Strong investment interest, growing Chinese jewellery demand, and a tighter supply outlook explain why Platinum is gaining attention.

Platinum has moved faster than gold this year, recording a YTD jump of roughly 57% with prices holding in the mid $1,600s per ounce.

Trading activity has remained active, and futures positioning shows steady interest rather than short-term speculation.

These signals suggest the rally has real support behind it.

RECOMMENDED: Platinum’s Comeback: From Undervalued To Leading The 2025 Rally

How ETF Flows And Physical Buying Are Supporting Platinum’s Surge

Investors have increased their exposure through Platinum ETFs, bars, and coins. Market updates show meaningful ETF inflows and strong physical buying, with some quarters bringing in hundreds of millions of dollars.

This has reduced available metal in major warehouses and added more pressure on the supply side.

When investment demand grows alongside rising prices, it often strengthens the trend rather than weakening it.

RECOMMENDED: Why Silver and Platinum Are the New Strategic Metals of 2025

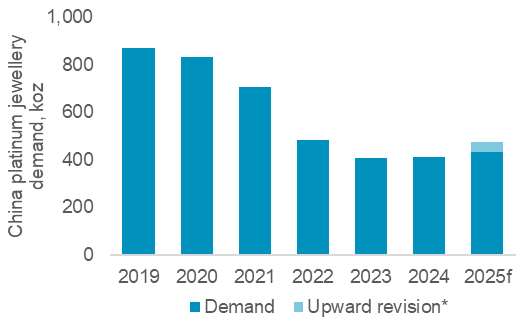

China’s Jewellery Demand And Its Impact On Platinum

China platinum demand is playing a much bigger role.

Jewellery fabrication is rising, and forecasts point to double-digit growth in 2025. China is also becoming a key source of bar and coin demand.

This shift is crucial because physical buying removes material from the market instead of simply rotating through financial accounts.

That change in the demand mix has helped stabilize platinum’s climb this year.

Why Platinum’s Supply Gap Matters For The Market

Analysts expect a noticeable Platinum supply deficit in 2025, with total output projected to fall to multi-year lows.

Reports from WPIC and other research groups estimate a shortfall in the hundreds of thousands of ounces.

A supply gap often supports higher prices, but the market still carries risks.

If investment flows slow or investors take profits, platinum could give back some gains.

ALSO READ: Platinum And Palladium Outperformance: Is The PGM Comeback Real?

Conclusion

Platinum stands out this year because of strong performance, active investment flows, rising Chinese demand, and a tighter supply picture.

The next few months will come down to how ETFs behave, how Chinese buyers respond to higher prices, and whether supply remains constrained.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

-

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

-

Turning-point forecasting across multi-timeframe charts.

-

Actionable insights on GDX, GDXJ, SIL, and SILJ.

-

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts:

- Weekly & Monthly Precious Metals Price Charts In The Absence Of COMEX Data(Dec 7th)

- A Strong Monthly Close for Silver. Is Silver Up & Away?(Nov 30th)

- This Is Why Precious Metals Investors Should Be Watching The USD (Nov 23rd)

- Precious Metals – The Candles Are Clear (Nov 15th)

- Gold, Silver, Miners – The Message of the Charts (Nov 8th)

What Our Members Say

“I have to say — your gold and market analysis is INCREDIBLE. The timing of your pullback forecasts has been spot on. People forget that even the strongest trends need healthy corrections!”

“The way you distinguish between accumulation moments and profit-taking moments has helped me tremendously. You've been right so many times — it’s honestly impressive.”

— Premium Newsletter Member

“Your team puts an extraordinary amount of work into the Gold Alerts and premium market updates. After all these years, the passion and consistency are still there. Respect.”

“Thanks to your research, I’ve become a much more patient investor. My decision-making is calmer, clearer, and more strategic — and the results show it.”

“Looking at gold, silver, and the S&P 500 from a long-term perspective has reduced so much stress. Your approach consistently outperforms short-term trading — the difference is night and day.”

— Gold Alert Subscriber

“I really appreciate the clarity and wisdom in your gold and market commentaries. The way you simplify complex trends has helped me understand the big picture like never before.”

— Long-Time Member