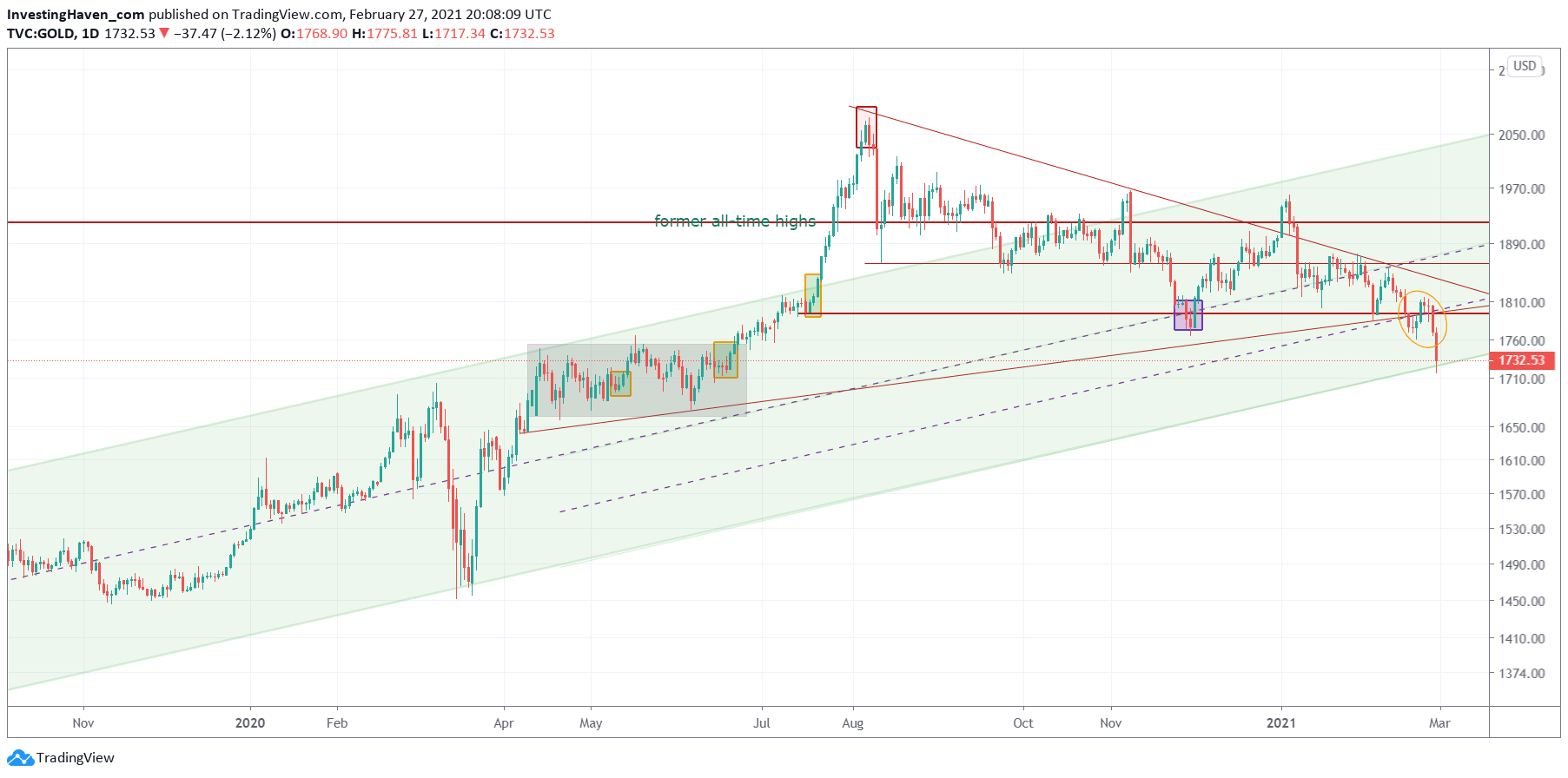

It is happening, in front of our eyes: gold’s decisive moment of 2021 is here. The same applies to silver. Gold’s multiy-year uptrend is now tested, and the market will decide whether it will ‘produce’ a breakdown or not … next week. Support should be strong around 1715 USD. We will know next week whether our gold price forecast for 2021 will be valid or completely crushed. Needless to say, this will have profound implications for our 2021 silver forecast.

The gold chart says it all.

Gold fell from 2075 USD/oz on August 6th, 2020 to 1732 USD/oz on Feb 26th, 2021. That’s a decline of 16.8% in 7 months. Time for a turnaround, or time for the real selling to start?

