Gold holds the top spot of the strongest global currency in 2019 (in the first six months of 2019). Why did gold become the strongest global currency of 2019? The answer is pretty straightforward, and has everything to do with both intermarket trends as per our investing method combined with monetary policies of central bankers around the world. What matters is this: gold confirmed its breakout and is set to continue to rise to our forecasted gold price of 1550 USD. All the rest is essentially irrelevant for investors, and may be ‘good to know’ at best.

The one and only thing that matters in financial markets, and is the most important thing for investors, is how intermarket trends work.

As said in our 100 investing tips overview:

Markets move in relation to each other, they do not move in a vacuum. Capital flows from one market to another market, considering that cash is also a market (any currency). This flow of capital can be identified by thoroughly analyzing chart patterns and trends in a handful of leading assets. They are primarily treasuries, currencies, leading stock market indices, gold, crude oil.

Essentially, what we are saying is that gold is performing so well because it is a great investment from a relative perspective. Compared to other assets, and especially comparing to other currencies, gold is a much more attractive investment.

To illustrate this point we refer to an article we wrote earlier today which says that the Euro, one of the leading indicators of the gold price (indeed, the Euro, more so than the U.S. Dollar) is flat for 12 months. This is an event that has not occurred before. That’s why we said that the Currency Market Writes History: Why The Euro Is Flat For 12 Months.

Moreover, fundamentally, monetary policies from central bankers around the world are designed to to support economic growth. However, this comes at the expense of their own currencies. If all central bankers concurrently do the same, they all devalue at the same time. The only way to recognize this phenomenon is by applying a baseline which is what gold stands for. Gold is the baseline for currencies.

