We said recently to give the gold and silver market the time they need to calm down. There was way too much tension in precious metals. Never a good idea to enter at that point, however exiting is what we have to do when there is tension. Right now, the picture in gold and silver is improving. This article is not meant to be a gold forecast nor silver forecast. All we want to understand is if this is a right time to enter … or not (yet).

We want to summarize the important, and still very relevant, insights from last week: Gold Falling In Love With Former All Time Highs?

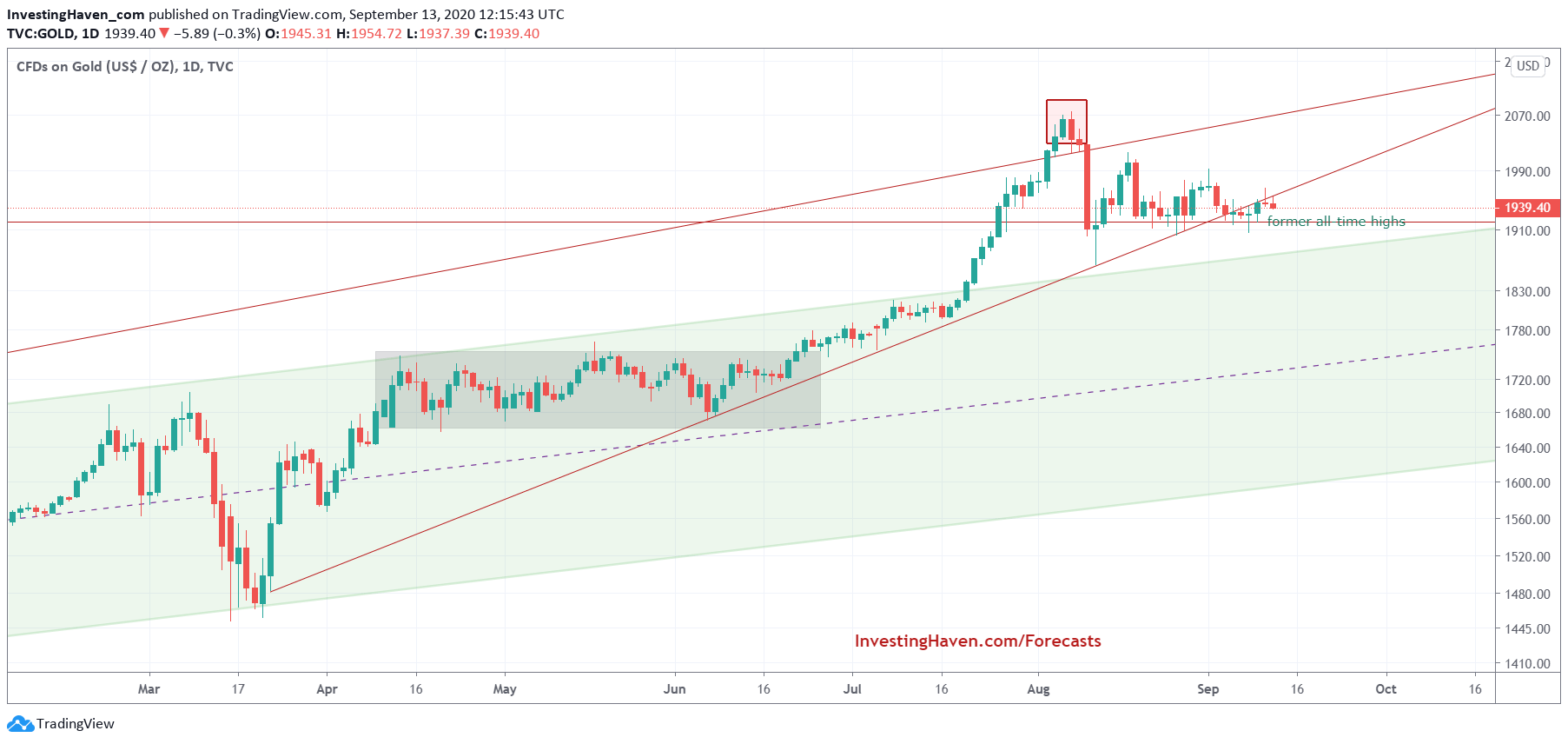

A few observations from the gold chart:

- Upside: The gold price is way above the rising channel, which indicates its price has risen too fast too high.

- Downside: Gold still trades above former highs, and it is now creating a very (very) solid support right at former all time highs.

- Trends: Gold is now entering an intersection of trends, one we have never seen before on any chart. This is getting really unique: a rising wedge, horizontal support at multi-decade all-time highs, with a medium to long term rising channel about to meet former all-time highs.