If anything, it is clear that the gold market is thoroughly testing a critical level, right here right now. A break lower will be catastrophic, but if 1725 USD/oz holds it might be the start of a longer term reversal. The latter scenario is the one we outlined in our gold forecast 2021, but the market will have to confirm this …

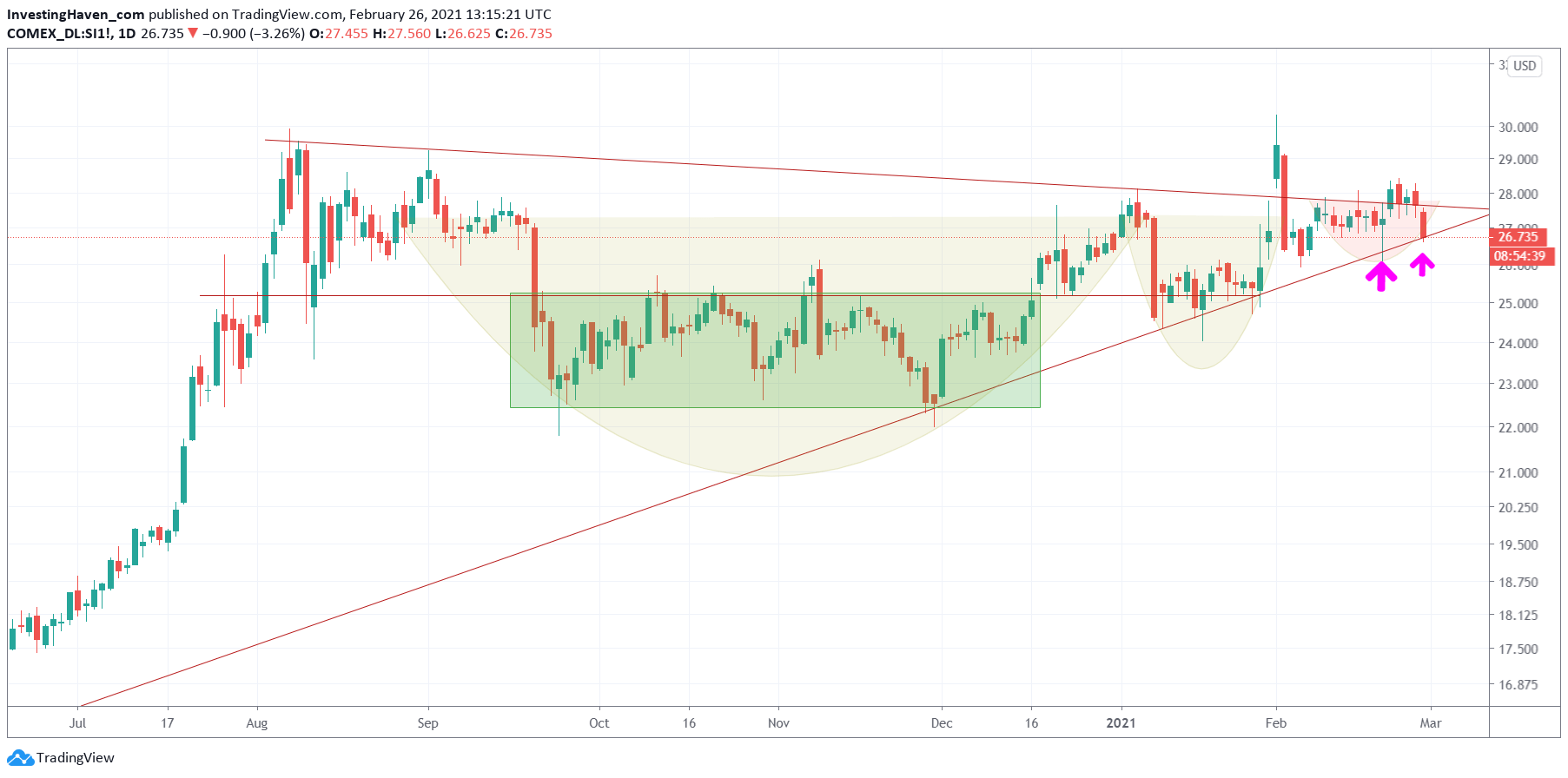

Silver is now, similar to gold, testing its 7 month uptrend. After a long consolidation it is make-or-break time in the silver market.

Silver is vulernable. One week ago we wrote Silver Market Finally Ready For An Orderly Breakout?

It didn’t happen, even though on Wednesday silver was ready to break higher! In two trading days, silver went from breakout-ready to breakdown-ready. Go figure.

Next week will be telling. And as always, the market will not be obvious. We can expect scenarios like a failed breakdown, or a recovery next week that is followed by a re-test of the same support levels one week later.

We give the gold and silver market the time they need. That’s probably two to three weeks to tell us more about their intention(s). There is no reason to rush any trade right now, let’s wait and see for now.