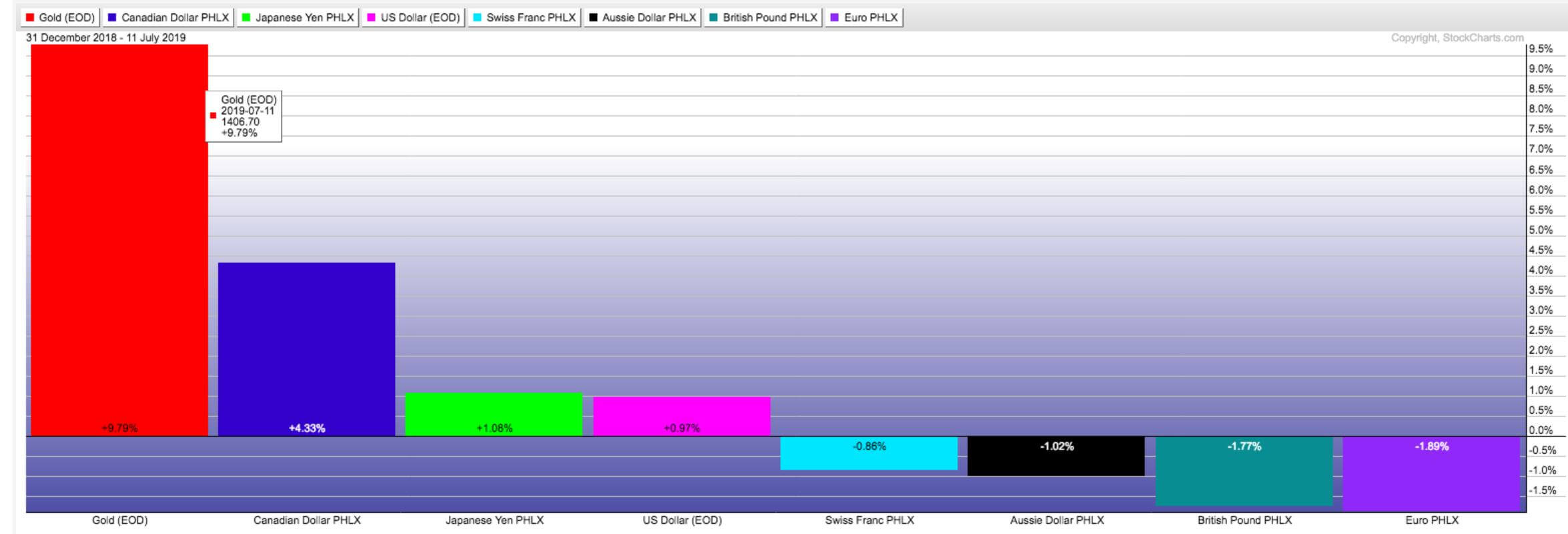

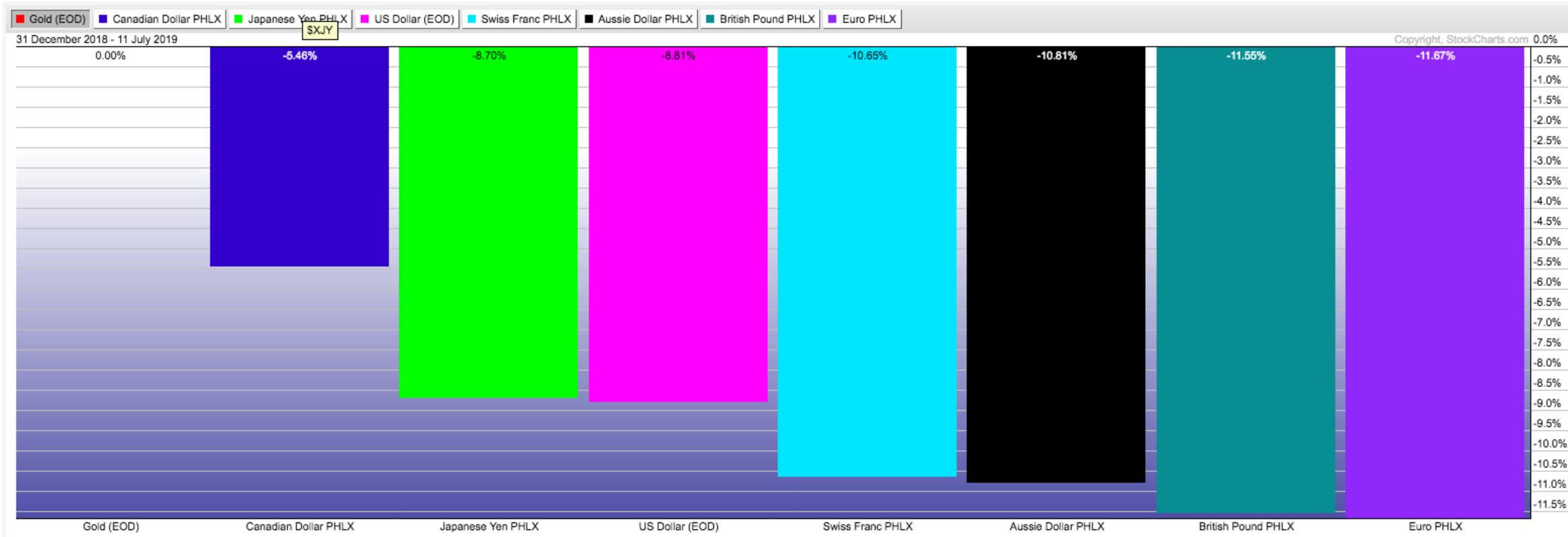

That’s what we also see on the following 2 charts, courtesy of StockCharts.com. John Murphy created the following 2 charts, and we owe him him full credits for his outstanding work (source).

The first chart shows the relative price performance of gold in red in the first 6 months of 2019, and compares it with the performance of the other leading global currencies (in this order: Canadian Dollar, Japanese Yen, US Dollar, Swiss Franc, Aussie Dollar, British Pound, Euro).

The second chart shows the price performance of gold in terms of another currency. So the baseline is set at 0% which is the price performance of gold, while the other currencies (same as above) have a significant negative performance against gold’s price.

[Ed. note: As of this week we will provide in-depth analysis to our ‘free newsletter’ subscribers. We will bring premium content with specific (gold and silver) investing tips on a weekly basis, mid-week, free of charge. We will do this for 4 to 6 months. Subscribe to our free newsletter and get premium (gold and silver) investing insights in 2019 for free. Sign up >> ]