All we can say is that (1) this is a unique setup (2) former all-time highs will be acting as a pivotal area.

We need a wait and see approach here.

So why we do repeat ourselves? If last week’s commentary was relevant, what is new to talk about gold this week?

One very, very important development is worth mentioning. Gold is calming down.

Is this important?

It is crucially important, not simply important.

Not only because we want to be buying, as investors, when a market is calm. But more importantly a calm market reveals mostly the ‘calm before the storm’.

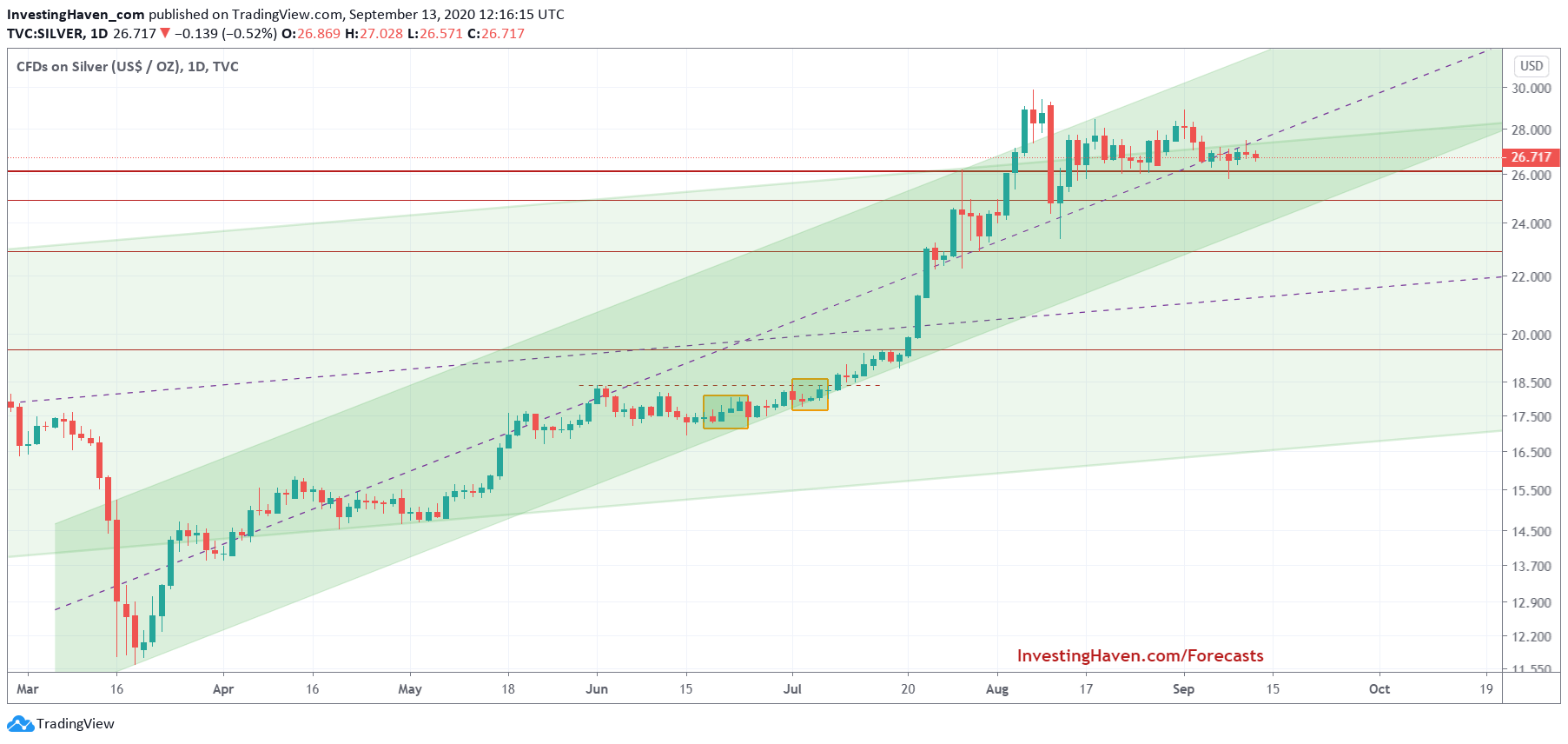

Silver is very similar to gold, and that’s a good thing.

The ‘calm before the storm’ is how we could read this silver chart.

For both gold and silver we want to see critical support being respected, and this calm state starting to point upward (slowly but surely). It would be an awesome development.