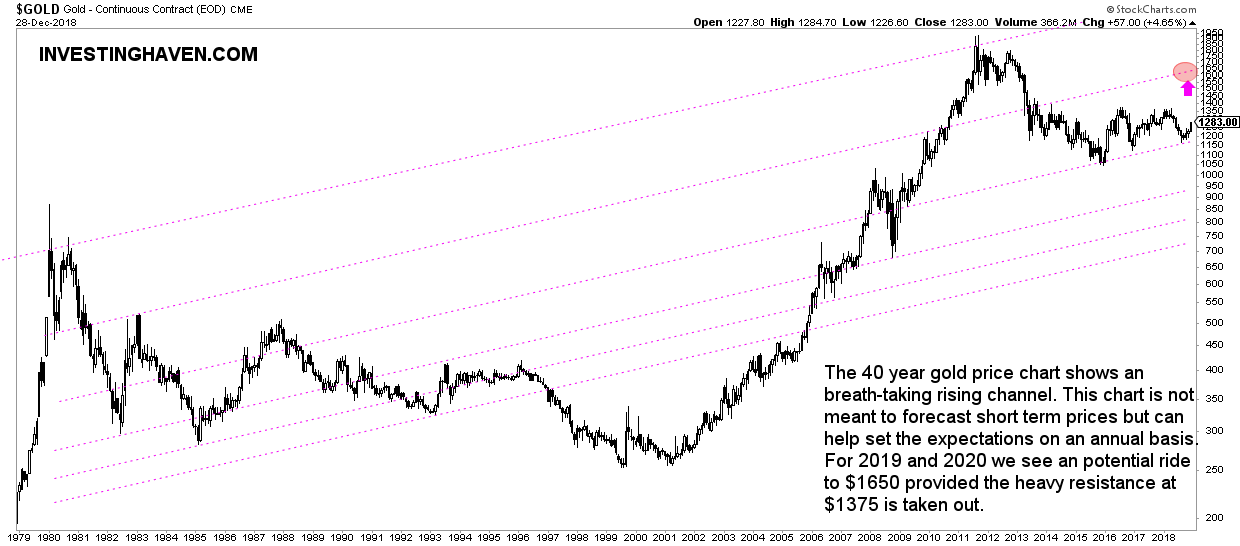

Long term gold charts are crucial because they show dominant trends. The gold price chart on 40 years is the one with the most historic data. It reveals an exceptional pattern not seen on any other historic gold price chart: a historic rising channel with several subchannels which can help us in forecasting gold price. It confirms our gold price forecast 2019.

Most investors tend to forget the importance of long term charts. It is so easy to get caught up in the endless stream of gold price news. Not that we consider this to be the reference but just as an illustration we refer to this gold news stream or simply the Google gold price feed.

The big problem with short term gold (GOLD) price analysis as well as short term oriented gold news is that it distracts from what really matters, i.e. dominant gold price trends.

When it comes to gold we would argue that the most dominant trend is visible on the historic 40 years gold price chart.

The importance of any gold price historic chart

It is crucial to always take a top down approach, in any market and for any investment. That’s because the most dominant trends are visible on historic charts. These dominant trends influence both long and short term trends.

In the ideal world the longer term charts confirm the shorter term charts. So say that the gold price historic chart on 40 years shows a pattern in which the gold price is moving, and there is a similar conclusion from the 10 year and 2 year gold price chart it would classify as a ‘confirmation’ of the different time frames. That’s re-assuring.

The opposite is true as well, and here it becomes interesting. IF the gold price historic chart on 40 years suggests that the gold price is heading into secular resistance but the 2 year chart shows a totally different picture then we talk about ‘divergence’. This is always tricky, as time frames are not aligned. In such a scenario we prefer to give the market time to show a direction.

Our point here is that it is imperative for gold investors to spend sufficient time analyzing the chart structures on the long term historic gold price charts combined with the shorter term time frames. Ultimately, it pays off in your gold investments.

Gold price historic chart on 40 years

Why do we consider the gold price historic chart on 40 years so important?

In other words why do we consider the gold price historic chart on 40 years more important than the 80 years chart or the 10 years chart?

There is a specific reason for this. And it is visible on the chart itself.

First, market-wise, the gold price started trading ‘freely’ with an open market in 1971, on August 15th. That’s when President Nixon took the U.S. off the gold standard. So any historic gold price chart should be after that date, as before it was not really relevant.

Second, chart-wise, the major peak of the gold price was set in 1980, and the longest consolidation in gold’s history. A fact that is kept secret by chartists is that rising channels which are the most dominant trends have their roots in major peaks and subsequent consolidations.

If we apply all this to the gold market it is clear that any gold chart after 1971 should be taken seriously. But between 1971 and 1977 there was not such a relevant price action. It all started in 1978.

You see why we choose the gold price historic chart on 40 years as the most relevant showing dominant trends?

Dominant trends on the 40 years gold price chart

Below is the gold price historic chart on 40 years.

What is truly exceptional is the rising channel which is really not visible to many. It requires some digging and analysis in order to identify it.

Take for instance the peak of 1982. Who could imagine that it has value at the present day? Look how this 1982 peak created a subchannel which provided support since 2016, during the heavy gold bear market as it marked the ultimate low of this bear market.

What this 40 year gold price chart learns for 2019 and 2020 is that there is a fair chance that gold’s price will rise to the top of this channel provided that 1200 holds strong as a monthly close. That’s also what we have been repeating recently: the importance of $1200.

As gold is getting a bid now we expect gold to rise to $1650 at a certain point where it will meet heavy resistance. This might happen in 2019 already but, for this, we need the lower timeframes.

Now this is exactly how to read long term charts: determine the ultra-important price points when it comes to dominant trends but zoom in to see how the market reacts on those important price levels.